UK accounts: upcoming HSBCnet payment and template screen changes

Starting in January 2025, we’ll be updating HSBCnet payment screens for CHAPS and international payments from accounts in the UK to support enriched ISO 20022 payment data.

The enhanced payment screens will be introduced in phases. We expect to complete the rollout to all HSBCnet profiles with UK accounts by the end of April 2025.

Here’s what’s changing in early 2025

Below are some of the changes you will notice in HSBCnet starting from January 2025.

- Payment creation screens are changing

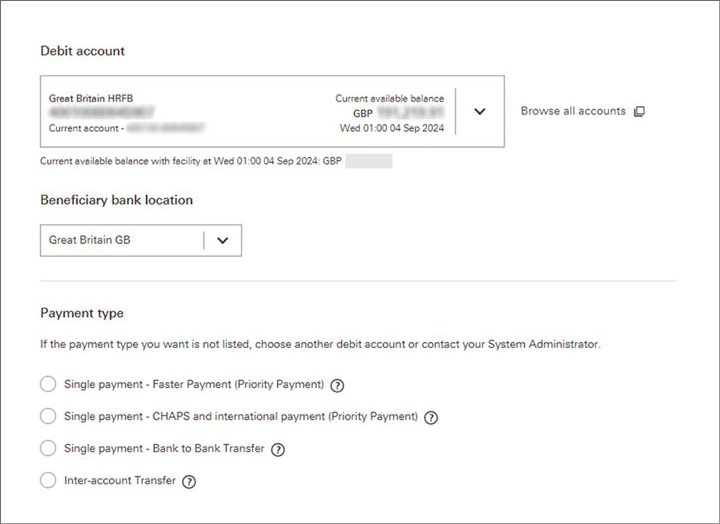

To help make creating payments simpler, we’re updating the available payment type options when creating a new payment or template. In early 2025, the new Priority Payment types (replacing the existing options) will be:

- Single payment – Faster Payment (Priority Payment)

- Single payment – CHAPS or international payment (Priority Payment)

Here’s what the new options will look like in the ‘Create payment or transfer’ screen:

Note: the image provided above is for demonstration purposes only. Your screen may look different based on your organisation’s requirements and the criteria that you select for a payment.

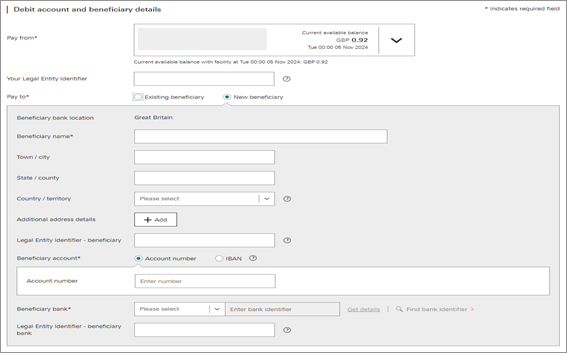

Once you’ve selected your desired payment type, you’ll be taken to the new, streamlined ‘Payment details’ screen where you’ll only see the fields that are relevant for that payment type.

If you want to change the debit account, you can use the new ‘Select a different account’ link.

From early 2025, when using an existing payment template, the ‘Single payment – Faster or Priority Payment’ type will be renamed to ‘Faster Payment, CHAPS, or international payment (Priority Payment)’.

- New and updated fields for payments and templates

In line with ISO 20022 standard, we’re introducing updated address fields and new regulatory fields for payments from accounts in the UK as follows:

Payment fields Current address fields Payment details required Create payment or transfer

screen ❯ ‘Pay to’ sectionBeneficiary name* Beneficiary address

- Address line 1

- Address line 2

- Country or territory

Name*

(extended to support up to 140 characters)Town / city State / county Country / territory Additional address details * Indicates a mandatory field New Purpose of Payment drop-down field Effective May 2025, Purpose codes will become mandatory for property transactions and transactions between financial institutions. Here’s an example of what the new payment screens will look like in HSBCnet:

- New Unique End-to-end Transaction Reference (UETR):

The UETR will be made available for UK CHAPS and international payments starting in January 2025.

A UETR is a string of 36 unique characters featured in all payment instruction messages carried over payment systems in the ISO 20022 standards. UETRs are designed to provide a single reference for a payment and provide transparency for all payment parties. You can track your payments or quote the UETR to our Client Services team when requesting payment investigation.

- Enhanced ‘Related reference’ field:

In line with ISO standards, the ‘Related reference’ field will support up to 35 characters.

What you need to do

To prepare for this change, we recommend that you review your UK CHAPS and international payments instructions as follows:

- Payment templates:

If you have any restricted or general templates created before January 2025, we recommend that you create a new template or modify existing templates as soon as the enhanced screen becomes available to help make sure you can continue to use your payment templates.

- Payments in ‘pending’ status:

If you have any UK CHAPS or international payments in ‘pending’ status, we recommend that you submit them before January 2025 to avoid payment rejections. If you complete these pending payments after the effective date, the payment creator will need to populate information in the new fields before the payment can be authorised.

- Forward-dated payments:

If you have any forward-dated payments they will be submitted with the payment information that has already been entered. We recommend that you cancel and re-create these payment instructions once the enhanced screen is available.

Do you use the ‘Instruction to bank’ fields in payments?

As payment infrastructures around the world continue to undergo modernisation, we’d like to remind you about some best practices to help make sure your payment instructions are sent successfully.

Using codewords in ‘Instruction to bank’ fields ❯

We’re here to help

To learn more about the new payment screens, please visit the ISO 20022 migration guide.

If you have any further questions or require additional assistance, please contact your HSBC representative.