|

||||

|

||||

Important changes coming in June

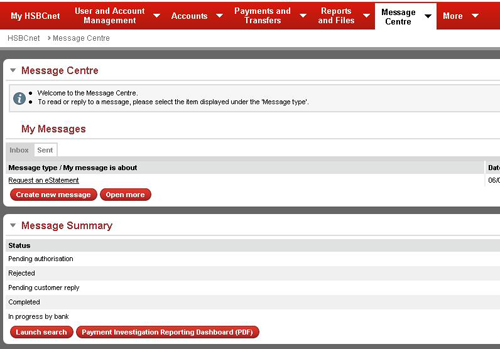

Enhancements effective 15/16 June: Self Service re-vamp and change of name to HSBCnet Message Centre Self Service is getting a facelift over 15/16 June. While the same functionality will be retained, ‘Self Service’ will have a new name – Message Centre – and have an improved interface in order to provide an enhanced experience. As part of this facelift, the ‘Service Requests’ and ‘Service Authorisation’ embedded features will be merged into ‘Message Summary’ and the current statuses of “Received by Bank” and “Bank Response” will display under the ‘Inbox’ or ‘Sent’ tabs. The new ‘Inbox’ tab within the ‘My Messages’ section will identify messages requiring further action or review by the logged on User and a Sent tab will display messages that have been sent to the bank by all Users of your company. View of new Message Centre. New messages can be created by clicking the ‘Create new message’ button which will reveal ‘Category’ and ‘Message type’ (currently ‘Template’ drop-down lists). View of ‘Create Message’ screen. Please note that the following categories will be renamed when creating a new message:

Some templates (renamed ‘Message types’) are also being re-categorised. Moving to the Account Service category are:

Moving to the Cheque Service category are:

If you need assistance with this updated service please review the new Message Centre User Guide which will be available in the HSBCnet Help Centre as of 17 June or contact your local HSBCnet Support Centre for help. Standing Instructions for ACH Payments available in more countries Effective 15/16 June, 2013, Standing Instruction (SI or “recurring payment”) functionality will be available for ACH Credit and Debit payments globally except for India, Malaysia, Philippines, Saudi Arabia, Vietnam, Japan, and Taiwan. Please note that in Mexico and Panama SI functionality will not be available for Online Payroll payments only. Points to remember:

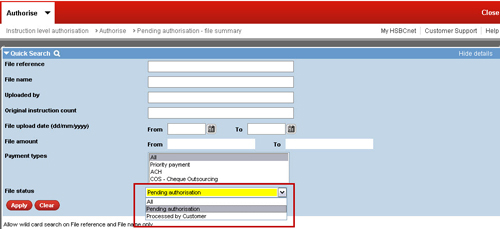

Enhanced Instruction Level Authorisation Effective 15/16 June, in order to improve usability, you can now filter the display of Enhanced Instruction Level Authorisation (ILA+) by selecting "All", "Pending Authorised" and "Processed by Customer" in the summary page. By default, only the files "Pending Authorised" will be shown in the summary page. Changes to Connect e-mail acknowledgements for customers in AsiaAs part of our ongoing commitment to rigorously protect your online information, we are enhancing the e-mail acknowledgements for files received through Connect. Effective 22/23 June 2013, your information (Client Name) as well as beneficiary information (Entity/Account Name and Beneficiary Name) will be masked in the acknowledgement. Only part of name will be displayed while some characters in the name will be replaced by "*". This enhancement ensures the security of sensitive information. Customers with Canadian accounts: enhanced cheque image retrieval services Starting 17 June, 2013, the new Message Centre (formerly called the Self Service tool) will have an additional template enabling customers with Canadian domiciled accounts to make requests for copies of archived cheques processed more than 90 days old from current date. The cheque images will show the front and back of archived cheques more than 90 days old from current date. There will be three options available for delivery of the copy of the cheque image:

There will be a $10.00 (Canadian dollars) charge per image requested. This new capability compliments the existing Cheque Image Retrieval tool where customers are currently able to view online, the front and back of cheques processed over the last 90 days from current date. Users already entitled to Self Service will automatically be entitled to the Message Centre as of 17 June and have access to this new service. However, System Administrators will have to entitle Users who currently don’t have access Self Service (after 17 June, please ensure to entitle Users to “Message Centre” to enable this enhanced cheque image retrieval capability) . Users should verify that their User Profile details such as postal and email addresses are updated to ensure correct delivery of the cheque image copy. For further information on how to use this service, please login to HSBCnet, go to the Help Centre menu and look for Message Centre under the Accounts sub-menu (after 17 June) or contact your local HSBCnet Customer Support Centre for further assistance New report to assist with Credit Note adjustment reconciliationEffective 17 June, a new Credit Notes report will be available help reconcile Credit Note Adjustments with Approved Invoices through the Reports and Files Download service. The new reports are also supported by AFD and can be set-up to be sent to a designated e-mail address. Kazakhstan customers: new message types (Self Service templates) available Customers in Kazakhstan who previously used the Multicash system will be able to perform the following functions on HSBCnet through the Message Centre as of 17 June:

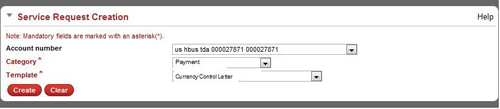

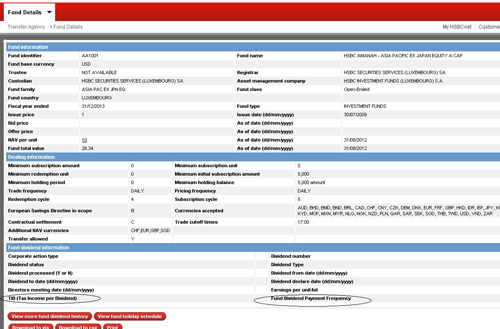

This new capability will provide on-line capability to request these types of certificates which may need to be issued for audit purposes, participation in a tender, for tax/other state authorities, or other purposes. When you input a Kazakhstan account number and select the ‘Payment’ category under the new “Create a new message” feature of the new “Message Centre” (currently ‘Service Request Creation’ as shown below), the available options will include ‘Currency Control Letter’. The ‘Request certificate’ template will be available when the ‘Account Services’ category is selected for a Kazakhstan account. The mandatory fields to action either request will be marked with an asterisk on subsequent screens. Alerts for customers in Korea using South Korea Digital Signing Effective 15/16 June, customers in Korea using South Korea Digital Signing (SKDS) will begin receiving SMS alerts of SKDS whenever certificates are issued, reissued, renewed and/or registered via “My KCC”. Transfer Agency customers: new fields visible Effective 15/16 June, there will be two additional fields visible on the Fund Details screen. Tax Income per Dividend (TID) and Fund Dividend Payment frequency will be displayed on the web front end in the Fund Details screen under the Fund dividend information section. Information availability will be determined by User entitlements. For more information, please view the Transfer Agency User Guide available in the HSBCnet Help Centre. Customers in Malta: enhanced Bill PaymentsOver 15/16 June, the Bill Payments experience for customers in Malta is being enhanced to provide customers with additional onscreen guidance to help correctly enter Bill Payments details. Additionally, a Customer Daily Limit check is being implemented for Bill Payments authorisation ensuring payments cannot be made for more than the assigned limit. Please note there will be a Malta specific transaction limit of Euro 230 thousand for the Bill Payments service. Customers with UK debit accounts: redirected Faster Payments using Account Switching serviceIn September 2013 UK banks are introducing an enhanced Account Switching service for personal and micro-enterprise customers, which sets a clear timescale of seven working days to migrate all Direct Debit mandates, Standing Order instructions and details of bill payments from the Old Bank to the New Bank - enabling a seamless transition for customers. As well as this initial process, the industry is introducing redirection and forwarding of payments/Direct Debits to ensure that the customer continues to have access to all their banking services. The redirection/forwarding will take place for 13 months from the date of the Account Switch. Effective 17 June, HSBCnet will support the advising of Redirected payments for Faster Payments through Report File Download (RFD) and Automated File Download (AFD) services. Additionally, the existing HSBCnet Faster payments SIPS (Single Immediate Payment) report will be enhanced to include the switched Beneficiary account information for Faster payments created via HSBCnet screens.

|

||||

Please do not reply to this e-mail. Our postal address: You received this e-mail notification because you are a registered User of HSBCnet. Should you have any concerns regarding the validity of this message, please contact your local HSBCnet customer support. If you wish to unsubscribe from receiving service information from HSBCnet, please click here. |

||||