China payments: send RMB payments to mainland China using SWIFT/BIC code

Last updated: 31 August 2020

You can now use a SWIFT/BIC code instead of the China National Automatic Payment System (CNAPS) code when making Priority Payments to mainland China in Chinese Yuan (RMB).

What this means for you

When you create RMB Priority Payments to China in HSBCnet, you can now use a SWIFT/BIC code instead of the CNAPS code. Using a SWIFT/BIC code instead of a CNAPS code is optional at this time.

We recommend that you provide a valid beneficiary SWIFT/BIC code when creating your payment instructions to help avoid payment delays or rejections.

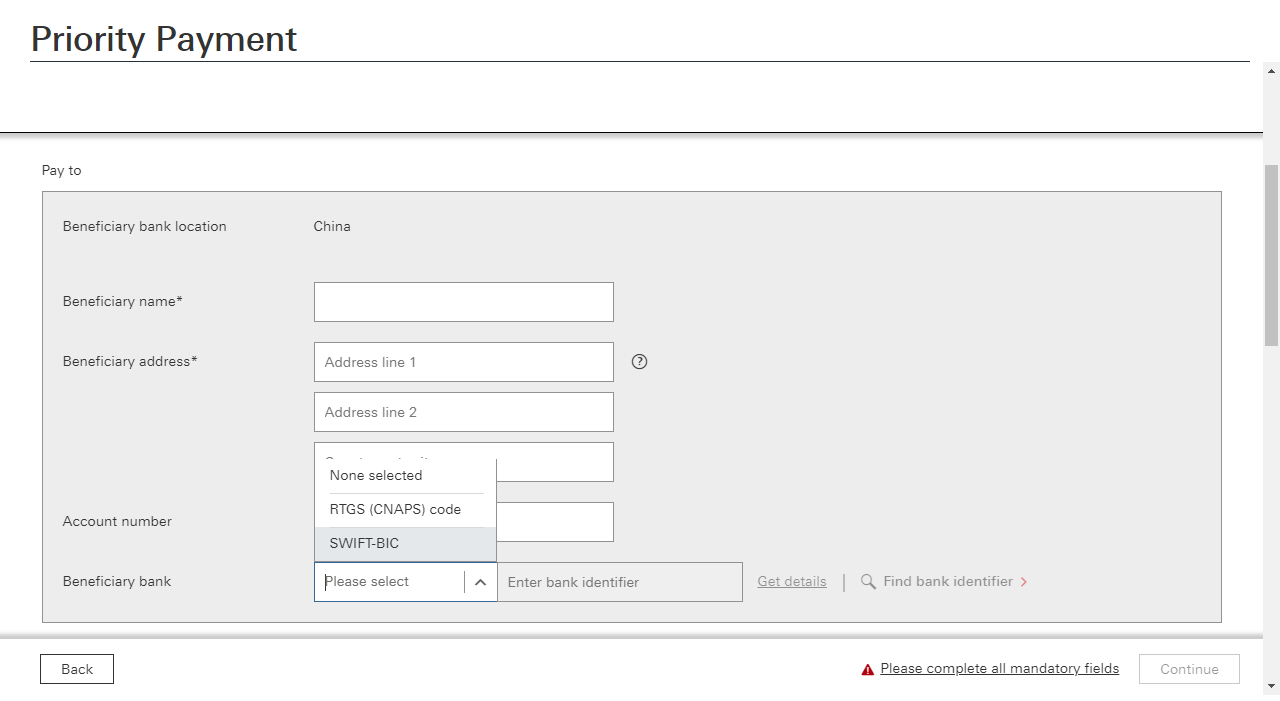

Here’s where to include a SWIFT/BIC code in HSBCnet:

(select image to enlarge)

What you need to do

To include a SWIFT/BIC code in your payments, we recommend that you (or another user in your organisation with the correct payment permissions) review your payments as follows:

- Payments created on-screen or via templates:

When creating a RMB payment to China, select ‘SWIFT-BIC’ in the Beneficiary bank field before entering in the beneficiary bank SWIFT/BIC code. You can use the ‘Find beneficiary identifier’ feature to look up beneficiary bank SWIFT/BIC codes as well.Reminder: when you update a restricted template, you’ll need to have another user approve the changes in the Authorisation summary service before the updated template can be used to make payments.

- File upload or HSBC Connect:

If you submit payment files using File upload or HSBC Connect, you can include the beneficiary SWIFT/BIC code in place of the CNAPS code in your payment files.If you have any questions about submitting these payments, please contact your local Client Services representative.

- Forward-dated payments and Standing instructions:

If you want to use a SWIFT/BIC code instead of the CNAPS code, make sure that you review any forward-dated payments or Standing instructions you’ve set up in HSBCnet.

Find out more

If you have any questions, please contact your local HSBCnet Support Centre.