|

||||||

|

||||||

Important changes coming in December

Several new enhancements will be introduced to HSBCnet over the weekend of 7/8 December delivering more convenience to your banking experience. Included are changes that will help to streamline and automate payment processes. In some instances new mandatory fields are being introduced to capture essential information so be sure to read on to determine how your use of HSBCnet will be improved. Enhancements effective 7/8 December: Customers using Message Centre can expect an enhanced experience as of 9 December including:

Balance and Transaction Reporting transition to Account Information In preparation for retiring Balance and Transaction Reporting (BTR) service and full transition to Account Information (for those who don’t already use Account Information exclusively), customers currently using BTR will notice that BTR descriptions under User Management/View User Access Level as well as Modify User Access Level will be changed to reference Account Information from 9 December, 2013. If you are not yet familiar with Account Information service find out more here > New warning message on payments Please be advised that you may see the following warning message displayed on some payment screens including: Priority Payments, customer transfers, bank to bank transfers and Priority Payment Zengin.

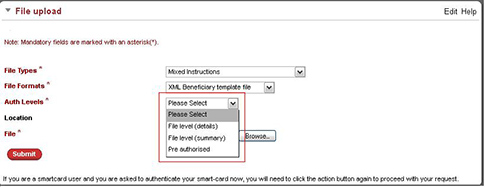

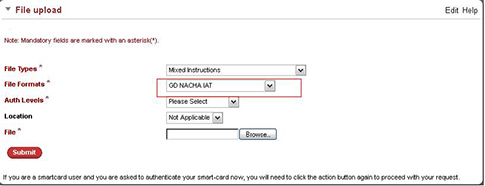

As stated, to avoid possible delays, it is recommended to submit these payment instructions in advance of the applicable cut-off times. Customers using a DP270 security device Please be advised that effective 9 December, 2013 when updating your Security Details you will be asked to enter a code from your Security Device instead of three characters from your password. This will now be consistent with the process for updating your personal information.Expanded File upload capabilities for Global DisbursementsGlobal Disbursements allows HSBC clients using this service to send a single file (containing multiple payments in multiple currencies to multiple destinations) to HSBC via HSBCnet File Upload. HSBC then converts the file by applying varied Foreign Exchange options, warehouses the file, and when appropriate process it through its payment network to beneficiaries globally. Currently, HSBCnet Global Disbursement clients can only upload beneficiary template files if they have a ‘Pre-authorised’ entitlement. However, effective 9 December, File upload will be enhanced to support the uploading of beneficiary template files with ‘file level’ entitlements as well as existing Pre-authorised access level. This means that users with ‘file level’ entitlements will also be able to upload beneficiary templates for CSV Beneficiary template files. Additionally, customers in the US will see the NACHA IAT file format label renamed to Global Disbursement NACHA IAT (GD NACHA IAT) as of 9 December.New workflow simplifies Guarantees and Standby DCsA revised and simplified workflow has been developed so that the File Attachment step for Guarantee and Standby DCs will be included in the application creation stage rather than the Acknowledgement page as of 9 December, 2013. This eliminates the need for the ‘the number of files to be attached’ field which will also be removed. By making it possible to attach documents when creating a Guarantee and Standby DC application/amendment request, the need to complete "the number of files to be attached" field is eliminated, and this field will be removed as of 9 December. For any records still pending over the weekend of 7/8 December, the following warning message will be displayed:

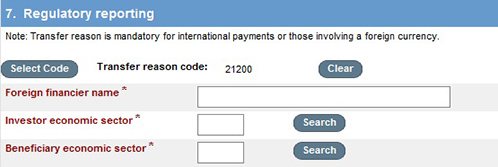

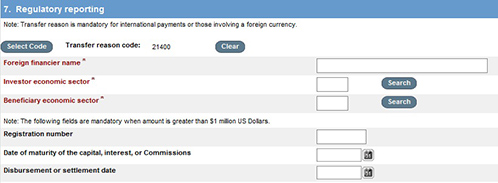

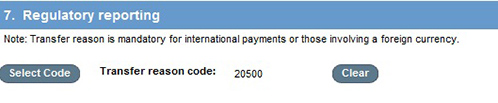

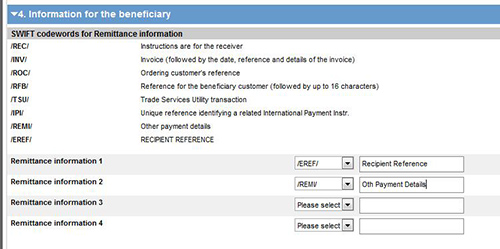

Mexican-Spanish language now available on HSBCnet screensEn EspañolCustomers who would prefer to view HSBCnet screens in Mexican-Spanish will have this option available as of 9 December, 2013. Please ensure that 'Mexican-Spanish' is selected as your preferred language within your User profile in order to view applicable screens in Mexican-Spanish. Please note, a mixture of English and Mexican-Spanish may be displayed on certain screens. Customers with accounts in Chile: improved Payments information To comply with regulatory reports required by the Central Bank of Chile (BCCh) additional Transfer code information will be captured in HSBCnet screens for Priority Payments and Inter-Account transfers from Chilean accounts in Chile effective 9 December, 2013. Beneficiary account number or IBAN field will also become mandatory for Priority Payments. Please note, customers with templates for these payments should update them to include the new information. When updating or creating new templates after 9 December, the appropriate regulatory fields will appear depending on which Transfer code is being used. Input screen for codes 20080 and 20090: Input screen for codes 212XX: Input screen for codes 214XX: Input screen for other codes: For ACH Payments, Purpose codes will now appear in English for easier customer reference.Customers with accounts in Malaysia: enhanced payment reference standard In line with Bank Negara Malaysia improvements to Malaysia’s electronic payment infrastructure, we will be upgrading our interbank GIRO payment facility via ACH and Priority Payments. This enhancement will support payment referencing to Beneficiaries. Effective 9 December, 2013, two new fields (‘Recipient Reference’ and ‘Other Payment Details’) will be available on ACH and Priority Payment screens for Malaysia accounts. These two fields should be used to capture and transmit meaningful transaction details to your Beneficiary for reference and reconciliation purposes. What happens from here? For more information, please contact your HSBC representative. Priority Payment Screen (click image to enlarge)

ACH Template Screen (click image to enlarge) Customers in Turkey: Virtual Account and Receivables Management service now available Beginning 9 December, customers in Turkey will be able to request and gain access to the Virtual Account and Receivables Management System. This service allows authorised users to manage receivables and collection account information maintained within HSBC. It provides access to transaction records, instruments and invoices processed through HSBCnet; and enables users to manage payor profiles, repair transactions, request intraday reports, submit enquiries and send advices to recipients. For more information about the Receivables Management service visit the HSBCnet Help Centre to view the Receivables Management User Guide and speak to your HSBCnet representative to request this service. Customers making payments or transfers to/from accounts in Canadian Dollars For customers making Priority Payments or Inter-Account Transfers through accounts on HSBCnet where the beneficiary bank or intermediary bank is in Canada and/or the debit/credit account is in Canada and/or the transaction is in Canadian Dollars, please note that payment screens will be updated as of 9 December to include Beneficiary address details. Please note, this will be a mandatory field when making such payments and transfers. Expanded Get Rate for customers in the United Kingdom (UK) As of 9 December, 2013, Get Rate will be made available to all customers in the UK who currently do not have access to the service. Get Rate helps you make timely and efficient cross-currency payments with a few simple clicks. This easy-to-use feature offers greater control over your currency payments, allowing you to view and instantly confirm FX rates when making single urgent payments, inter-account transfers and demand drafts from your local accounts. Key benefits:

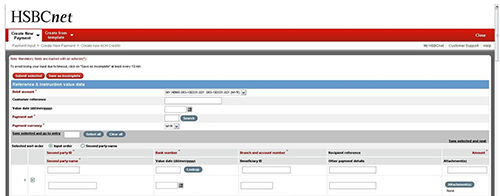

How it works Get Rate is simple to use and appears automatically for eligible payment instructions at the final stage of authorising individual transactions. It provides you with a real-time quote for the debit/credit amounts and the exchange rate. Important note about authorisation: Get Rate eligible transactions cannot be processed in bulk using a single authorisation (eg. Select all > Authorise selected). To process these transactions efficiently, tick the checkbox next to the applicable FX transactions and choose “Authorise selected one by one”. This will allow you to review and accept the rates for each selected payment prior to authorisation. You may also click on the underlined payment amount to obtain the Get Rate offers for each payment individually. For more information about how to use Get Rate, please refer to these three manuals available in the HSBCnet Help Centre:

Enhancement for Repurchase agreement business in China The back-end processing on HSBCnet File upload and Connect will be enhanced to support Repurchase agreement (Repo) business in China as of 9 December, 2013. This enhancement adds Repo related information (“Repo rate” and “Repo maturity date”) to the transaction ‘Advanced search’ and transaction/instruction ‘Enquiry detail’ screens for China. The "Repo rate" and "Repo maturity date" field will be displayed only if applicable. To view, add the new Repurchase agreement maturity date “Repo maturity date” as one of the searching criteria if China is selected as the location and institution. HSBCnet Transfer Agency (HSS): Luxembourg enhancements Effective 9 December, 2013 the search criteria for the Holders by Fund and Fund Deal Enquiry is being enhanced to include additional search criteria including agency branch, distribution office and Fund family etc. The Fund details will also include a list of distribution countries and on the Transaction details screen, a breakdown of the Commissions will be displayed. Please note, data will only be displayed in appropriate fields where available and only for Luxembourg customers at this time. |

||||||

Please do not reply to this e-mail. Our postal address: You received this e-mail notification because you are a registered User of HSBCnet. Should you have any concerns regarding the validity of this message, please contact your local HSBCnet customer support. If you wish to unsubscribe from receiving service information from HSBCnet, please click here. |

||||||