Having trouble reading this e-mail? View the online version or view this newsletter after logging on to HSBCnet. |

||||||||||||||

|

||||||||||||||

|

||||||||||||||

|

|

||||||||||||||

Important changes coming in December

|

||||||||||||||

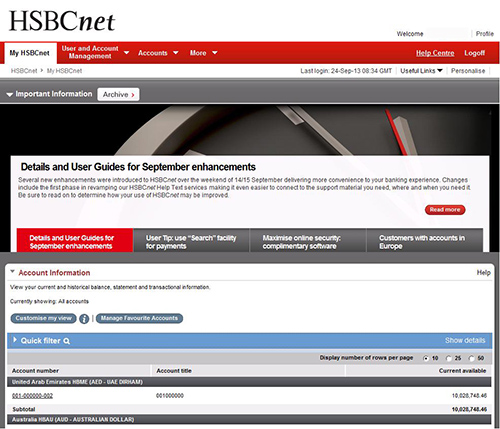

More visibility for 'Account Information' service ‘Account Information’, now available under the ‘Accounts’ tab allows you to enquire on your account balances and statements, while also featuring a rich user experience that includes:

Effective 14 December, ‘Account Information’ will become visible on your My HSBCnet home screen for easy access, if it is not already available there. To provide a smooth transition, all information within 'Account Information' can be found in the same way you’re used to in Balance and Transaction Reporting. For further assistance, please refer to the following resources:

An Account Information Training Video is also available in the HSBCnet Help Centre. Example of Account Information on HSBCnet Personal page as of 14 December: |

||||||||||||||

Changes to HSBCnet Website Terms and Conditions As you may be aware, there has been a recent change to the UK banking regulator, where the FSA (Financial Services Authority) has been replaced by two separate regulatory authorities (FCA - Financial Conduct Authority and PRA - Prudential Regulation Authority). As a result, all FSA references within the HSBCnet Website Terms and Conditions will be updated and replaced to reflect the new regulatory authorities, FCA and PRA in December. |

||||||||||||||

Customers with accounts in the Eurozone: requirements for SEPA End Date Regulation Passed in March 2012, European Union Regulation No. 260/2012, also referred to as the SEPA End Date Regulation (EDR), established the mandatory deadline by which legacy Euro ACH transactions within the Eurozone must be migrated to SEPA schemes. The deadline is 1 February, 2014. This means that domestic and cross-border Euro transactions, where both the Payer’s and the Beneficiary’s bank accounts are located within the Eurozone, will have to be SEPA compliant by this date. For more information on SEPA End Date Regulation requirements and the changes coming to HSBCnet to facilitate the transition to SEPA, select the ‘Read more’ button below. |

||||||||||||||

Customers with accounts in the United Arab Emirates: Reminder regarding Payment Purpose code requirements for UAE Domestic and ACH Payments The electronic funds transfer system provided by the Central Bank of UAE (UAEFTS) expedites payment and returns processing times for domestic electronic payments. As part of this service, the UAE Central Bank regulations mandate that a payment purpose code is provided for instructions debiting UAE domiciled accounts. As a reminder, the inclusion of a code referencing the purpose of payment to the beneficiary account is required for all UAE domestic payments (where both the debit and credit account is in the UAE) and ACH payments. Payment instructions submitted through HSBCnet without a valid Payment Purpose code may be rejected, delayed, or incur additional charges. Salaries processed via Wages Protection System (WPS) do not require a Payment Purpose code. Please note: when completing the Regulatory reporting section of payment instructions screens, ensure the SWIFT code ‘/BENEFRES/’ is selected from the first dropdown menu to minimise processing errors. For more information on Payment Purpose codes, please review the “Purpose of Payment: UAE Regulatory Reporting” User Guide available in the HSBCnet Help Centre or contact your local HSBCnet Support Centre. |

||||||||||||||

IBAN required for Qatar account payments effective 31 December In compliance with the Qatar Central Bank, effective 31 December, 2013, all banks in Qatar are required to accept and process payment instructions with a valid International Bank Account Number (IBAN). What is IBAN? Applying the IBAN If you have an account in Qatar, please ensure that the IBAN is communicated to all parties from whom you are expecting a remittance. Additionally, you will need to amend any standing orders for payments to beneficiary accounts held in banks within Qatar other than HSBC by providing the IBAN equivalent for the beneficiary account. Please note, all HSBC payment / instruction submission channels have been enhanced to accept IBAN. Generating your IBAN Please note that this generator is applicable only for HSBC account numbers in Qatar. For further information regarding IBAN, visit http://www.hsbc.com.qa/1/2/qa/business. You may also contact your HSBC representative or your local HSBCnet Helpdesk |

||||||||||||||

Customers with Latvian accounts: conversion to Euro as legal tender Effective 1 January, 2014, Latvia will convert to using the Euro (EUR) as legal tender and the Latvian Lats (LVL) will no longer be accepted or accessible through HSBCnet. Required action: Before closing your LVL account:

Please note that as of 1 January there will be no access to conduct transactions through LVL accounts and as such, any payment templates must be recreated through existing or new EUR accounts. For more information please view our Frequently Asked Questions. If you need additional support with regards to this change or require assistance with the actions outlined above please contact your HSBC representative. |

||||||||||||||

Reminder for customers authorising payments through HSBCnet on HSBC accounts in Italy: new transaction entitlement requirements As a reminder, in order to comply with Italian Anti-Money Laundering legislation and regulations, user entitled to authorise payments on HSBC accounts in Italy (via HSBCnet) were required to provide the documents listed below to your usual Client Service Manager or Relationship Manager in Italy by 1 October, 2013. Required documents: For those users from whom we have not yet received the required documentation, authorisation rights on HSBC accounts in Italy (via HSBCnet) will be removed on 1 December (until proper documentation is received and verified). If you have not already submitted your documents, please speak with your usual Client Service Manager or Relationship Manager in Italy to make arrangements to do so, immediately. For further clarification concerning the necessary forms, signatures and countersignatures required you may also contact our dedicated Team at the following email address: italy.enquiry.team@hsbc.com. |

||||||||||||||

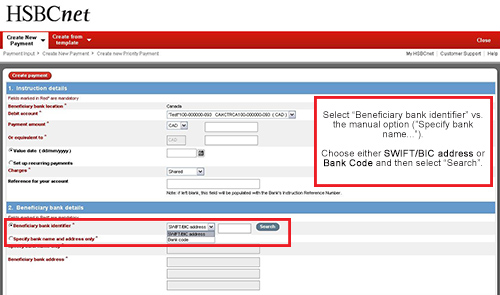

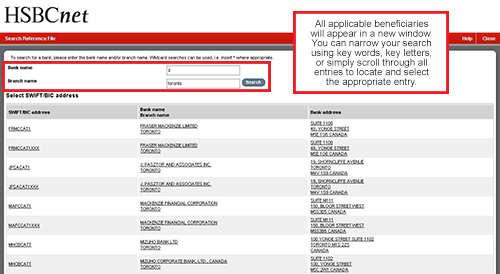

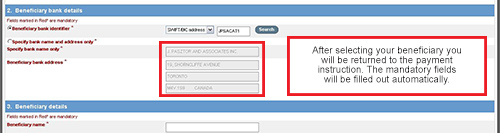

HSBCnet User Tip: Minimise errors by using "Search" to identify Beneficiary bank details When creating a payment please use the “Search” facility to locate and populate the “bank name” and “bank address” fields under the Beneficiary bank details section. Using the “Search” facility to automatically populate the required fields ensures that only valid information, recognisable by HSBCnet systems (e.g. BIC code) is retrieved and entered. Manual entries (typing in the beneficiary bank name and address using free text) can often trigger processing errors in the backend causing delays or making it necessary to repair the instruction. How to use the “Search” facility: 1.) 2.) 3.) |

||||||||||||||

Holiday Fraud Watch

For further information on how to protect yourself from fraudulent attacks, please click on the Security Alerts and Tips link in the HSBCnet logon box. |

||||||||||||||

Information on HSBCnet service interruptions

At times it is necessary to schedule non-regular maintenance windows to perform special types of maintenance. Notification of both planned and unplanned maintenance periods will also be posted to the HSBCnet Important Information section.

*Maintenance window dates, beginnings and ends may be subject to change (with notice) to accommodate maintenance requirements. ** For the duration of File upload maintenance window, the following services will be visible but not accessible: Internet Trade Services, image retrieval service and access to Russian Internet Banking through HSBCnet. Attempting to access these services will produce an error message until the maintenance window ends. |

||||||||||||||

Please do not reply to this e-mail. Our postal address: You received this e-mail notification because you are a registered User of HSBCnet. Should you have any concerns regarding the validity of this message, please contact your local HSBCnet customer support. If you wish to unsubscribe from receiving service information from HSBCnet, please click here. |

||||||||||||||