|

||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||

Important changes coming in December

Be sure to read on to see how these changes will enrich your HSBCnet experience. Enhancements effective 5/6 December: Account Information service enhancements Effective 6 December, 2015, the Account Information service on HSBCnet will be enhanced with a new Account type dropdown list, within the Filter tab. This will enable you to easily browse through different types of accounts. In order to see the Account type column on the Account information page, select the Account type option within the Customise view feature. Additional information can be found within the Account Information service’s Help Text on HSBCnet or by contacting your local HSBCnet Support Centre. Report Writer: additional reports available Report Writer allows you to generate customised reports online via the Reports and Files Download service in HSBCnet. Effective 6 December, Report Writer is being enhanced to include the following two administrative reports:

For additional information on Report Writer and Administrative reports, please contact your local HSBCnet Support Centre. Important information for customers with accounts in Mexico: Beneficiary registration required for payments effective 7 December Effective 7 December 2015, creating a payment using your Mexico debit account will require the receiver of the payment to be a registered beneficiary. This is a regulatory requirement indicated in the General Decree applicable to Credit Institutions as stated by Comisión Nacional Bancaria y de Valores (CNVB). Read on to learn more about how to register your beneficiaries for your payment instructions. Security enhancements for customers in Mexico Effective 7 December 2015, and in compliance with local regulations introduced by Comisión Nacional Bancaria y de Valores (CNVB), HSBCnet will introduce the following enhancements for Users on your profile.

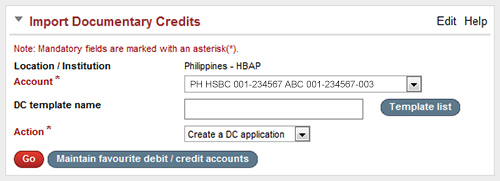

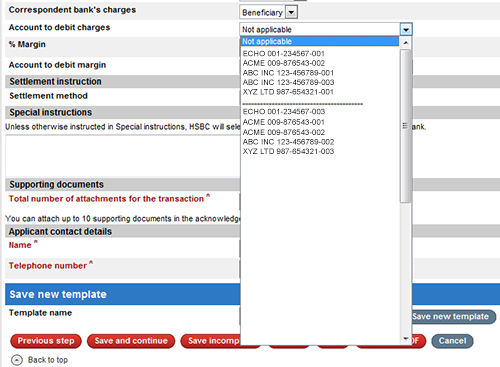

For additional information regarding these enhancements, please contact your local HSBCnet Support Centre. New favourite accounts feature for Trade Services Effective 6 December, the Maintain favourite debit/credit accounts feature will be available for Guarantees, Standby Documentary Credits and Trade Services on HSBCnet. This new feature provides you with convenient access to your most commonly used accounts for trade transactions. From 6 December, you can use this new feature to create and maintain a list of “favourite accounts” that will appear first on account dropdown lists. You will be able to maintain separate favourite debit or credit account lists for Trade, Guarantees and Standby Documentary Credit transactions. You can access this feature by selecting the ‘Maintain favourite debit/credit accounts’ button within the Trade Services. As displayed in the image below, the favourite debit or credit accounts will be displayed at the top of the account dropdown list, followed by a separator and the remainder of your accounts. Additional information on the Maintain favourite debit/credit accounts feature can be found within the Trade Services Help Text on HSBCnet. For more information, please contact your local trade representative. Customers with accounts in the US: enhancements to Intra-Day and End of Day Bank Statements On 7 December, 2015, Intra-Day and End of Day bank statements for some of your accounts are being enhanced to reduce differences in the transaction narrative between the two reports. As a result, you will see the changes highlighted below in the transaction narrative of the HSBCnet Intra-Day and End of Day bank statements for some of your accounts.

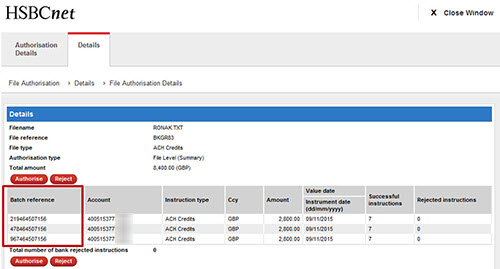

As a result of these changes, your internal ERP systems or automated account reconciliation programs may be impacted. To ensure the on-going operation of your automated reconciliation processes, we recommend you review your internal systems and, if required, update them with the new settings on or after 7 December. If you have any questions, please contact your local HSBC representative or your local HSBCnet Support Centre for additional assistance. File Upload: UK BACS Standard 18 payment file enhancementsEffective 6 December, HSBCnet File Upload screens and reports are being enhanced to include unique reference details from BACS Standard 18 payment files for UK ACH. From the effective date, you will see the `Narrative of Users choice’ reference (as input in your BACS Standard 18 files) displayed in the “Batch Reference” column on the following File Upload screens:

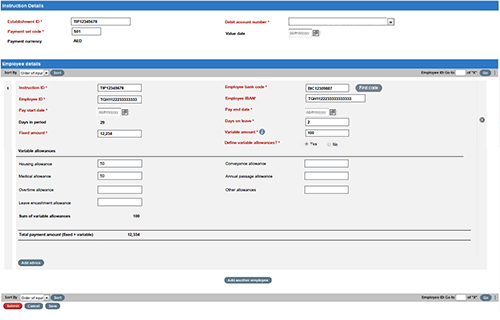

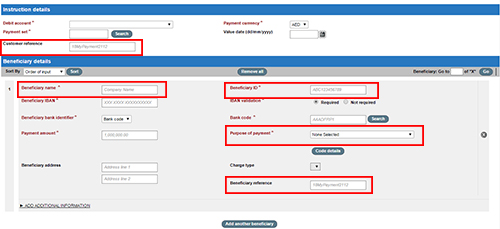

The screenshot below highlights the ‘Batch reference’ column that will display the ‘Narrative of Users choice’ information after 6 December. The File Upload Report, available via the Reports and Files Download service in HSBCnet, is also being updated to include the ‘Narrative of Users choice’ in the ‘Batch Reference’ field. Customers with accounts in UAE: upcoming enhancements to UAE Wages Protection System (WPS) payments Effective 6 December 2015, the existing UAE WPS payment screens and file formats will be updated in accordance with Central Bank of the UAE guidelines. Summary of UAE WPS changes effective 6 December:

ACH Credit - Wages Protection System Payments

For additional details on creating WPS payments in HSBCnet, please refer to the UAE Wages Protection System guide available post-logon in the HSBCnet Help Centre. This guide can also be found in the Create new Payment service window by selecting the ‘Help’ link in the top right corner. Alerting enhancement: mandatory alerts for Sole Transaction Control profiles with accounts in Egypt Effective 6 December, customers operating under Sole Transaction Control (STC) with accounts in Egypt may receive one or both of the following mandatory alerts as part of on-going efforts to mitigate online fraud:

e-Cheque service for accounts domiciled in Hong Kong HSBC is introducing e-Cheque services as part of an industry wide launch of the new e-Cheque payment method in Hong Kong. Effective from 7 December, 2015, the new e-Cheque service will be made available to customers with eligible HKD, USD and CNY accounts domiciled in Hong Kong operated via HSBCnet. For further assistance, please contact your local HSBCnet Support Centre. Important update for customers with accounts in Oman: ACH Credit payment screen enhancements and SWIFT BIC code implementation Please be advised that the ACH Credit payment screen and SWIFT BIC code enhancements for Oman mentioned in the October edition of HSBCnet News will no longer be available on 6 December 2015. Upon the confirmation of a new effective date, we will issue a new written notification to advise of the availability of these enhancements on HSBCnet. We regret any inconvenience that may have been caused. For your reference, the previous communications regarding Oman ACH Credit enhancements are available here.> |

||||||||||||||||||||||||||||||||||||