UAE account holders: send domestic payments using the Immediate Payment system from 27 June 2019

Last updated: 27 May 2019

As previously communicated, from 5 May 2019, you’re now able to receive domestic paymentsvia the UAE Funds Transfer System (UAEFTS) – Immediate Payment Instruction (IPI).

Starting 27 June 2019, we’re updating HSBCnet so that you can also send domestic payments using the UAEFTS-IPI.*

The UAEFTS-IPI is a 24/7 payment system in the UAE which supports real-time domestic Dirhams funds transfers for amounts up to 10,000. Please note that the UAEFTS-IPI scheme supports certain specific Purpose of Payment codes.

What this means for you:

The UAEFTS-IPI allows you to send** and receive payments faster and more efficiently. Here’s what’s changing on HSBCnet from 27 June 2019 for outward payments via the UAEFTS-IPI:

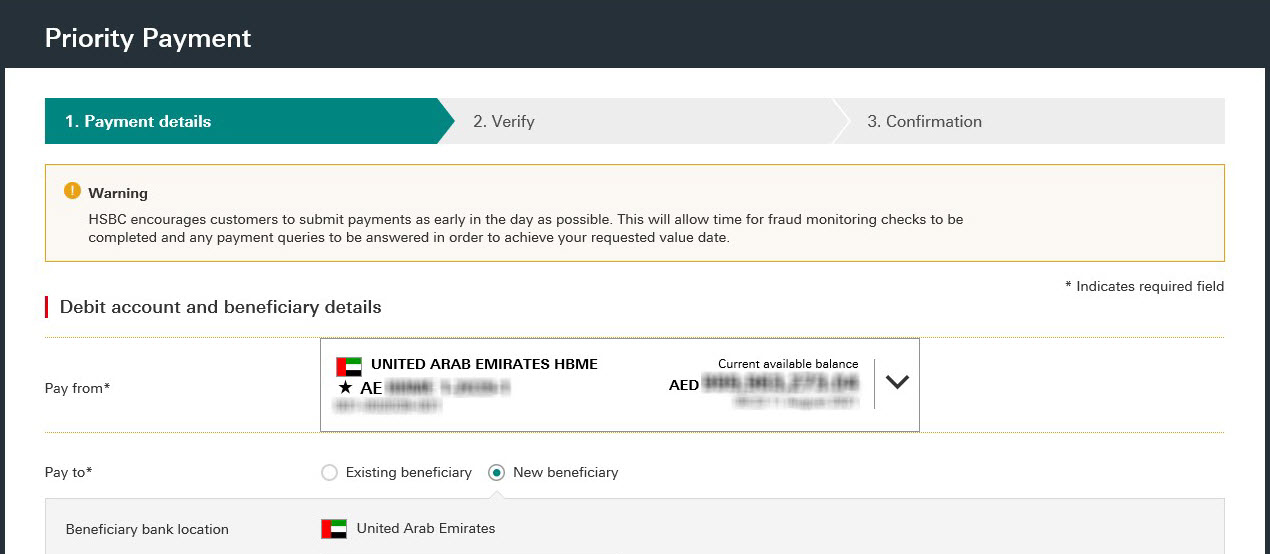

- Enhanced Priority Payment screens:

From 27 June 2019, when you create a Priority Payment from a UAE-domiciled AED account, you’ll see the following key changes:

- Create payments using the new ‘Send instantly with immediate confirmation’ option:

You’ll be able to choose how to send your payments using either the ‘Standard Payment’ or the new ‘Send Instantly’ option.

- Intuitive fields:

As you complete the Debit account and beneficiary details in your payment instruction, the Immediate Payment service option will be automatically selected based on the criteria you’ve entered (including the payment amount, the beneficiary bank identifier code, and Purpose of Payment code ).

- Create payments using the new ‘Send instantly with immediate confirmation’ option:

- File Upload service:

From 27 June 2019, you can send Priority Payments via the UAEFTS-IPI using the HSBCnet File Upload service or HSBC Connect. If you plan to submit such payments, please contact your Client Services representative to obtain the new file specification requirements in our updated Message Implementation Guides (MIG).

Account Information and Statement reporting

On 5 May 2019, we introduced new account statement narratives and transaction codes for payments that are received via the UAEFTS–IPI system. From 27 June 2019, we're introducing new account statement narratives and transaction codes for payments initiated via the UAEFTS-IPI system. The enriched statement information will help you identify your transactions more easily.

If you have an automated account reconciliation process in place for your Dirhams accounts in the UAE, please review the detailed information about new statement narratives and transaction codes for Account Information and Statement reporting.

Find out more

If you have any questions, please contact your UAE HSBC representative or local HSBCnet Support Centre.

*For fees and charges related to the UAEFTS-IPI service, please contact your HSBC Representative.

** Subject to HSBC terms and conditions and its internal compliance guidelines.

The postal address for related inquiries is:

HSBC Group Head Office

HSBC - GLCM Digital

London UK E14 5HQ

This communication is provided by HSBC Bank plc on behalf of the member of the HSBC Group that has contracted with your organisation for the provision of HSBCnet services. You received this email notification because you are a registered user of HSBCnet. Should you have any concerns regarding the validity of this message, please contact your local HSBCnet customer support.

We maintain strict security standards and procedures to prevent unauthorised access to information about you. HSBC will never contact you by email or otherwise ask you to validate personal information, such as your username, password or account numbers. If you receive such a request, please call your local HSBCnet customer support. Links within our emails will only take you to information pages.

If you wish to unsubscribe from receiving service information from HSBCnet, please select here.

© Copyright. HSBC Bank plc 2019. All rights reserved.

Privacy & Data Protection Statement | Terms & Conditions

Deutsche | En español | En français (Canadian) | En français (European) | 繁體中文 | 简体中文