|

Deutsche |

En español |

En français (canadien) |

En français (européen) |

繁體中文

简体中文 |

Bahasa Indonesia

Hello,

On 17 July 2023, we’ll be updating the following services for domestic Priority Payments from accounts in Thailand:

- HSBCnet

- File Upload service

- HSBC Connect

To avoid rejections, we strongly recommend that you review and update your payments as soon as possible after 17 July 2023 to make sure that the correct address details are included in the new fields.

Also, from 17 July, you will not be able to authorise domestic Priority Payments from Thailand accounts using the ‘Payment file ILA’ link in the HSBCnet menu. Read on to learn more.

What’s changing in HSBCnet?

Below are some of the changes you’ll notice in HSBCnet (including HSBCnet Mobile) starting from 17 July 2023.

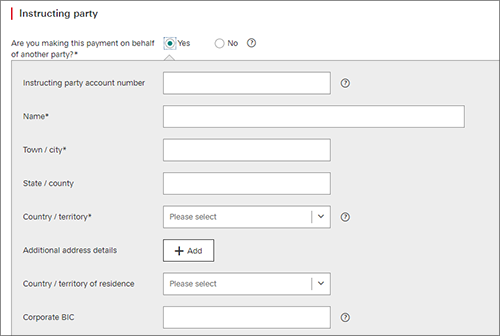

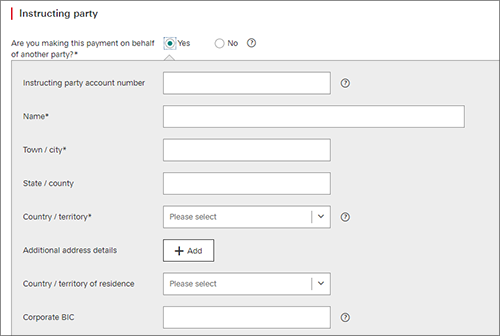

New address fields for Priority Payment screens and templates:

When you create a Thai Baht (THB) currency Priority Payment in Thailand, you will see the following new fields (replacing the current address fields):

| Section in Priority Payment screens |

Current address fields |

New address fields

(from 17 July) |

- Beneficiary Details

- Instructing Party (Ultimate Debtor) payments made on behalf of another party

- Final Beneficiary (Ultimate Creditor) payments intended for someone other than the named beneficiary

|

Name*

Address*

- Address line 1

- Address line 2

- Country or territory

|

Name* field extended to support up to 140 characters |

| Town / city* |

| State / county |

| Country / territory* dropdown list |

| Additional address details |

| * indicates a mandatory field |

Here’s an example of what the new ‘Instructing party’ address fields will look like:

(select image to enlarge)

These new address fields are also being introduced for Payment Authorisation and Activity Log screens for domestic Priority Payments from Thailand accounts.

To prepare for this change, we strongly recommend that you review your HSBCnet payment instructions as follows:

- Payment templates:

If you have any restricted templates created before 17 July 2023 that contain Instructing Party information, you will not be able to use these templates for payment creation after 17 July. We strongly recommend that you create a new restricted template or modify the existing restricted template as soon as possible after 17 July 2023 as you will need to use the new template for any payment after that date.

If you have any general templates created before 17 July 2023 that contain Instructing Party information, you will need to select the applicable country when creating the payment after 17 July.

Reminder: When you update a restricted template, you will need to have another user approve the changes in the Template Summary service before the template can be used to make payments.

- Priority Payments in ‘pending’ status:

If you have any Priority Payments with Instructing Party details in ‘pending’ status, we recommend that you submit them before 17 July 2023 to avoid payment rejections. If completing these pending payments after 17 July 2023, the payment creator will need to update the instruction using the new address fields.

- Forward-dated payments and Standing Instructions:

If you have any forward-dated payments or Standing Instructions, they will be submitted with the payment information that has already been entered. We recommend that you cancel and re-create these payment instructions as soon as possible after 17 July 2023 to avoid possible rejection.

For any Standing Instructions with Beneficiary and/or Instructing Party address details, you will need to re-create those instructions using the new fields as soon as possible after 17 July. This will help you benefit from the enhanced name and structured address information.

- New Unique End-to-end Transaction Reference (UETR) field in HSBCnet

The UETR field will be available for domestic Priority Payments from Thailand accounts from 17 July 2023. You can quote this UETR to our Client Service team for further investigation.

A UETR is a string of 36 unique characters featured in all payment instruction messages carried over Swift and RTGS systems adopting ISO 20022 standards.

Important note about the Payment file ILA service

From 17 July, you will not be able to authorise domestic Priority Payments from Thailand accounts using the ‘Payment file ILA’ link in the HSBCnet menu. We recommend that you authorise ILA payment files using the Authorisation Summary service.

What’s changing for Priority Payments submitted using HSBCnet’s File Upload service and HSBC Connect?

From 17 July 2023, please make sure that payment files comply with the changes for domestic payments. Please review the updated Message Implementation Guide for iFile, XML V.2, XML V.3, and PayMul. From 17 July, your payment files will need to meet all the requirements in the guides.

Here’s some of the changes we’ve made to the Message Implementation Guides effective from 17 July 2023:

| For payments with: |

Required details: |

| Forwarding agent |

Forwarding agent name |

Must be included with:

Accompanying address in structured address format, with a minimum of town name and country code. |

| Ultimate debtor |

Ultimate debtor name |

| Ultimate creditor |

Ultimate creditor name |

| Invoicer |

Invoicer name |

| Invoicee |

Invoicee name |

Initiating Party

(XML V.2/XML V.3) |

Choose one of the following options:

- Initiating Party ID with Initiating Party name and structured address (Name, Town/City and Country code are mandatory)

- Initiating Party ID without Initiating Party name and address

- Initiating Party ID with Initiating Party name only

|

| Intermediary Agent (XML V.2/XML V.3) |

Intermediary agent name |

If you use Intermediary Agent 2 and/or Intermediary Agent 3, you must include the

accompanying address in structured address format with a minimum of town name/country code.

There is no change for Intermediary Agent 1. |

For all payments:

From 17 July, you must no longer provide unstructured address details in Address Line fields of payment files to avoid payment rejections. The unstructured address format for the above fields will no longer be supported by domestic payment networks. |

Please make sure to review the updated guides to see all the updated payment file requirements.

Find out more

To learn more about this change and to obtain the updated Message Implementation Guide (MIG), contact your local HSBC representative.

Sincerely,

Your HSBCnet team

|