Having trouble reading this e-mail? View the online version or view this newsletter after logging on to HSBCnet. |

||||||||||||||||||||

|

||||||||||||||||||||

|

||||||||||||||||||||

New look coming to the HSBCnet logon page As part of our continued effort to enhance your online experience, www.hsbcnet.com will receive an updated look on the weekend of 8/9 August 2015. The refreshed design sets the stage for additional features to be added that will deliver improved support options for new Users prior to logging into HSBCnet. The streamlined layout is easy to read, delivers quick, single-click access to key areas of interest and displays logon and registration functions prominently on the front page. This enhancement will not impact existing post-logon features or layout of HSBCnet transaction screens. However, as a reminder, please ensure you are using a current, updated internet browser* for an improved online user experience. |

||||||||||||||||||||

Balance and Transaction Reporting will soon be demised For those users who have been using the Balance and Transaction Reporting (BTR) service to receive information on their accounts, please note that ‘Account Information’ has been introduced to replace Balance and Transaction Reporting. However, the two services are still available in parallel for a limited time. To provide a smooth transition, all information within 'Account Information' can be found in the same way you are used to in Balance and Transaction Reporting. For further assistance please review the following: Additional resources including a Quick Guide to compare Account Information and BTR as well as an Account Information training video are available in the service Help Text. |

||||||||||||||||||||

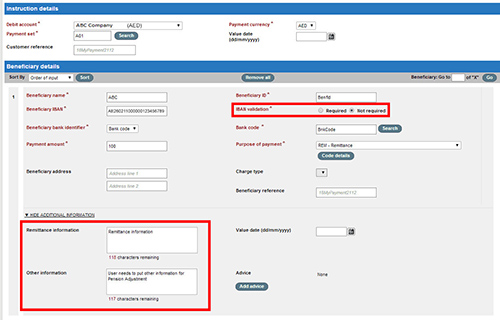

Customers with accounts in the UAE: ACH Credit enhancements to support Pension Adjustments Further to our communications sent in February, March and May 2015, from 1 June 2015 you have been able to submit your pension contributions (if any) via HSBCnet. This is in accordance with the General Pension & Social Security Authority (GPSSA) guidelines. From 20 September 2015, we are further enhancing HSBCnet ACH Credit payment screens and payment files uploaded via the File Upload service. This change is designed to support Pension Adjustment payments in the UAE. In addition to the existing “Remittance Information” field, HSBCnet ACH Credit payment screens will include a new “Other Information” field. As of 20 September, the “Other Information” field can be used to provide detailed information for Pension Adjustment payments. Read on to learn more about how to capture Pension Adjustment information accurately in your payment instrutions. |

||||||||||||||||||||

Action required: new Payment Purpose code requirement for Saudi Arabia payments Further to our communications sent in June 2015 with regards to the above, please note that the inclusion of a Payment Purpose code will now become mandatory effective 20 September 2015 for cross-border payments debiting Saudi Arabia accounts. Due to regulatory requirements introduced by the Saudi Arabian Monetary Agency (SAMA), the HSBCnet payment system will be upgraded to support the implementation of Payment Purpose codes in Saudi Arabia. As a result of this change, cross-border payment instructions submitted through HSBCnet (as well as Host to Host [HSBC Connect] / SWIFT FileAct channels) will be required to include a valid Payment Purpose code. Instructions submitted without a valid Payment Purpose code may be rejected. Payments affected are:

Please note: domestic Saudi Arabia (ACH) payments will not require a Payment Purpose code at this time. Customers making on-screen payments in HSBCnet

Important note: any currently existing cross-border on-screen payment templates must be amended to include the Payment Purpose code after 20 September. Customers making payments using the File Upload service

For additional information regarding Payment Purpose codes, please contact your local HSBCnet Support Centre. |

||||||||||||||||||||

Customers with HSBC accounts in France: new IBAN account number format From 18 July 2015, the account number format for HSBC accounts in France on HSBCnet has moved to International Bank Account Number (IBAN) format. As part of the IBAN implementation, the following features have been introduced on HSBCnet:

View additional details regarding implementation of IBAN in France > Important information regarding the intra-day available balance in Report Writer (RW) and Global Information Reporting (GIR) reports: Please be advised that the intra-day available balance for HSBC France accounts included in Report Writer (RW) and Global Information Reporting (GIR) reports is not displaying correctly at this time. The intra-day available balance is currently displaying the same as the ledger balance. We are aware of the issue and are working to correct the RW and GIR reports. In the meantime, to view your current available balance for HSBC accounts in France, please use the Account Information service in HSBCnet. We apologise for the inconvenience. Viewing your HSBC France account information: For further assistance with this change, please contact your local HSBCnet Support Centre. |

||||||||||||||||||||

Security information regarding Business E-mail Compromise English | En français | En Español |繁體中文 | 简体中文 It’s a good idea to be wary of any requests from your beneficiaries (via e-mail, phone or otherwise) to change their banking details. The request may be an attempt to divert payment funds to a fraudulent account. Fraudulent requests may be disguised as originating from a supplier and ask that you change the supplier’s bank account information. As a precaution, always take the extra step of checking directly with your supplier through an alternative communication method outside of the e-mail environment, such as a phone call to a trusted source in their company, to confirm that the change request is genuine. In some cases, the fraudulent request to change supplier information or make a payment to an unfamiliar account supposedly comes from your organisation’s CEO, President or other administrator. When reviewing any type of payment instructions from an internal source, ensure the request uses your organisation’s official channels and follows authorised processes and procedures. |

||||||||||||||||||||

Information on HSBCnet service maintenance windows

At times it is necessary to schedule non-regular maintenance windows to perform special types of maintenance. Notification of both planned and unplanned maintenance windows will also be posted to the HSBCnet Service Updates section.

*Maintenance window dates, beginnings and ends may be subject to change (with notice) to accommodate maintenance requirements. Note: in the week prior to a service maintenance period, a Service Update banner confirming the maintenance window will be available post-logon in HSBCnet. Please review this information in advance of any planned maintenance period to confirm the date and time. |

||||||||||||||||||||