Having trouble reading this e-mail? View the online version or view this newsletter after logging on to HSBCnet. |

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

Important changes coming in March Several new enhancements will be introduced to HSBCnet over the weekend of 14/15 March delivering more convenience to your banking experience. Changes include multiple enhancements to the Account Information service, a new look and feel for HSBCnet Signature Matrix screens and supporting documentation attachment capability for accounts in Israel, Malta and South Africa. Be sure to read on to see how these changes will enrich your HSBCnet experience. |

||||||||||||||||||||||||

Customers with accounts in Singapore: upcoming enhancements to the GIRO (ACH) payment service Due to an industry-wide initiative supported by The Monetary Authority of Singapore (MAS) and The Association of Banks in Singapore (ABS), the interbank payment infrastructure for GIRO payments will be upgraded in the first quarter of 2015. HSBC will be enhancing its GIRO (ACH) services along with this industry wide initiative. As a result of the GIRO service upgrade, when making domestic SGD ACH payments from accounts in Singapore on screen in HSBCnet you will be required to input a SWIFT Bank Identification Code (BIC) and a Payment Purpose code. Customers using File Upload service will not be required to include these codes as a result of this upgrade.

In addition, the following enhancements will also be introduced on HSBCnet after the GIRO upgrade:

If you have further queries regarding the GIRO upgrade, please email us at hsbcnetcentresg@hsbc.com.sg or contact your local HSBCnet Support Centre. |

||||||||||||||||||||||||

Reminder: Balance and Transaction Reporting will soon be demised For those users who have been using the Balance and Transaction Reporting service to receive information on their accounts, please note that ‘Account Information’ has been introduced to replace Balance and Transaction Reporting. However, the two services are still available in parallel for a limited time. To provide a smooth transition, all information within 'Account Information' can be found in the same way you are used to in Balance and Transaction Reporting. For further assistance please review the following: Additional resources including a Quick Guide to compare Account Information and BTR as well as an Account Information training video are available in the service Help Text. |

||||||||||||||||||||||||

Customers with accounts in UAE: new pension requirements and ACH Credit enhancements Beginning June 2015, Banks in UAE are required to report details of pension contributions by customers for UAE nationals to the Ministry of Labour. To support this, ACH Credit screens for accounts in UAE are being updated to capture additional details for pension payments. The new screens are much more user friendly and follow the current payment processing workflow for easy transition. In addition to requirements to update details for pension payments, you will also be required to notify us in writing of any adjustments to staff pension payments. Payment files submitted via HSBCnet File Upload tool are also being enhanced to capture the additional details for pension payments and to capture Purpose of Payment - Purpose of payment for all ACH Credit payments will also become mandatory as of 19 April. Read on for detailed information on how ACH Credit screens are being enhanced to support UAE pension requirements, as well as information for customers using File Upload. |

||||||||||||||||||||||||

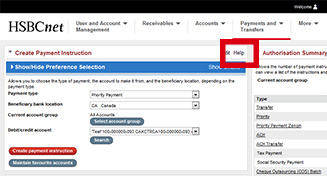

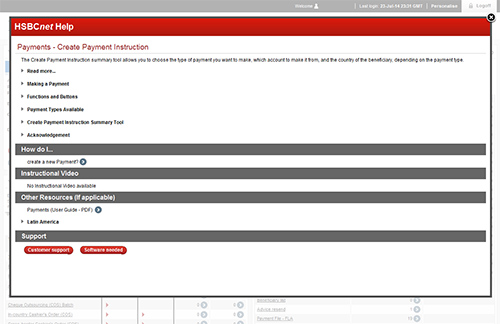

User Tip: Help Text allows you to access help, when and where you need it In our ongoing efforts to enhance your HSBCnet experience, we have made it easier for you to access support where and when you need it with our Help Text service. Help Text is embedded within HSBCnet services and provides you with direct access to relevant support information without navigating away from your current task. To use the Help Text service, select the ‘Help’ link in the top right corner of any service window. The Help Text window will be displayed as an overlay in your existing browser window. Information included in the Help Text service includes:

Closing the Help Text window will revert you back to your current task. Information in the Help Text window is available for viewing online, with select guides available in a printable format. If you require additional assistance, the “Customer support” button will direct you to the contact information for your local HSBCnet Support Centre. |

||||||||||||||||||||||||

Hints and Tips: notify your beneficiary of the details of submitted payments with the Advising service Including advices on payment instructions via HSBCnet allows you to inform your beneficiaries of the details of your submitted payments. With the Advising service, you are able to create advice templates to allow quick access to beneficiary notification information while creating your payment. Once you’ve added an advice to the payment instruction, recipients will receive a system generated e-mail advice. You can include up to six recipients per payment instruction. Pertinent information is provided on the e-mail subject line to assist the recipients in identifying the email content. Advices dispatched by e-mail include a description of the payment, the advice reference number, and a customer reference number or instruction reference number. Please note: Advising also provides the option to send the notification by fax and by postal mail for recipients residing in Asia. For more information on the Advising service, please review the “Payments User Guide” which is located via the Help Text in the Payments service on HSBCnet. Included in this guide are details relating to the following Advising services:

If you need additional guidance on using the Advising service, please contact your local HSBCnet Support Centre. |

||||||||||||||||||||||||

Security Tip: staying protected against "Social Engineering" The term “Social Engineering” in reference to online banking security describes the tactics used by fraudsters to manipulate people into divulging confidential information and/or performing actions online that put them at risk. Being vigilant against this type of fraud helps keep you protected. What "Social Engineering" may look like What you should know HSBC will never request information that could be used to make a payment (such as token details other than the serial number on the back, account numbers, passwords, etc). Also, under no circumstances will HSBC ever ask you to undertake actions using your Security Device or ask you to divulge any of your security details over the phone. If you are ever doubtful about your HSBCnet activities, please call your local HSBCnet Support Centre. You can also contact your HSBCnet Support Centre or your HSBCnet Representative for further verification if you doubt the authenticity of incoming telephone calls purporting to be from HSBC. Reminder: upgrade your browser to protect your online experience For additional information on fraud matters and your responsibilities with regards to online safety, please refer to our Security Alerts and Tips page published under the HSBCnet logon menu. |

||||||||||||||||||||||||

Information on HSBCnet service interruptions

At times it is necessary to schedule non-regular maintenance windows to perform special types of maintenance. Notification of both planned and unplanned maintenance windows will also be posted to the HSBCnet Service Updates section.

*Maintenance window dates, beginnings and ends may be subject to change (with notice) to accommodate maintenance requirements. |

||||||||||||||||||||||||