Having trouble reading this e-mail? View the online version or view this newsletter after logging on to HSBCnet. |

||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||

Important changes coming in June Several new enhancements will be introduced to HSBCnet over the weekend of 14/15 June delivering more convenience to your banking experience. Changes include improved services for HSS customers, expanded alerts and Message Centre capabilities as well as several updates for customers with accounts in Mexico. Be sure to read on to see how these changes will enrich your HSBCnet experience. |

||||||||||||||||||||||||||||||

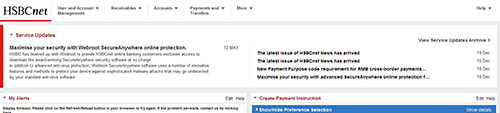

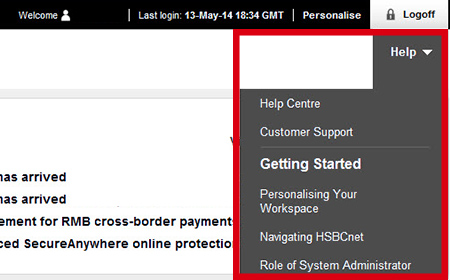

Coming soon: updates to HSBCnet display and functional design Coming soon are a number of changes designed to make HSBCnet easier to use. These include:

|

||||||||||||||||||||||||||||||

Customers with accounts in the Eurozone: requirements for SEPA End Date Regulation The mandatory deadline for all legacy Euro transactions within the Eurozone to migrate to harmonised SEPA schemes for both Credit Transfers and Direct Debits was 1 February 2014 (the “Original End Date”). However, the European Parliament has endorsed an additional transition period which permits the processing of non-SEPA compliant payments (legacy payments) alongside SEPA Credit Transfer (SCT) and SEPA Direct Debit (SDD) transactions for a period of up to six months after the Original End Date. Ireland, Belgium, Malta and Spain have determined shorter transition periods. To learn more about SEPA key changes and how HSBC can help, you are encouraged to review our SEPA Migration Guide and to speak with your migration or sales manager about the latest updates. HSBCnet enhancements for SEPA integration

For further assistance |

||||||||||||||||||||||||||||||

Customers with accounts in Canada: extended cut-off times for USD wire payments Effective 2 June 2014, USD wire cut-off times to Canada and the US for same-day–value transfers will be extended for greater convenience. USD payments received after the established deadlines will be processed on the next business day.

Please note: The cut-off times quoted for USD Wire Payments apply only to transactions that can be straight-through processed without manual intervention. If the transaction is received after 1:00 pm PT / 4:00 pm ET and requires any repair or manual processing, the transaction may be held until the next business day for processing. If you have any questions regarding the new payments deadlines outlined below, please contact your local HSBCnet Support Centre. |

||||||||||||||||||||||||||||||

Customers domiciled in Vietnam: e-Statements now available for your local Vietnam accounts HSBCnet e-Statements are now available to customers domiciled in Vietnam for local Vietnam accounts. They can be downloaded via the Reports & File Download (RFD) service on HSBCnet. New e-Statements are generated and made available through RFD at the same frequency at which your paper statements are usually sent. The content and layout for e-Statements will also match your paper form statements. Please note: users will need to be entitled by HSBCnet System Administrators before being able to access and download e-Statements. For more information please contact your HSBC representative or local HSBCnet Support Centre. |

||||||||||||||||||||||||||||||

Important change affecting Customers making payments to Allied Banking Corporation (Allied Bank) in the Philippines Due to the merger of Philippine National Bank (PNB) and Allied Banking Corporation (Allied Bank), we wish to advise you of the following changes when making payment instructions to Allied Bank, with effect 1 July 2014:

Sample: Making a payment instruction intended for an Allied Bank beneficiary account via HSBCnet. In addition, manual fund transfer forms with Allied Bank as the intended beneficiary bank will no longer be accepted. For more details or should you have any questions on these changes, please do not hesitate to call your Client Services Manager or Relationship Manager. |

||||||||||||||||||||||||||||||

Security Tip: Instructed to change a supplier's bank account details? Make sure to take a closer look It’s a good idea to be wary of any requests from your beneficiaries (via e-mail, phone or otherwise) to change their banking details. The request may be an attempt to divert payment funds to a fraudulent account. Fraudulent requests may be disguised as originating from a supplier and ask that you change the supplier’s bank account information. As a precaution, always take the extra step of checking directly with your suppliers, either through an original e-mail address or a phone call to a trusted source in their company, to confirm that the change request is genuine. In some cases, the fraudulent request to change supplier information or make a payment to an unfamiliar account supposedly comes from your organisation’s CEO, President or other administrator. When reviewing any type of payment instructions from an internal source, ensure the request uses your organisation’s official channels and follows authorised processes and procedures. |

||||||||||||||||||||||||||||||

Hints and Tips: Verify your payment status Not sure if your payment was approved and processed by the bank? Use the Payment Summary service to verify your payment status. To access the Payment Summary service in HSBCnet, select “Payment Summary” from the “Payments and Transfers” menu. Locate your payment by selecting the type of payment from the list presented in the Payment Summary section. In the Status Summary window, you can review the status of your payments created in the last 35 days. For your reference, “Received by bank” status means that the payment has been authorised and received by bank systems. “Processed by bank” will be displayed when the payment has been debited from your account and sent to the beneficiary. Additional information regarding Payments and the Payment Summary service is available in the Payments section of the HSBCnet Help Centre. |

||||||||||||||||||||||||||||||

Hints and Tips: Making cross-border foreign currency payments For cross-border foreign currency payments, there are some countries that require specific information to be included in the payment instructions (MT103). Following the simple guidelines below for inputting your beneficiary or beneficiary’s bank information in your payment instructions will help to avoid payment delays and/or additional costs associated with having insufficient information related to your cross-border foreign currency payments.

|

||||||||||||||||||||||||||||||

Information on HSBCnet service interruptions

At times it is necessary to schedule non-regular maintenance windows to perform special types of maintenance. Notification of both planned and unplanned maintenance periods will also be posted to the HSBCnet Important Information section.

*Maintenance window dates, beginnings and ends may be subject to change (with notice) to accommodate maintenance requirements. |

||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

Please do not reply to this e-mail. Our postal address: You received this e-mail notification because you are a registered User of HSBCnet. Should you have any concerns regarding the validity of this message, please contact your local HSBCnet customer support. If you wish to unsubscribe from receiving service information from HSBCnet, please click here. |

||||||||||||||||||||||||||||||