| |

Customers with accounts in the UAE: ACH Credit enhancements to support Pension Adjustments

Further to our communications sent in February, March and May 2015, from 1 June 2015 you have been able to submit your pension contributions (if any) via HSBCnet. This is in accordance with the General Pension & Social Security Authority (GPSSA) guidelines.

From 20 September 2015, we are further enhancing HSBCnet ACH Credit payment screens and payment files uploaded via the File Upload service. This change is designed to support Pension Adjustment payments in the UAE.

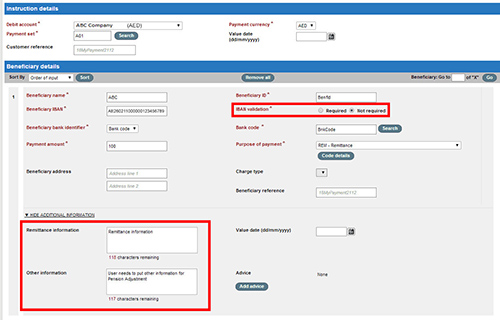

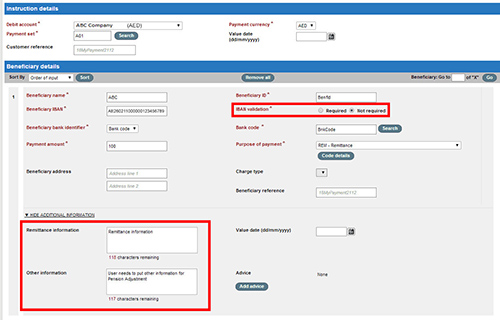

In addition to the existing “Remittance Information” field, HSBCnet ACH Credit payment screens will include a new “Other Information” field. As of 20 September, the “Other Information” field can be used to provide detailed information for Pension Adjustment payments.

For pension payments or adjustments initiated via the ACH Credit screen on HSBCnet, please be advised that you must select the "Not required" option in the "IBAN validation" field.

To ensure the Pension Adjustment information is captured accurately in your payment, please follow the format as outlined in the table below:

Pension Adjustments |

Remittance Information |

Please provide “Remittance Information” in the below format for your pension adjustments:

This field will accept up to 140 characters

Format for Pension Adjustments:

ADJSTEMPLOYEEIDXXXXX/EMPLOYERIDXXX/S/MMYYYY/B0000000.00/

H0000000.00/S0000000.00/C0000000.00/L0000000.00/O0000000.00/

T0000000.00

Where,

ADJST is a static key word to be used for Pension Adjustment payments

EMPLOYEEIDXXXXX is the 15 characters Employee ID of the UAE National

EMPLOYERIDXXX is the 13 characters Employer ID as provided by GPSSA

S is the type of employer. This must be ‘R’ for Private and ‘U’ for Public

MMYYYY is the month and year

B0000000.00 is the Basic Amount prefixed with fixed letter ‘B’

H0000000.00 is the Housing Allowance prefixed with fixed letter ‘H’

S0000000.00 is the Social Allowance prefixed with fixed letter ‘S’

C0000000.00 is the Child Allowance prefixed with fixed letter ‘C’

L0000000.00 is the Cost of Living Allowance prefixed with fixed letter ‘L’

O0000000.00 is the Other/ Supplementary Allowance prefixed with fixed letter ‘O’

T0000000.00 is the Total Monthly Salary inclusive of all allowances prefixed with fixed letter ‘T’

All above amounts must be 7 digits and 2 decimals. You must provide amounts left padded with zeroes (e.g. B0000250.00) |

Other Information |

Please provide “Other Information” in the below format for your pension adjustments:

This field will accept up to 175 characters

Format for Pension Adjustments:

E0000000.00/C0000000.00/BDDMMYY/HDDMMYY/SDDMMYY/CDDMMYY/LDDM

MYY/ODDMMYY/HP000DDMMYY/ZP000DDMMYY/LT000DDMMYY/SL000DDMM

YY/UA000DDMMYY/ST000DDMMYY/LP000000000.00

Where,

E0000000.00 is the Employee Contribution prefixed with fixed letter ‘E’

C0000000.00 is the Employer Contribution prefixed with fixed letter ‘C’

BDDMMYY is the effective date of the new Basic Amount in format DDMMYY prefixed with fixed letter ‘B’

HDDMMYY is the effective date of the new Housing Allowance in format DDMMYY prefixed with fixed letter ‘H’

SDDMMYY is the effective date of the new Social Allowance in format DDMMYY prefixed with fixed letter ‘S’

CDDMMYY is the effective date of the new Child Allowance in format DDMMYY prefixed with fixed letter ‘C’

LDDMMYY is the effective date of the new Cost of Living Allowance in format DDMMYY prefixed with fixed letter ‘L’

ODDMMYY is the effective date of the new Other Allowances in format DDMMYY prefixed with fixed letter ‘O’

HP000DDMMYY, where 000 is the number of days on sick leave with half pay (right aligned and zero padded),

DDMMYY is the date from which leave was availed, prefixed with fixed letter ‘HP’

ZP000DDMMYY, where 000 is the number of days on sick leave with zero pay (right aligned and zero padded),

DDMMYY is the date from which leave was availed, prefixed with fixed letter ‘ZP’

LT000DDMMYY, where 000 is the number of days on unpaid leave long term (right aligned and zero padded),

DDMMYY is the date from which leave was availed, prefixed with fixed letter ‘LT’

SL000DDMMYY, where 000 is the number of days on unpaid study leave (right aligned and zero padded),

DDMMYY is the date from which leave was availed, prefixed with fixed letter ‘SL’

UA000DDMMYY, where 000 is the number of days on unauthorized leave (right aligned and zero padded),

DDMMYY is the date from which leave was availed, prefixed with fixed letter ‘UA’

ST000DDMMYY, where 000 is the number of days on unpaid leave short term (right aligned and zero padded),

DDMMYY is the date from which leave was availed, prefixed with fixed letter ‘ST’

LP000000000.00 is the Unpaid leave payment amount prefixed with fixed letter ‘LP’

All above amounts must be 7 digits and 2 decimals. You must provide amounts left padded with zeroes (e.g. E0000250.00)

You must provide details exactly in the format specified. Example, If you do not have “Effective date of the new

Basic Amount”, you must still provide this as “BDDMMYY” |

Purpose of Payment |

Please provide ‘PEN’ as Purpose of Payment for your pension payments and pension adjustments

Please note that Purpose of Payment code is mandatory for all ACH Credit payments and can be selected from a drop down list with detailed information on the selected code available via the Code details button |

Bank Code |

:Please provide ‘985110101’ as Bank Code for your pension payments and pension adjustments |

To avoid payment rejections, please do not provide pension payments, pension adjustments and other ACH Credit payments in a single batch |

From 20 September, when creating a payment instruction using general or restricted templates, you will be able to provide additional comments for your Pensions Adjustments within the “Other Information” field.

Information for customers using the HSBCnet File Upload service

You will also have the option to provide additional information for Pension Adjustments in Payment Files uploaded via HSBCnet File Upload. For detailed information on how to incorporate Pension Adjustment information into your payment files, please review the table below.

Pension Adjustments |

| iFile |

SECPTY -"@LVP@" - Field 44

Payment Details Line 1 |

ADJSTEMPLOYEEID12345/EMPLOYERID123/ |

SECPTY -"@LVP@" - Field 45

Payment Details Line 2 |

S/MMYYYY/B0000000.00/H0000000.00/ |

SECPTY -"@LVP@" - Field 46

Payment Details Line 3 |

S0000000.00/C0000000.00/ |

SECPTY -"@LVP@" - Field 47

Payment Details Line 4 |

L0000000.00/O0000000.00/T0000000.00 |

SECPTY -"@LVP@" - Field 55

Bank to Bank Information Line 1 |

E0000000.00/C0000000.00/BDDMMYY |

SECPTY -"@LVP@" - Field 56

Bank to Bank Information Line 2 |

/HDDMMYY/SDDMMYY/CDDMMYY/LDDMMYY |

SECPTY -"@LVP@" - Field 57

Bank to Bank Information Line 3 |

/ODDMMYY/HP000DDMMYY/ZP000DDMMYY/ |

SECPTY -"@LVP@" - Field 58

Bank to Bank Information Line 4 |

LT000DDMMYY/SL000DDMMYY/UA000DDMMYY |

SECPTY -"@LVP@" - Field 59

Bank to Bank Information Line 5 |

/ST000DDMMYY/LP000000000.00 |

| MEABASIC |

Column No - AF - Remittance Information 1 |

ADJSTEMPLOYEEID12345/EMPLOYERID123/ |

| Column No - AG - Remittance Information 2 |

S/MMYYYY/B0000000.00/H0000000.00/ |

| Column No - AH - Remittance Information 3 |

S0000000.00/C0000000.00/ |

| Column No - AI - Remittance Information 4 |

L0000000.00/O0000000.00/T0000000.00 |

| Column No - AM - Bank to Bank Information 1 |

E0000000.00/C0000000.00/BDDMMYY |

| Column No - AN - Bank to Bank Information 2 |

/HDDMMYY/SDDMMYY/CDDMMYY/LDDMMYY |

| Column No - AO - Bank to Bank Information 3 |

/ODDMMYY/HP000DDMMYY/ZP000DDMMYY/ |

| Column No - AP - Bank to Bank Information 4 |

LT000DDMMYY/SL000DDMMYY/UA000DDMMYY |

| Column No - AQ - Bank to Bank Information 5 |

/ST000DDMMYY/LP000000000.00 |

| XML v2.0 |

Remittance Information Unstructured

<RmtInf> <Ustrd> |

ADJSTEMPLOYEEID12345/EMPLOYERID123/ |

| <RmtInf> <Ustrd> |

S/MMYYYY/B0000000.00/H0000000.00/ |

| <RmtInf> <Ustrd> |

S0000000.00/C0000000.00/ |

| <RmtInf> <Ustrd> |

L0000000.00/O0000000.00/T0000000.00 |

| <RmtInf> <Ustrd> |

E0000000.00/C0000000.00/BDDMMYY |

| <RmtInf> <Ustrd> |

/HDDMMYY/SDDMMYY/CDDMMYY/LDDMMYY |

| <RmtInf> <Ustrd> |

/ODDMMYY/HP000DDMMYY/ZP000DDMMYY/ |

| <RmtInf> <Ustrd> |

LT000DDMMYY/SL000DDMMYY/UA000DDMMYY |

| <RmtInf> <Ustrd> |

/ST000DDMMYY/LP000000000.00 |

| Paymul |

Group 16 - FTX+PMD

Element - 4451-C108-4440

Free text first instance |

ADJSTEMPLOYEEID12345/EMPLOYERID123/ |

Group 16 - FTX+PMD

Element - 4451-C108-4440

Free text - next instances |

S/MMYYYY/B0000000.00/H0000000.00/ |

Group 16 - FTX+PMD

Element - 4451-C108-4440

Free text- next instances |

S0000000.00/C0000000.00/ |

Group 16 - FTX+PMD

Element - 4451-C108-4440

Free text- next instances |

L0000000.00/O0000000.00/T0000000.00 |

Group 16 - FTX+PMD

Element - 4451-C108-4440

Free text second instance |

E0000000.00/C0000000.00/BDDMMYY |

Group 16 - FTX+PMD

Element - 4451-C108-4440

Free text - next instances |

/HDDMMYY/SDDMMYY/CDDMMYY/LDDMMYY |

Group 16 - FTX+PMD

Element - 4451-C108-4440

Free text - next instances |

/ODDMMYY/HP000DDMMYY/ZP000DDMMYY/ |

Group 16 - FTX+PMD

Element - 4451-C108-4440

Free text - next instances |

LT000DDMMYY/SL000DDMMYY/UA000DDMMYY |

Group 16 - FTX+PMD

Element - 4451-C108-4440

Free text - next instances |

/ST000DDMMYY/LP000000000.00 |

Where,

ADJST is a static key word to be used for Pension Adjustment payments

EMPLOYEEIDXXXXX is the 15 characters Employee ID of the UAE National

EMPLOYERIDXXX is the 13 characters Employer ID as provided by GPSSA

S is the type of employer. This must be ‘R’ for Private and ‘U’ for Public

MMYYYY is the month and year

B0000000.00 is the Basic Amount prefixed with fixed letter ‘B’

H0000000.00 is the Housing Allowance prefixed with fixed letter ‘H’

S0000000.00 is the Social Allowance prefixed with fixed letter ‘S’

C0000000.00 is the Child Allowance prefixed with fixed letter ‘C’

O0000000.00 is the Other/ Supplementary Allowance prefixed with fixed letter ‘O’

L0000000.00 is the Cost of Living Allowance prefixed with fixed letter ‘L’

T0000000.00 is the Total Monthly Salary inclusive of all allowances prefixed with fixed letter ‘T’

E0000000.00 is the Employee Contribution prefixed with fixed letter ‘E’

C0000000.00 is the Employer Contribution prefixed with fixed letter ‘C’.

E0000000.00 is the Employee Contribution prefixed with fixed letter ‘E’

C0000000.00 is the Employer Contribution prefixed with fixed letter ‘C’

BDDMMYY is the effective date of the new Basic Amount in format DDMMYY prefixed with fixed letter ‘B’

HDDMMYY is the effective date of the new Housing Allowance in format DDMMYY prefixed with fixed letter ‘H’

SDDMMYY is the effective date of the new Social Allowance in format DDMMYY prefixed with fixed letter ‘S’

CDDMMYY is the effective date of the new Child Allowance in format DDMMYY prefixed with fixed letter ‘C’

LDDMMYY is the effective date of the new Cost of Living Allowance in format DDMMYY prefixed with fixed letter ‘L’

ODDMMYY is the effective date of the new Other Allowances in format DDMMYY prefixed with fixed letter ‘O’

HP000DDMMYY, where 000 is the number of days on sick leave with half pay (right aligned and zero padded), DDMMYY is the date from which leave was availed, prefixed with fixed letter ‘HP’

ZP000DDMMYY, where 000 is the number of days on sick leave with zero pay (right aligned and zero padded), DDMMYY is the date from which leave was availed, prefixed with fixed letter ‘ZP’

LT000DDMMYY, where 000 is the number of days on unpaid leave long term (right aligned and zero padded), DDMMYY is the date from which leave was availed, prefixed with fixed letter ‘LT’

SL000DDMMYY, where 000 is the number of days on unpaid study leave (right aligned and zero padded), DDMMYY is the date from which leave was availed, prefixed with fixed letter ‘SL’

UA000DDMMYY, where 000 is the number of days on unauthorized leave (right aligned and zero padded), DDMMYY is the date from which leave was availed, prefixed with fixed letter ‘UA’

ST000DDMMYY, where 000 is the number of days on unpaid leave short term (right aligned and zero padded), DDMMYY is the date from which leave was availed, prefixed with fixed letter ‘ST’

LP000000000.00 is the Unpaid leave payment amount prefixed with fixed letter ‘LP’

All above amounts must be 7 digits and 2 decimals. You must provide amounts left padded with zeroes (e.g. E0000250.00)

Please provide ‘PEN’ as Purpose of Payment for your pension adjustments

Please provide ‘985110101’ as Bank Code for your pension payments and pension adjustments

You must provide details exactly in the format specified. Example, If you do not have “Effective date of the new Basic Amount”, you must still provide this as “BDDMMYY”

For XML v3.0, please contact your HSBC representative. |

To avoid payment rejections, please do not provide pension payments, pension adjustments and other ACH Credit payments in a single batch |

Please note that from 20 September 2015, we will no longer accept additional information for Pension Adjustments on your company's official letterhead.

For additional information on UAE Pension Adjustment payments, please contact your local HSBCnet Support Centre or your HSBC representative.

|

|

|

|