|

||||

|

||||

Important changes coming in March

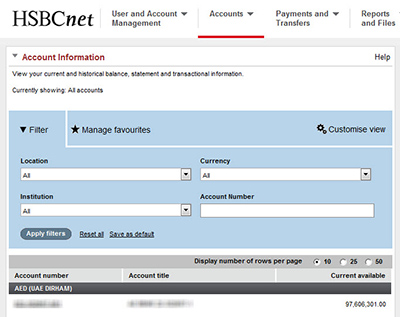

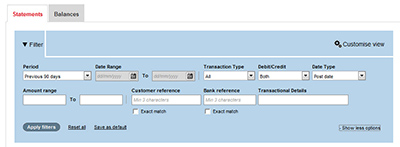

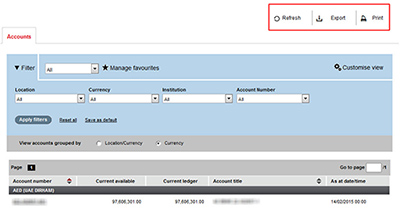

Be sure to read on to see how these changes will enrich your HSBCnet experience. Enhancements effective 14/15 March: Account Information enhancements Effective 15 March, 2015, you will notice several new and enhanced features and labels in the Account Information service designed to improve your user experience.

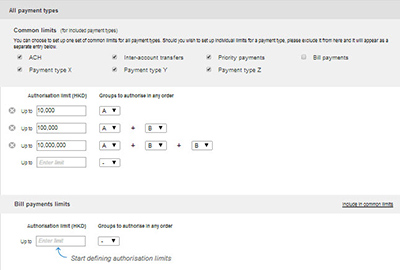

New look and feel for HSBCnet Signature Matrix screensEffective 16 March, HSBCnet will introduce a new look and feel to the Maintain Signature Limits screens. Some of the new enhancements available to System Administrators are as follows:

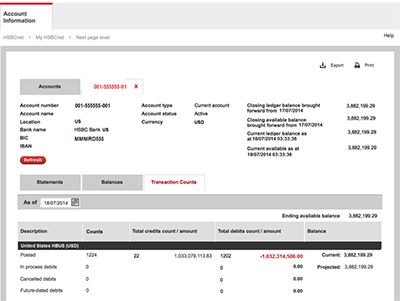

These changes are being implemented to further improve your ability to manage your Signature Groups and limits. For further information on how to use these new functions, please contact your local HSBCnet Support Centre. Account Information enhancement for US-domiciled customers with US checking accountsEffective 14 March 2015 (the “effective date”), the Account Information service will be enhanced for US-domiciled customers with US checking accounts. As of the effective date, you will be able to view a snapshot of your organization’s transactions within Account Information, in a new tab titled "Transaction Counts". The Transaction Counts tab is available for each of your US checking accounts. It will display the following real time status counts:

With this enhancement, you will be able to view these Transaction Counts for the past 180 calendar days. Customers with accounts in Israel, Malta and South Africa: supporting documentation attachment service for payments In March, an attachment function for payment instructions will be available to customers with accounts in Israel, Malta and South Africa. This service will enable customers to conveniently attach supporting documentation required to complete specific payments through a secure file attachment function on HSBCnet. A new 'Add Supporting Documentation' button will appear on online payment creation screens and payment/authorisation summary screens. You will immediately be able to send files electronically saving you the time and effort of having to fax or email required documents before payments can be processed. Applicable payments include:

File formats accepted include:

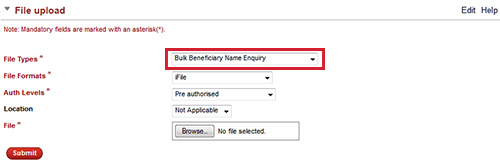

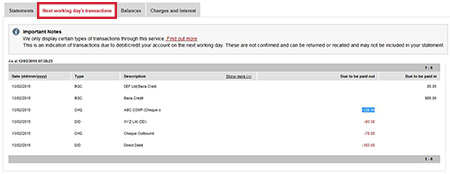

If the 'Add Supporting Documentation' button is not visible on the payment you are creating, or you choose not to include documentation through this method, your payment will be progressed according to your existing process. You will be able to add up to 10 attachments to support an individual payment. The Payment/Authorisation summary service allows you to either attach, ‘view supporting documents’, download, or search existing attachments. For your reference, a record of attached files will be kept in the Activity Log. Please note: The maximum file size of submitted attachments must be less than 20 megabytes in total. Each attachment’s filename must be 35 characters (including file extension) or less. For additional guidance on how to use this new payments feature, please review the “How do I add supporting documents to a Payment?” Quick Guide available post logon in the payment service Help Text or contact your local HSBCnet Support Centre. File Upload customers with accounts in Korea: beneficiary name checking for domestic KRW currency payments On 16 March, customers with accounts in Korea making domestic KRW transactions via File Upload service will benefit from Beneficiary name checking capability. You can upload a domestic KRW payment file for the Beneficiary checking process, by selecting the new file type, Bulk Beneficiary Name Enquiry, within the File upload screen. This will not be available for Connect H2H customers and Encryped file customers at this time. Customers with UK Retail Processing System (RPS) accounts: Next Working Day Transactions accessible via Account Information Effective 15 March, UK RPS account holders (with RPS Current, Savings & Loan accounts only) will be able to access Next Working Day (NWD) Transactions through HSBCnet’s Account Information service. A new tab is being introduced along with the existing tabs (Statement, Balances, Charges & Interest) to display these transactions on the same page for the selected account. Customers will be able to view NWD Transactions for the following payment types:

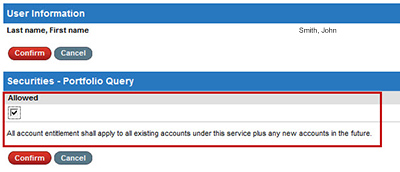

Enhanced statement quality for SEPA Credit Transfers within Account Information We are enhancing the quality of statements for SEPA Credit Transfers on accounts in Czech Republic, Malta, and Poland. These changes will enrich HSBCnet Account Information services. Effective 16 March, statements for accounts in the affected countries will include an improved customer reference for SEPA Credit Transfers debit entries. The usual Customer Reference of ‘KREF’ will be replaced with the actual Customer Reference, currently only visible in the Additional Narrative after the code word /KREF/. "All Accounts" entitlement option for HSS customers HSS customers will now have the option to use the “All Accounts“ entitlement link on the Maintain User Access Level screen for the following services.

This new link will allow you to not only entitle a user to all your current Securities accounts to the above services, but also allows you to entitle a user to any future security accounts that may be added. For further assistance, please contact your local HSBCnet Support Centre. |

||||