|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

Important changes coming in March

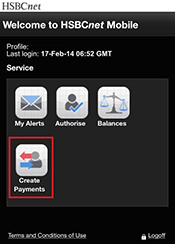

Enhancements effective 15/16 March: HSBCnet Mobile launches Inter-account Transfer and Bill Payment creation capability Over the weekend of 15/16 March, the HSBCnet Mobile platform will be enhanced to support the creation of Inter-account Transfers and Bill Payments*. The streamlined payment creation process on HSBCnet Mobile has been designed to operate in the

The “Create Payments” icon on the HSBCnet Mobile home screen will present Users with the following options for payment creation:

Beneficiaries for Priority Payments and Bill Payments must have been previously accepted as known and trusted beneficiaries on the main HSBCnet site prior to being available for use on the mobile platform (payments to new beneficiaries will not be possible).

Any related limits and entitlements are the same as when using the main HSBCnet site.

Standing Instructions and Sole-Transaction Control payment creation functions are also supported on HSBCnet Mobile.

Please note: HSBCnet Mobile Priority Payment and Inter-Account Transfer creation is only available to Users assigned a DP270 security device.

For more information on how to create payments using HSBCnet Mobile please visit the HSBCnet Help Centre post logon to review the updated HSBCnet Mobile User Guide after 15/16 March.

If you have never used HSBCnet Mobile before – it’s easy to get started. Simply enter www.hsbcnet.com/mobile into your smartphone’s web browser** and use your logon credentials to gain instant access to:

For additional guidance, view our HSBCnet Mobile Training video or speak to your HSBCnet representative.

* Inter-account Transfer creation functionality will be available to customers and accounts in the following countries: Singapore, UAE, Vietnam, Saudi Arabia, Brazil, Thailand, Bahrain, Kuwait, Oman, Mexico, and Bermuda.

Bill Payment creation functionality will be available to customers and accounts in the following countries: Singapore, UAE, Vietnam, Saudi Arabia, Brazil, Bahrain, Oman, Mexico, and Bermuda.

** Currently, HSBCnet Mobile only supports the following mobile phones:

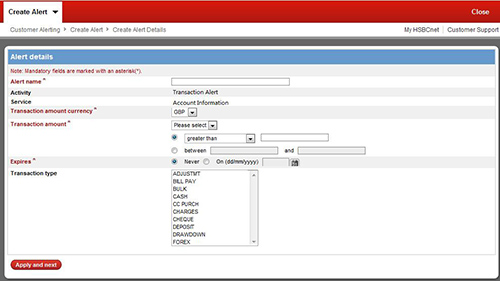

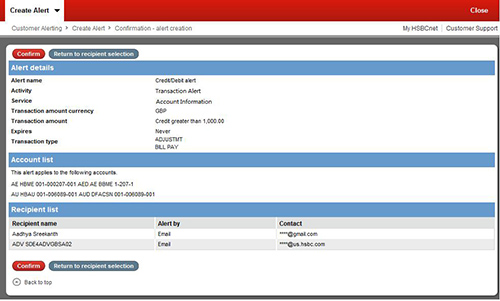

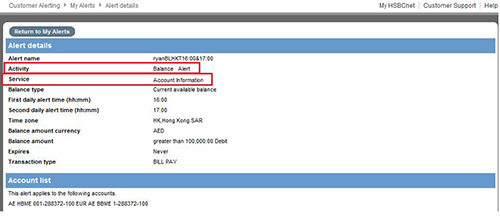

1 In those countries that currently support this specific service. Alerting enhancements: new "Transaction type" field Effective 17 March, an optional field “Transaction type” will be added in Create Alert Details and Change Alert screens with an option list to allow multiple selections. The new field “Transaction type” will also display the selected transaction type option(s) in Credit/Debit alert Confirmation, Acknowledgement and Alert Details screens. For those alert rules without Transaction type selected, the field value will be blank. The Transaction type value will also be included in e-mail notification content for Credit/Debit alert types. Value options will be the same as those used in Account Information and include:

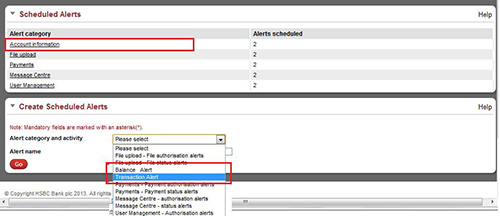

As a result of this new field you will also be able to schedule an alert by Transaction 'type'.

Please note: you will continue to receive existing scheduled alerts according to parameters already available, however if you wish to select a 'type' of transaction to alert off (rather than amount or date) you will need to update the existing alert or schedule a new one. Alerting enhancements: labelling enhancements to align with Account Information Effective 17 March, some labels in alerting screens (both Balance and Debit/Credit alert types) will be renamed to be consistent with Account Information capability. Additionally,

“This alert is to advise you that your Account has been updated.”…

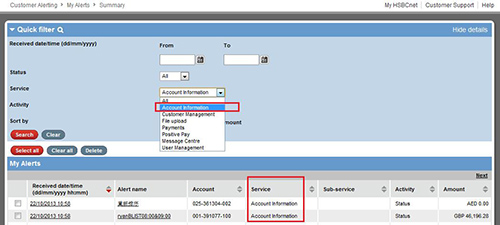

In several areas labels that currently read as “Balance transaction reporting” will change to “Account Information”; “Balance and Transaction Report - Credit/Debit Alert” will be renamed “Transaction Alert”; and “Balance and Transaction Report - Balances Alert” will become “Balance Alert”, including:

For example: Additionally, the Service option label “Accounts” will be renamed to “Account Information”:

For example: Additional information and assistance with using the Alerts service can be found within the service Help Text on HSBCnet. Alerting enhancements: Mobile input requirements for Sole Transaction Control profiles with accounts in Singapore and Hong Kong As part of regulatory requirements, Singapore and Hong Kong customers operating under Sole Transaction Control (STC), as well as global STC customers holding accounts in either Singapore or Hong Kong, can expect to be asked to input their mobile number when updating or editing their User profile after 17 March.

This new requirement will increase your online security and enhance control and oversight over HSBCnet activity by enabling you to be notified of activity via SMS when certain User profile changes are made including:

Alerting enhancements: mandatory alerts for Sole Transaction Control profiles with accounts in Mexico and SingaporeEffective 17 March, customers operating under Sole Transaction Control (STC) with accounts in Mexico or Singapore may receive one or both of the following mandatory alerts as part of on-going efforts to mitigate online fraud:

Alerting enhancements: mandatory alerts for all customersRegulatory requirements state that electronic notifications must be provided to customers for activities that happen through online channels. For this reason the additional alert triggers listed below will be applied to all customers globally operating under all profiles.

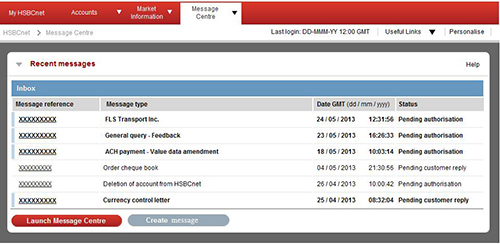

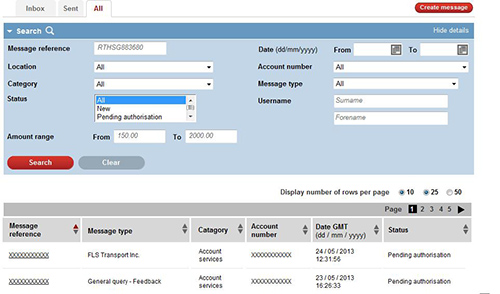

These alerts will be automatically granted to you as of 17 March. Message Centre: new attachment capability and enhancements for a more streamlined experienceThe launch of Message Centre has provided a secure platform for HSBCnet customers to initiate administrative and transactional queries with HSBC. As part of on-going efforts to continuously improve this communication channel, we will be rolling out several enhancements to Message Centre effective 17 March. These include:

For detailed information on how to use the updates services being offered through Message Centre please review the Message Centre User Guide available in the on screen Help Text or contact your local HSBCnet Support Centre. Wage Protection System for UAE Onscreen ACH and File Upload Effective 17 March, UAE customers will now be provided with the flexibility to send their Wage Protection System (WPS) transactions in different ways (i.e. online input, industry standard and HSBC specific file formats). The current HSBCnet offering only allows for uploading the Salary Information File (SIF) file format at File Level authorisation. This enhancement will now expand your WPS payment options to on screen ACH Credits.

The UAE WPS is an electronic salary transfer system that allows institutions to pay workers’ wages via banks and financial institutions. Please note that the WPS only applies to employers registered with the UAE Minister of Labour. Customers wishing to make non-WPS onscreen payments can select the ACH Payments sub payment type under ACH Credits. Effective 17 March, on screen Mexico Bill Payments that have been fully processed by the bank will now have the option to print a receipt for that transaction. A new "Print PDF" button within the Bill Payments Summary Details page will be available. Bill Payments processed prior to this date will also have the Print PDF button as of 17 March.

Mexico Bill Payments that have been submitted through the File Upload service will have the associated receipt available through the Reports and File Download service. The receipt will contain the summary information for all the Bill payments made within that file. New ISPB code method for Brazil TED payments Versão em Português

Effective March 22, a new Beneficiary Bank Identifier code listed as 'ISPB code' will be available for use for Brazil TED payments (High Value payments). While this option will be available earlier, please refrain from using the service prior to the effective date as it may result in the rejection of your TED payment. The implementation of this new code will satisfy regulatory requirements set by the Central Bank of Brazil to support messages using the ISPB code which identify the financial institutions in the Brazilian Payment System. This option will be seen when the following TED payment creation conditions are met (Core Payment and TED Payment screens): Debit account is a Brazil domiciled account and Payment amount currency is BRL.

Please note: When the credit account is from a banking institution the minimum TED amounts remains as BRL 1,000.00, but for non-banking institutions (which don't have bank codes, only ISPB codes) there is no minimum amount for TED payments.

For customers that operate with files there will be a layout change required if they need to use ISPB codes. To get information on the layout changes, please contact hsbcnet.implementationbrazil@hsbc.com.br.

For further assistance, please contact Brazilian HSBCnet Support at 0800 701 3911 (Local) / + 55 41 3307 6911 (International) or via e-mail: hsbcnet.supportbrazil@hsbc.com.br. Enhanced statement quality for SEPA Credit Transfers within Account Information This March, we are enhancing the quality of statements for SEPA Credit Transfers on accounts in France, Ireland, Netherlands, and Spain. These changes will enrich HSBCnet Account Information (and Balance and Transaction Reporting) services. Effective 17 March, statements for accounts in the affected countries will include an improved customer reference for SEPA Credit Transfers debit entries. Simplifying your user experience We are continuing to look for ways to implement efficiencies throughout HSBCnet. Effective 17 March, we are rolling out enhancements which will reduce the number of windows being opened during your HSBCnet sessions starting with your Log On process. The extra window that opens when you click the Log On button from hsbcnet.com (used for username input), will be eliminated – allowing for the same, initial window to be used for further log in credentials. Additionally, we are streamlining the closing of active windows. From 17 March you will no longer be asked, “Are you sure you want to close this page” when opening new pop-up windows while making a payment - instead it will close automatically upon completion. |

||||||||||||||||||||||||||||

Please do not reply to this e-mail. Our postal address: You received this e-mail notification because you are a registered User of HSBCnet. Should you have any concerns regarding the validity of this message, please contact your local HSBCnet customer support. If you wish to unsubscribe from receiving service information from HSBCnet, please click here. |

||||||||||||||||||||||||||||