|

||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||

Important changes coming in September

Be sure to read on to see how these changes will enrich your HSBCnet experience. Enhancements effective 13/14 September: Security enhancements to payment and receivables advising As part of our continuous drive to improve information security on e-mail communication and protect sensitive business information from unintended users, HSBC will introduce new security measures to its Payment and Receivables E-mail Advising service from 15 September 2014. Effective 15 September 2014, all payment and receivables advices via e-mail will be sent out with sensitive data partially masked, such as account number, remitting account name, and beneficiary account name. Read on to learn more about how advices will be enhanced. Beneficiary Name and Address field enhancement for payment entry screens As of 15 September, payment screens that allow you to enter beneficiary name and address information will be revised to allow you to first enter or search for the Beneficiary bank identifier wherever possible This change is being implemented to improve your payment processing time. If the Beneficiary bank identifier cannot be found, the option to manually enter the beneficiary name and address will still be available through the "Cannot find the Bank and Address" section for these exceptional cases. Please be aware that manually entering the beneficiary bank name and address may subject the payment to possible delays and additional processing fees. It is recommended that payments and payment templates be updated to use the beneficiary bank identifier wherever possible. New "Treat as Confidential" marker for Message Centre Message Centre will be enhanced to now include a "Treat as Confidential" marker option to the General query messages. This additional "Treat as Confidential" button will allow you to ‘encrypt’ a General query message so that your message content and any associated attachments cannot be viewed by another colleague with Message Centre entitlements. Additional Message Centre changes included the following items:

Bill Payment alerts for US, Canada and Mexico A new mandatory alert rule will be implemented automatically to support email alerts to the creator and authoriser of bill payments involving Mexico debit accounts or Mexico customers. US and Canada debit accounts will also be supported by email alerts being sent to the creator and authoriser when a bill payment has been rejected by the bank. File Upload service: removal of ACH Domestic file formats for select SEPA countries As of September 15, the following ACH local file formats will be removed from the File Upload HSBCnet service for the following SEPA countries: Spain, Belgium, Ireland, Malta, Greece, France, Italy, Germany, and the Netherlands.

These changes are part of the ongoing process to meet the SEPA regulatory end date Regulation. Customers with accounts in Australia: enhanced Customer Reference Numbers for BPAY bill payments

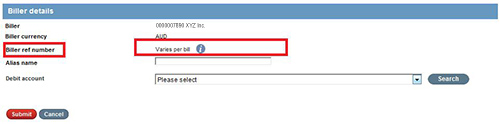

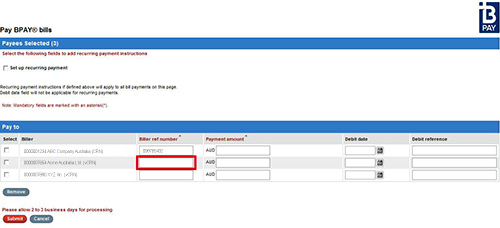

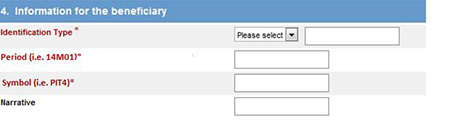

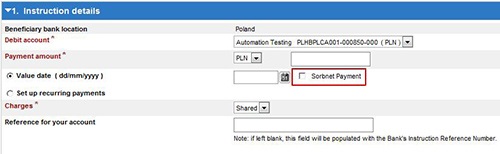

Intelligent Customer Reference Number (iCRN) How it works When creating BPAY bill payments for a biller with vCRN references, you will need to input each bill’s unique vCRN in the “Biller ref number” field for each individual bill payment. Due to the requirement for unique reference numbers for each payment, recurring payments are not supported for vCRN BPAY bill payments. Additional information and assistance with submitting BPAY bill payments can be found within the service Help Text on HSBCnet or by contacting your local HSBCnet Support Centre. BPAY® is a registered trademark BPAY Pty Ltd ABN 69 079 137 518. Customers with accounts in Poland: changes to Priority Payment screensPoland HSBCnet Priority Payment screens (in English and Polish language as well as for template creation screens) are being enhanced to provide more well-defined labelling. The three Poland Priority Payment types affected by these enhancements are – Standard, TAX and ZUS payments. In some instances as detailed below, enhancements will include addition of new labels and deletion of old and/or redundant fields and labels for a more streamlined experience. Deletion of old and redundant fields and labels Making some fields optional Labels updated to include sample input text Customers with accounts in Poland: Beneficiary bank name auto generation The “Beneficiary bank name” will be auto-generated from “beneficiary account number or IBAN” for Standard Priority Payment in PLN, TAX, ZUS. Auto-generation only applies to the Create Payment Instruction screen when Section 2 “beneficiary bank details” is not entered. Auto generation of Beneficiary bank name will only apply to PLN currency payments. Customers with accounts in Poland: SORBNET Payments A dedicated checkbox for SORBNET payments will be available on Standard Priority Payments in PLN currency only. By selecting this option, you have the option to speed up your payments under PLN 1 million by sending it via SORBNET . Payments above PLN 1 million are sent via SORBNET automatically. Note: This checkbox is only available when using the Create Payment Instruction screen but not when using Create Template. When the SORBNET checkbox is selected, the value date field is unavailable and you will not be able to select any value date. For SORBNET payments, the value date is assigned during final authorisation. SORBNET payments are available for viewing under the Account Services Activity Log For more information about these changes please review the How do I create a Priority Payment from Polish accounts? Quick Guide located in the Payments Help Text on HSBCnet or by searching "Poland Priority Payments" in the HSBCnet Help Centre." Customers with accounts in Kuwait: new regulatory requirements for salary payments and enhanced ACH Credit screens Effective 15 September, banks in Kuwait are required to report the details of salary payments made by customers to the Ministry of Social Affairs and Labour (MOSAL). For this reason, customers with accounts in Kuwait are requested to provide “Beneficiary Reference” details using the format below for salary payments executed via HSBCnet ACH credit screens or File Upload tool.

Where:

Example: SALARY123456789012Sep14RRRRRRRRRRRR The Beneficiary Reference corresponds to the following fields (in different file formats) for HSBCnet File Upload service:

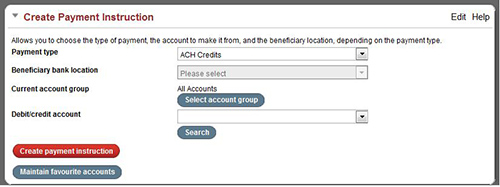

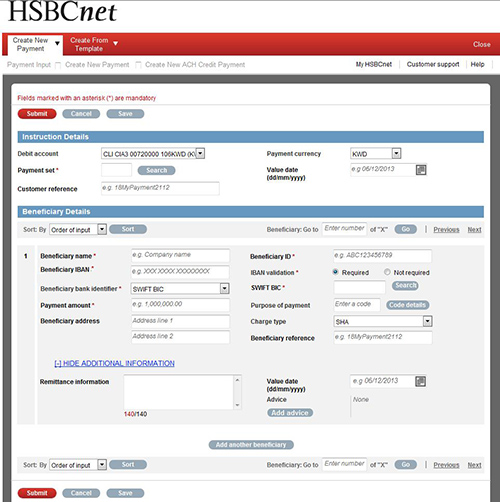

ACH Credit screens for accounts in Kuwait are also being updated effective 15 September to capture additional details for salary payments. The new screens are much more user friendly but follow the current payment processing workflow for easy transition. To launch the new ACH payment ‘Create’ screen from ‘Create Payment Instruction, select “ACH Credits” as the ‘Payment type’ and the appropriate ‘Debit/credit account’. When ‘Create payment instruction’ is selected, the ‘Create new ACH Credit payments’ screen will be launched in a new window. Several labels on the ‘Create new ACH Payment’ screen have been changed to ensure payment instruction information is easier to complete and more accurate:

New ‘Create new ACH Credit Payment’ screen: After payment creation, an updated Review screen will be displayed however the required actions will be the same as well as for the Acknowledgement (after selecting Confirm), Authorisation Summary, Authorisation and Partial Authorisation screens. Important to note: If authorising existing payments created prior to 15 September, HSBCnet will automatically send the instruction to ‘pending repair’ status changing it to the new input screen from which the required new fields will need to be populated. Forward dated payment instructions cannot be modified. If details need to be changed, the instruction will need to be cancelled and recreated. |

||||||||||||||||||||||||||||||||||||||

Please do not reply to this e-mail. |

||||||||||||||||||||||||||||||||||||||