|

|||||||||

|

|||||||||

Important changes coming in June

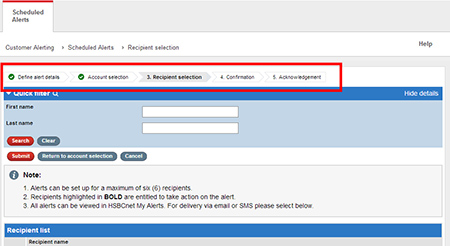

Be sure to read on to see how these changes will enrich your HSBCnet experience. Enhancements effective 13/14 June: Inter-Account Transfer payment enhancement Effective 14 June, 2015, HSBCnet Inter-Account Transfer payment screens are being enhanced to ensure that payment instructions capture only supported currencies in an effort to help avoid payment delays/rejections. When creating Inter-Account Transfer (IAT) payment instruction, the payment currency choices will be limited to the currency of the debit/credit account. However, if the debit account country does not support the currency of the credit account, the currency of the debit account will be the only option displayed in the payment instruction. Any existing Restricted Templates with non-supported currencies will need to be manually updated and authorised by entitled users prior to use for a payment. If you input a currency that is not supported by the debit account country, the following message will be displayed: “The selected Transfer currency is not supported by your bank. Please review Important information for File Upload customers: “Transfer currency must match DR or CR account currency” For additional guidance on this enhancement, please review the “How do I create an Inter-Account Transfer?” Quick Guide available post-logon in the payment service Help Text or contact your local HSBCnet Support Centre. New Look and Feel for HSBCnet Customer Alerting service Over the weekend of 13/14 June, the Customer Alerting service on HSBCnet will be enhanced with an improved interface designed to provide a consistent, streamlined experience. While the Customer Alerting screens will have a new look and feel, they will retain the functionality that you are familiar with. Service enhancements include:

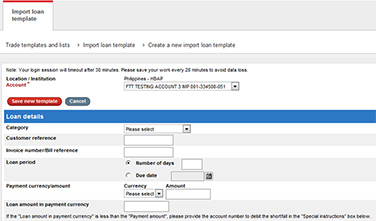

Mandatory Alert changes for customers in Hong Kong and Singapore As a reminder, we recommend that you verify that your mobile phone number is updated in HSBCnet to ensure that you receive your scheduled alerts. When you select your name from the top of any HSBCnet screen you will open the User Profile screen where you can update your mobile phone number and other personal contact information. If you need assistance with this updated service please review the Customer Alerting User Guide which is available in the HSBCnet Help Centre or within the Customer Alerting service Help Text. Enhancements for Trade ServicesEffective 15 June, the following Trade Services enhancements to the Import Loan and Documentary Credit (DC) Application will be available on HSBCnet. Import Loan System Administrators must ensure that Users have access by entitling them to the Trade Templates & Lists service, as well as, Import Account – Import Finance service. DC Application

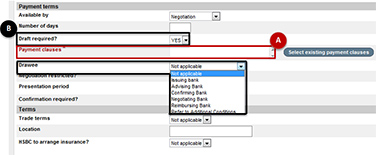

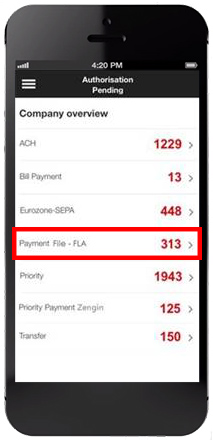

For Trade Services, Guarantees and Standby Documentary Credit, the major currency codes have been restructured to display at the top of the currency dropdown list, followed by a separator, and the remaining currencies in alphabetical order. This will simplify the currency selection process. For more information, please contact your local trade representative. HSBCnet Mobile: File Level Authorisation service now

|

|||||||||

Report ID |

Report name |

|---|

HUBRAFRB |

Beneficiary Name Checking Report |

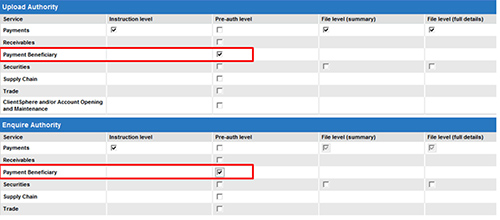

The entitled users can download the Beneficiary Name Checking reports in the RFD service.

For additional information and assistance regarding this change, please contact your local HSBCnet Support Centre.

Brazil GARE ICMS tax payments coming soon to HSBCnet

Effective 15 June, customers in Brazil will have the ability to make their GARE (Guia de Arrecadação Estadual) tax payments through the Bill Payment service on HSBCnet.

GARE tax payments in Brazil are issued either with a barcode or without a barcode. For GARE tax payments issued with a barcode, HSBCnet will accept all types of tax payments. For GARE tax payments issued without a barcode, only Impostos Sobre Circulação de Mercadorias e Prestação de Serviços (ICMS) payments will be accepted on HSBCnet.

In order to make the GARE (with barcode) and GARE ICMS (without barcode) tax payments, you will need to be entitled to a Brazilian BRL currency debit account on HSBCnet. To access this service, select the Bill Payment service from the Payments menu on HSBCnet.

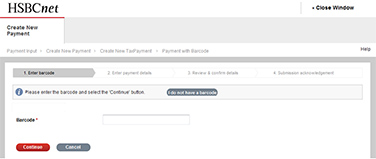

When creating the new payment instruction for a GARE tax payment, you will be prompted to enter a barcode. If you do not have a barcode for the tax payment, you will have the option to select the ‘I do not have a barcode button’ as shown in the image below and pay your GARE ICMS tax payment.

If you provide a barcode in your payment instruction, HSBCnet will validate the barcode and you will advised if you have input an invalid or duplicate barcode. If an invalid barcode has been input, you will need to re-enter a valid barcode. If entering a duplicate barcode, you will be asked to confirm that you wish to proceed with the payment or cancel the payment instruction.

Once you have completed the associated payment details in the payment instruction, you will be asked to submit and confirm the payment instruction. Please note, the payment date will be rejected by the system if it falls on a local statutory holiday in Brazil. In this case, you will need to input another business day in the “Payment date” field to proceed. If your company uses Dual Transaction Control, you will need to have the payment instruction authorised via the Authorisation Summary service on HSBCnet.

For additional information on using this service, please review the Brazil Tax Payment section of the Bill Payments User Guide available in the HSBCnet Help Centre and also within the Bill Payment service Help Text.

Account Information enhancement for accounts in France

As of 15 June, Account Statement Details and Transaction Details screens will display a CFONB Code table for accounts in France.

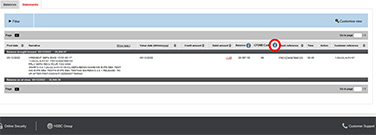

The CFONB column will have an (i) icon which can be selected to display the CFONB Code table for reference on transactions.

Historical Statement enhancements for customers with accounts in UK

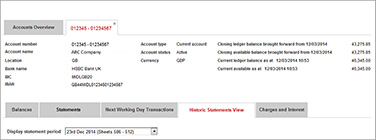

Effective 14 June, customers with UK Current, Savings and Foreign currency accounts, will have access to a new tab, “Historic Statements View”, through the Account Information Service.

Located alongside the existing “Balances”, “Statements”, “Next Working Day Transactions”, and “Charges & Interest tabs”, “Historic Statements View” will display:

- historic transactions going back to 2006 for UK Business Current and Savings accounts in printable statement format.

- 7 years of historic transactions for UK Foreign Currency accounts in printable monthly period format.

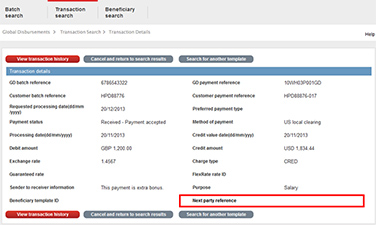

New reference field for UK Global Disbursement Transaction screens

Effective 15 June, a new Next party reference field will be added to the Global Disbursements Transaction details and Transactions details history screens. The field is principally used for Global Disbursement Demand Draft Instrument Numbers or reference information received from the Correspondent Network.