Having trouble reading this e-mail? View the online version or view this newsletter after logging on to HSBCnet. |

||||||||||||||||||||

|

||||||||||||||||||||

|

||||||||||||||||||||

Important upgrade information for Internet Explorer 6 users Due to vulnerabilities present in Internet Explorer 6 (IE6), HSBCnet will end support for Internet Explorer 6 on 16 January 2015. HSBCnet is committed to maintaining the highest security standards in our online banking services by continuously evaluating ways to enhance our system integrity. In order to ensure that you are receiving the highest levels of security, we strongly suggest that our customers currently using Internet Explorer 6 (IE6) upgrade as soon as possible, before 16 January 2015, to a newer version of Internet Explorer (IE8 or above), or another modern browser (see below) to ensure continued access to our online banking services. |

||||||||||||||||||||

Customers with accounts in Hong Kong: standardisation of USD Priority Payments effective 1 February 2015

HSBC Hong Kong will be standardising all USD telegraphic transfers (Priority Payments on HSBCnet) to be cleared via HSBC USA effective from 1 February 2015, which will roll out by phases. This may affect the overseas bank charges that apply. For USD Priority Payments, besides the outward telegraphic transfer charges levied by HSBC Hong Kong, there are other overseas bank charges involved. These charges are either deducted from the remittance proceeds or collected from the remitter, depending on the choice that remitter makes on overseas bank charges. Read on for details of how overseas bank charges for USD Priority Payments may be affected. |

||||||||||||||||||||

Customers with accounts in Indonesia: transaction limit for RTGS payments and extended cut-off times As recently communicated by Bank Indonesia*, effective 15 December 2014, all outward transactions with debit amount up to or equal to Indonesian Rupiah (IDR) 100 million must be routed through Bank Indonesia’s National Clearing System (SKNBI). To comply with the Bank Indonesia requirement, any RTGS payment instructions you submit in HSBCnet with debit amount up to or equal to IDR 100 million will be automatically routed through SKNBI and subject to the applicable SKNBI charges.

If you have any questions, please contact your Relationship Manager or HSBC Corporate Call Center at (021) 2551-4777. |

||||||||||||||||||||

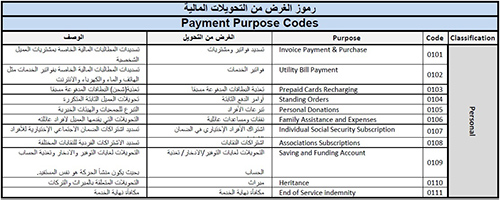

Implementation of new Payment Purpose codes for payments to Jordan As per Central Bank of Jordan’s directives, all incoming and outgoing payments (MT103) processed through Jordanian banks must clearly include a Purpose Code in field 70 of the MT103. This will be effective from 2 February 2015. As a result, the inclusion of the code referencing the purpose of payment (PoP) should be given in the below format for all payments being sent to Jordanian banks to ensure that processing delays and additional repair fees may not apply.

List of PoP codes: |

||||||||||||||||||||

Customers with accounts in Taiwan: new Payment Purpose code requirements The Central Bank of the Republic of China (Taiwan) (“CBC”) has published a new version of “Outward Remittance/Inward Remittance Payment Purpose Code” which took effect on 1 January, 2015. For your reference: To comply with CBC’s new policy, from 1 January, 2015, please start using the new version of payment purpose code, as well as update the payment purpose code in all Payment Templates, or the relevant system settings for File Upload where necessary. Payments created by File Upload: Payments created by Payment Template: HSBC will provide manual conversion until the end of January 2015 if you are unable to shift to the new payment purpose code immediately due to time constraints. However, to meet the requirement of CBC, please ensure all adjustments or changes can be completed by 31 January, 2015. Should you have any questions, please do not hesitate to contact your HSBC representative or local HSBCnet Support Centre (for Taiwan: +886 2 8072 3993). |

||||||||||||||||||||

Hints and Tips: distinguish payments by including information for the beneficiary When possible, use the Information for the beneficiary section to identify unique details for each payment. This section in the Priority Payment form allows you to convey payment information to the beneficiary such as invoice and reference details. This will help you, and the beneficiary, distinguish multiple payments made to the same beneficiary where the amount and value date are the same. You can input beneficiary information in up to four “Remittance information” fields within the Information for the beneficiary section. Select the desired SWIFT code word from the drop-down list. Each field has a maximum length of 30 characters. Use multiple fields for the same code word if you need to enter more information. Descriptions of each code word are listed for your reference.

|

||||||||||||||||||||

Security Tip: quick safeguards for banking-on-the-go HSBCnet and HSBCnet Mobile afford the convenience of conducting your banking at any time and from anywhere you have an internet connection. While HSBCnet uses multiple layers of protection to enhance your security, here are a few reminders for safeguarding your online banking activity whether you are accessing HSBCnet Mobile on the go, connecting to HSBCnet from your laptop via a new internet connection, or using a trusted stationary computer terminal.

If travelling circumstances make it necessary to use a public or shared computer or internet service to access HSBCnet, signing off when finished is crucial. Once you have signed off, you should enhance your security by clearing the browser's cache which maintains a copy of web pages that have been recently viewed. |

||||||||||||||||||||

Information on HSBCnet service interruptions

At times it is necessary to schedule non-regular maintenance windows to perform special types of maintenance. Notification of both planned and unplanned maintenance windows will also be posted to the HSBCnet Service Updates section.

*Maintenance window dates, beginnings and ends may be subject to change (with notice) to accommodate maintenance requirements. |

||||||||||||||||||||