|

||||||||||||||

|

||||||||||||||

Important changes coming in June

Enhancements effective 14/15 June: Enhanced PDF reports generated by Report Writer Effective 16 June, PDF reports generated by the Report Writer service on HSBCnet will be enhanced to include the HSBC logo in the top left corner of each page.* The enhanced reports are designed to make it easier to identify reports associated with HSBC accounts, as well as qualify the reports as official bank records for your day-to-day business needs. The HSBC logo will not be visible when using the “Report Preview” within the Report Writer service. * Please note: Inter Company Lending (ICL) reports will not display the HSBC logo. Customer Alerts now available for Trade, Guarantee and Standby Documentary Credit transactions For certain countries, customers can now use the Customer Alerting feature of HSBCnet to set up e-mail alerts for their Trade, Guarantee and Standby Documentary Credit transactions. An e-mail alert will be generated for user nominated account(s) when the status of a transaction (for example, Deleted by customer, Pending Authorisation, Pending Check, Pending Repair, etc.) changes before the transaction is submitted to the bank. This alerting feature will eliminate the need for Users to log on to HSBCnet to determine the status of specific transactions and only log on when action is required. Service features include:

The countries supporting Alerting feature for Trade transactions include:

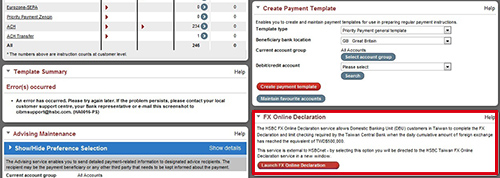

All sites which have deployed HSBCnet for Guarantees will support Customer Alerting for Guarantee transactions. For additional information on creating and reviewing scheduled alerts please refer to the Customer Alerting, Internet Trade Services, and Guarantee and Standby DC User Guides in the Help Centre. Hang Seng Customers in China: access to the Hang Seng China Electronic Commercial Draft System through Hang Seng HSBCnet In compliance with regulatory requirements being implemented by the People’s Bank of China (PBOC), Hang Seng HSBCnet will be enhanced to include an embedded link to the Hang Seng China Electronic Commercial Draft System (ECDS). ECDS is the platform developed by the PBOC - China Central Bank for nationwide payment and settlement of domestic electronic commercial draft. Effective Tuesday 17 June, customers with CN HASE Renminbi (RMB) currency trade accounts will be eligible to use the Electronic Commercial Draft via the Hang Seng China ECDS. How it works: Once a User is entitled, the new embedded link will appear under the “China Electronic Commercial Draft” tab. In the China Electronic Commercial Draft window, Users can select the link “Launch Hang Seng China ECDS” to open the service in a new browser window. Hang Seng China ECDS will launch automatically from HSBCnet, you will not be required to log in separately to the system. You will remain logged in to HSBCnet until you log out or your HSBCnet session times out. Important note for HSBC China customers with RMB trade accounts: If you require assistance with entitlements for this service, please contact your local HSBCnet Support Centre. For more information regarding ECDS enrolment, please contact your Hang Seng Relationship Manager. Customers with accounts in Taiwan: Foreign Exchange Online Declaration for TWD payments As a foreign exchange control country, the central Bank of Taiwan is implementing a requirement for corporate customers to complete a Foreign Exchange (FX) Online Declaration for all FX transactions from accounts in Taiwan when the daily cumulative equivalent is TWD $500,000 or greater. From Monday 30 June, HSBCnet Users will be able to access the FX Online Declaration directly through an embedded link in HSBCnet. Important note: until access to the FX Online Declaration is made available on HSBCnet at the end of June, you are required to continue submitting the FX Declaration Form via the current service channel. From the effective date, once the daily cumulative amount equivalent to TWD $500,000 or greater has been reached, HSBCnet Users will be required to complete the FX Online Declaration after submitting the following transactions:

After submitting instructions for eligible transactions, you will be reminded to complete the FX Online Declaration. You can access the link to the FX Online Declaration in the Payments menu. When you select “Launch FX Online Declaration” a new browser window will open. There are no additional entitlements or logon credentials required to access and complete the FX Online Declaration. For more information regarding the FX Online Declaration, please contact your local HSBC representative. Customers with accounts in Mexico: new SPEI payment category and payments and receivables advising enhancementEffective 16 June local payments from accounts in Mexico (in either MXN or USD currency) will be newly categorised as SPEI payments. Additional sections will be made available on the Priority Payment screen when a SPEI payment is detected.

In addition, PDF payment receipts will be generated for these newly categorised SPEI Priority Payments as well as File upload Priority payments and ACH – In house MX payments. Once the payment has been processed successfully by the bank, a payment receipt will be generated and posted to Reports and File Download as follows:

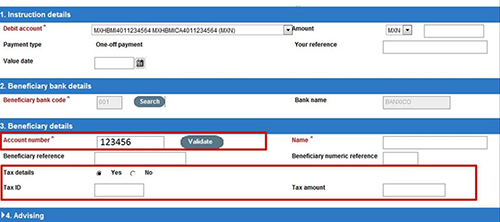

Customers with accounts in Mexico: tax details and beneficiary account validationFrom 16 June, Tax ID and Tax amount details can be included when using the following services to make local payments in Mexico:

As an additional enhancement, you will be able to ‘validate’ beneficiary account numbers for local HSBC Mexico accounts within HSBCnet. Validating an account number is optional and can be found on the following payment types:

Please note: Sole Transaction Control customers will be required to create a general or restricted template before being able to create Priority Payments via HSBCnet. Customers with accounts in Mexico: enhancement to Positive Pay servicesAdditional capabilities will be rolled out to the Mexico Positive Pay service and be available for use through Message Centre as of 16 June:

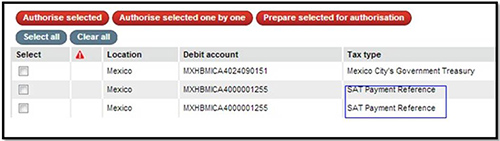

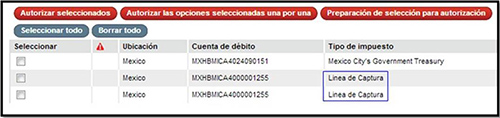

Customers with accounts in Mexico: HSBCnet Federal Taxes enhancementAs part of regulatory requirements, the “Linea de captura” tax payment in Mexico is being renamed to “Pago Referenciado SAT” with the corresponding English wording, “Capture line”, modified to “SAT Payment Reference” within the following services and screens:

En Español: Customers with accounts in Australia: enhanced BPAY bill payment authorisation

As part of our on-going commitment to enhancing the BPAY services offered on HSBCnet effective 16 June, BPAY bill payments will be available in the authorisation queue for up to 35 days in “Pending Authorisation” status. Please note, when authorising payments within the 35 day window, the value date will be equal to the date of authorisation, not the date the payment was created.* Payments not authorised within the 35 day window will need to be re-created. Additional information and assistance with submitting BPAY bill payments can be found within the service Help Text on HSBCnet or by contacting your local HSBCnet Support Centre. *The value date for BPAY bill payments authorised after the cut-off time for a set day will be the next business day. BPAY® is a registered trademark BPAY Pty Ltd ABN 69 079 137 518. Customers with accounts in Greece: enhancement of local tax payment typesEffective 16 June, the Tax Payment screen in Greece will be enhanced to include the “Assessed Debts (owed to Local Tax Offices) (VEV)” (in Greek: “Βεβαιωμένες Οφειλές Δ.Ο.Υ.”) tax payment type. HSBCnet Users currently entitled to Tax Payments in Greece will be automatically entitled to create tax payments with the above tax payment type option from the effective date. Please note: when submitting tax payments using the above tax type, you will be required to input your 30 character VEV Payment ID and amount, as stated in the note for payment provided by the Greek Tax authority (TAXISNET). If you require further assistance creating tax payments on HSBCnet, please contact your local HSBCnet Support Centre. Global customers using HSBCnet Global Disbursements (GD) and Message Centre Services Clients using both Global Disbursements (GD) and Message Centre services can now investigate their GD batches and payment instructions directly through HSBCnet with queries on individual GD batches and payment instructions being raised directly via the GD Track and Trace service. If you are already using Global Disbursements but are not yet entitled to Message Centre, your System Administrator can entitle you to this service by following the Message Centre User Guide and Message Centre Entitlements Quick Guide. Please type in “Message Centre” into the search function in the HSBCnet Help Centre post logon to view the guides. HSS Customers: improved Administration reports and “Time Series” tab introduced for greater oversight of fund performance We are continuing to enhance HSS services for HSBCnet. As of June 16, 2014 three new Administrative reports will be made available for HSS customers providing a more manageable summary of details for HSBCnet user access levels and entitlements. They can be accessed through the existing Administration Reports service on HSBCnet and include:

Additionally, a new enquiry tab called “Time Series” will be implemented for the Performance Management service within the Client Portal. The “Time Series” enquiry will provide information on how a selected fund is performing on either a daily, weekly, monthly, quarterly or yearly basis. Users will be able to select a fund and define the parameters for the type of data to be provided on the specified fund. |

||||||||||||||

Please do not reply to this e-mail. |

||||||||||||||