Having trouble reading this e-mail? View the online version or view this newsletter after logging on to HSBCnet. |

||||||||||||||

|

||||||||||||||

|

||||||||||||||

|

|

||||||||||||||

Important changes coming in March

|

||||||||||||||

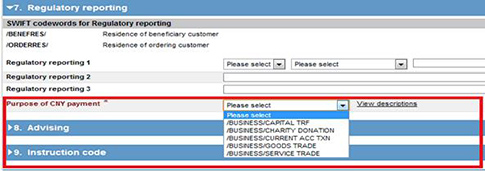

New Payment Purpose code requirement for RMB cross-border payments As part of upgrades to the China National Advanced Payment System (CNAPS) to support enhanced regulatory requirements, the inclusion of a Payment Purpose code will be mandatory for all on screen RMB cross-border payments effective 17 March 2014. Customers using File Upload will also be required to include the new Payment Purpose code information in their payment file formats by 27 April, 2014.

Please note: as a result of this change, instructions submitted onscreen through HSBCnet after 17 March (or via File Upload after 27 April) without a valid Payment Purpose code may be rejected, delayed, or incur additional charges. Domestic RMB payments do not require a Payment Purpose code however there may be requirements for inclusion of a Payment Purpose code in accordance with your local country-specific payment requirements. Customers making payments onscreen Customers using File Upload

Please note:

More information For further assistance, please contact your Cash Management specialist to obtain more detailed information. |

||||||||||||||

Customers with accounts in the Eurozone: requirements for SEPA End Date Regulation The mandatory deadline for all legacy Euro transactions within the Eurozone to migrate to harmonised SEPA schemes for both Credit Transfers and Direct Debits was 1 February 2014 (the “Original End Date”). However, the European Parliament has endorsed an additional transition period which permits the processing of non-SEPA compliant payments (legacy payments) alongside SEPA Credit Transfer (SCT) and SEPA Direct Debit (SDD) transactions for a period of up to six months after the Original End Date. Ireland, Belgium and Spain have determined shorter transition periods, which are detailed below. To learn more about SEPA key changes and how HSBC can help, you are encouraged to review our SEPA Migration Guide and to speak with your migration or sales manager about the latest updates. HSBCnet enhancements for SEPA integration

For further assistance If you have any additional questions please don’t hesitate to speak with your HSBC representative. Furthermore, if you are not in a position to move to XML, have questions concerning your current formats, or need guidance with XML requirements, our SEPA migration experts are more than happy to provide support. You can identify and reach experts for your specific location by visiting www.hsbcnet.com/sepa. |

||||||||||||||

Customers with accounts in Australia: extended payment cut-off times Effective Monday, 10 March, the local payment cut-off time on HSBCnet for ACH (Direct Entry) payments from HSBC accounts in Australia to other local banks in Australia will be extended. From 10 March the final or last weekday cut-off time for local payments to be processed on that same day will be changed from 5.00PM AEST to 6.00PM AEST. This change provides an extra hour each weekday to process ACH payments from accounts in Australia. Any payment sent with a blank value date received by the bank before 6PM after 10 March will be processed on the same day. |

||||||||||||||

Process improvement for Payment Orders in Brazil The number of processing days for payment orders with debit on Brazilian accounts through HSBCnet and HSBC Connect has been changed from D-1 to D0. Customers are now able to send payment orders for the same day that a beneficiary requests the withdrawal and are no longer required to send the payment order one day ahead as done previously. Please note: Even though this type of payment can be authorised until 7:30pm through HSBCnet, withdrawals requested by beneficiaries thorough an HSBC branch location should respect branch working hours, which are normally from 10am to 4pm. For further assistance, please contact Brazilian HSBCnet Support at 0800 701 3911 (Local) / + 55 41 3307 6911 (International) or e-mail hsbcnet.supportbrazil@hsbc.com.br. |

||||||||||||||

New electronic funds transfer service coming soon to Singapore Fast And Secure Transfers (FAST) is a new electronic funds transfer service soon to be available in Singapore. The new service will allow you to transfer SGD funds almost immediately between your HSBC account and another participating bank account. HSBC is one of the 14 banks participating in this initiative driven by the Association of Banks in Singapore (ABS). Currently, it can take up to three working days for customers to transfer money from one account to another across banks. With FAST, you will be able to transfer and receive funds via HSBCnet almost immediately and receive a notification on the status of the transfer. FAST is being introduced to meet consumer and business demand within Singapore for faster funds transfer services and will be launched by the middle of this year. More details will be provided nearer to the launch date. |

||||||||||||||

Instructed to change a supplier's bank account details? Make sure to take a closer look. It’s a good idea to be wary of any requests from your beneficiaries (via e-mail, phone or otherwise) to change their banking details. The request may be an attempt to divert payment funds to a fraudulent account. Fraudulent requests may be disguised as originating from a supplier and ask that you change the supplier’s bank account information. As a precaution, always take the extra step of checking directly with your suppliers, either through an original e-mail address or a phone call to a trusted source in their company, to confirm that the change request is genuine. In some cases, the fraudulent request to change supplier information or make a payment to an unfamiliar account supposedly comes from your organisation’s CEO, President or other administrator. When reviewing any type of payment instructions from an internal source, ensure the request uses your organisation’s official channels and follows authorised processes and procedures. |

||||||||||||||

Information on HSBCnet service interruptions

At times it is necessary to schedule non-regular maintenance windows to perform special types of maintenance. Notification of both planned and unplanned maintenance periods will also be posted to the HSBCnet Important Information section.

*Maintenance window dates, beginnings and ends may be subject to change (with notice) to accommodate maintenance requirements. |

||||||||||||||

|

||||||||||||||

Please do not reply to this e-mail. Our postal address: You received this e-mail notification because you are a registered User of HSBCnet. Should you have any concerns regarding the validity of this message, please contact your local HSBCnet customer support. If you wish to unsubscribe from receiving service information from HSBCnet, please click here. |

||||||||||||||