Having trouble reading this e-mail? View the online version or view this newsletter after logging on to HSBCnet. |

||||||||||||||||

|

||||||||||||||||

|

||||||||||||||||

| 12 | ||||||||||||||||

Important changes coming in September Several new enhancements will be introduced to HSBCnet over the weekend of 19/20 September delivering more convenience to your banking experience. Changes include: Message Centre is being made available for all HSBCnet users, Account Information enhancements for accounts in the UK, as well as viewable SPEI electronic payment receipts in Mexico. Be sure to read on to see how these changes will enrich your HSBCnet experience. |

||||||||||||||||

HSBCnet News is getting a new look Coming soon is a newly redesigned format for HSBCnet News. The new easy-to-read layout features a streamlined look and feel, including menu tabs to make it easier for you to find the information you need. HSBCnet News articles will be organized into four menu tabs:

If you have not already done so, please add "HSBCnet.Communications@email.hsbcnet.com" to your list of approved senders to ensure you receive important information from HSBCnet by e-mail. |

||||||||||||||||

Balance and Transaction Reporting will soon be demised For those users who have been using the Balance and Transaction Reporting (BTR) service to receive information on their accounts, please note that ‘Account Information’ has been introduced to replace Balance and Transaction Reporting. However, the two services are still available in parallel for a limited time. To provide a smooth transition, all information within 'Account Information' can be found in the same way you are used to in Balance and Transaction Reporting. For further assistance please review the following: Additional resources including a Quick Guide to compare Account Information and BTR as well as an Account Information training video are available in the service Help Text. |

||||||||||||||||

Customers with accounts in Qatar: Salary Information File (SIF) for Wage Protection System (WPS) In February 2015, there were amendments to the Labour Law directing companies to route their employee salary payments through Wage Protection System (WPS), which was introduced by the Qatar Central Bank (QCB). As an HSBCnet customer, your organisation can meet the WPS regulatory requirement by paying your employees’ wages by uploading the Salary Information File (SIF) for Wage Protection System (WPS) using the File Upload service.

For a detailed SIF guide, select the Help option in the top right corner of the File upload service. For additional information on Qatar WPS and the File Upload service, please contact your local HSBCnet Support Centre or your HSBC representative. |

||||||||||||||||

Customers with accounts in Israel: Beneficiary Address requirement for cross-border payments Effective 20 September, 2015, beneficiary address information will be required for all cross-border payments debiting Israel accounts where the payment amount is equal to or greater than 1 Million Israeli Shekel (ILS), or its equivalent value. As of the effective date, the Beneficiary Address field in HSBCnet will be mandatory for all payment instructions that meet the above criteria. You will be able to input up to three lines of information in the Beneficiary Address field. Please note that a minimum of one line of information is required in this field. If the beneficiary address information is not included as outlined above, you will receive an error message on HSBCnet and you will not be able to process the payment further. Action required

Important information for customers using the File Upload service: For cross-border payment files submitted using File Upload, where the debit account is in Israel and the payment amount is equal to or greater than 1 Million Israeli Shekel (ILS), or its equivalent value, please include the beneficiary address information in the Beneficiary Address field (minimum 1 line). Failure to include this information will result in payment rejection. Supported File formats: Israel Flat file, MT103, XML V2/3, Paymul APCAS and CRG For additional guidance on this enhancement, please review the Help Text available post-logon in the File Upload service or contact your local HSBCnet Support Centre. |

||||||||||||||||

Customers with accounts in Canada: new USD correspondent bank Please be informed that on 28 September 2015 there will be changes to HSBC Bank Canada's correspondent bank for domestic and international payments in USD currency. New HSBC Bank Canada correspondent bank ‒ CitiBank, New York, SWIFT code CITIUS33. Please note that while there will be a short transition period, where payments in USD will continue to be accepted by the previous correspondent bank, customers are encouraged to make the above changes as soon as possible to avoid the risk of payments being rejected. |

||||||||||||||||

Action required: Purpose of payment code requirement for payments from accounts in the Philippines Effective 19 October 2015, the inclusion of Purpose of payment code will be mandatory for payments debiting Philippines accounts made on-screen in HSBCnet and using the File Upload service. Due to regulatory requirements of the Bangko Sentral ng Pilipinas, the HSBCnet payment system will be upgraded to support the implementation of Purpose of payment codes in the Philippines. As a result of this change, payment instructions submitted through HSBCnet will be required to include a valid Purpose of payment code. Instructions submitted without a valid Purpose of payment code will be rejected. Select the link below to learn more about how to incorporate Purpose of payment codes in your payments. |

||||||||||||||||

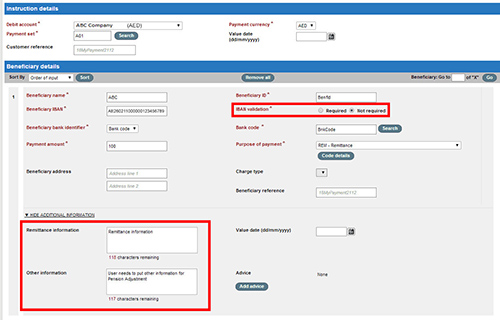

Customers with accounts in the UAE: ACH Credit enhancements to support Pension Adjustments Further to our communications sent in February, March and May 2015, from 1 June 2015 you have been able to submit your pension contributions (if any) via HSBCnet. This is in accordance with the General Pension & Social Security Authority (GPSSA) guidelines. From 20 September 2015, we are further enhancing HSBCnet ACH Credit payment screens and payment files uploaded via the File Upload service. This change is designed to support Pension Adjustment payments in the UAE. In addition to the existing “Remittance Information” field, HSBCnet ACH Credit payment screens will include a new “Other Information” field. As of 20 September, the “Other Information” field can be used to provide detailed information for Pension Adjustment payments. For pension payments or adjustments initiated via the ACH Credit screen on HSBCnet, please be advised that you must select the "Not required" option in the "IBAN validation" field. Read on to learn more about how to capture Pension Adjustment information accurately in your payment instructions. |

||||||||||||||||

Security Tip: staying protected against "Vishing" English | En français |En Español |繁體中文 | 简体中文 | العربية “Vishing”, also known as Voice Phishing, is the term used to describe tactics used by fraudsters to “fish” for personal information (such as online banking security credentials) over the phone. Being vigilant against this type of fraud helps keep you protected. Fraudsters may contact you pretending to be from HSBC. They may try to direct you to perform actions which would enable unauthorised payments to be sent to the criminal. This could include providing security codes generated from your token. HSBC will never request information that could be used to make a payment (such as account numbers, passwords, security device details other than the serial number on the back, etc). As a precaution, always take the extra step of verifying any requests through an alternative communication method. Also, under no circumstances will HSBC ever ask you to divulge any of your security details over the phone, by text message or via e-mail. If you are ever doubtful about your HSBCnet activities or the authenticity of incoming telephone calls purporting to be from HSBC, please call your local HSBCnet Support Centre or your HSBCnet Representative for further verification. |

||||||||||||||||

User Tip: improve payment processing with up-to-date SWIFT BIC information The inclusion of up-to-date SWIFT BIC information in your payment instructions helps enable straight-through processing, preventing processing delays, rejections and charges associated with incorrect payment details. Use the HSBCnet Beneficiary Bank Identifier field to validate and automatically populate bank information, including SWIFT BIC details. As there are updates to bank identifiers globally, ensuring that all payments and payment templates are verified to reflect the most up-to-date SWIFT BIC details is an essential part of successful payment processing. Below are examples of error messages that may be displayed on HSBCnet if an invalid SWIFT BIC code is input in a payment instruction:

In case of an error message, reach out to your payment beneficiary to advise that the SWIFT BIC is not valid and request their most up-to-date payment information. For further assistance, please contact your local HSBCnet Support Centre. |

||||||||||||||||

Information on HSBCnet service maintenance windows

At times it is necessary to schedule non-regular maintenance windows to perform special types of maintenance. Notification of both planned and unplanned maintenance windows will also be posted to the HSBCnet Service Updates section.

*Maintenance window dates, beginnings and ends may be subject to change (with notice) to accommodate maintenance requirements. Note: in the week prior to a service maintenance period, a Service Update banner confirming the maintenance window will be available post-logon in HSBCnet. Please review this information in advance of any planned maintenance period to confirm the date and time. |

||||||||||||||||