We’re making it easier for you to send and track SEPA payments

Last updated: 3 July 2024

We’re enhancing payment features in HSBCnet and the HSBCnet Mobile app to help make it easier to send and track SEPA payments to beneficiaries in Europe.

Germany accounts: SEPA Instant Credit Transfers now available

We’ve enhanced HSBCnet payments services to allow you to send and receive SEPA Instant Credit Transfers (SCT Inst) from eligible HSBC accounts in Germany. This is in addition to the existing SCT Inst payment functionality already available for HSBC accounts in France, Ireland, Luxembourg and the Netherlands.

SCT Inst payments enable you to send real-time payment instructions from HSBC Euro (EUR) currency accounts to beneficiary accounts with participating banks located within the Single Euro Payments Area (SEPA). SCT Inst transactions are:

- processed within 10 seconds.

- available 24 hours a day, 7 days a week, 365 days a year.

- sent from participating banks for payments valued at EUR 100,000 equivalent or less.

Users that currently have EuroZone payment permissions for HSBC accounts in Germany will now also be able to send SCT Inst payments.

Send SEPA payments using the HSBCnet Mobile app

From July, you can create SEPA payments to trusted beneficiaries from select European debit accounts using the HSBCnet Mobile app.

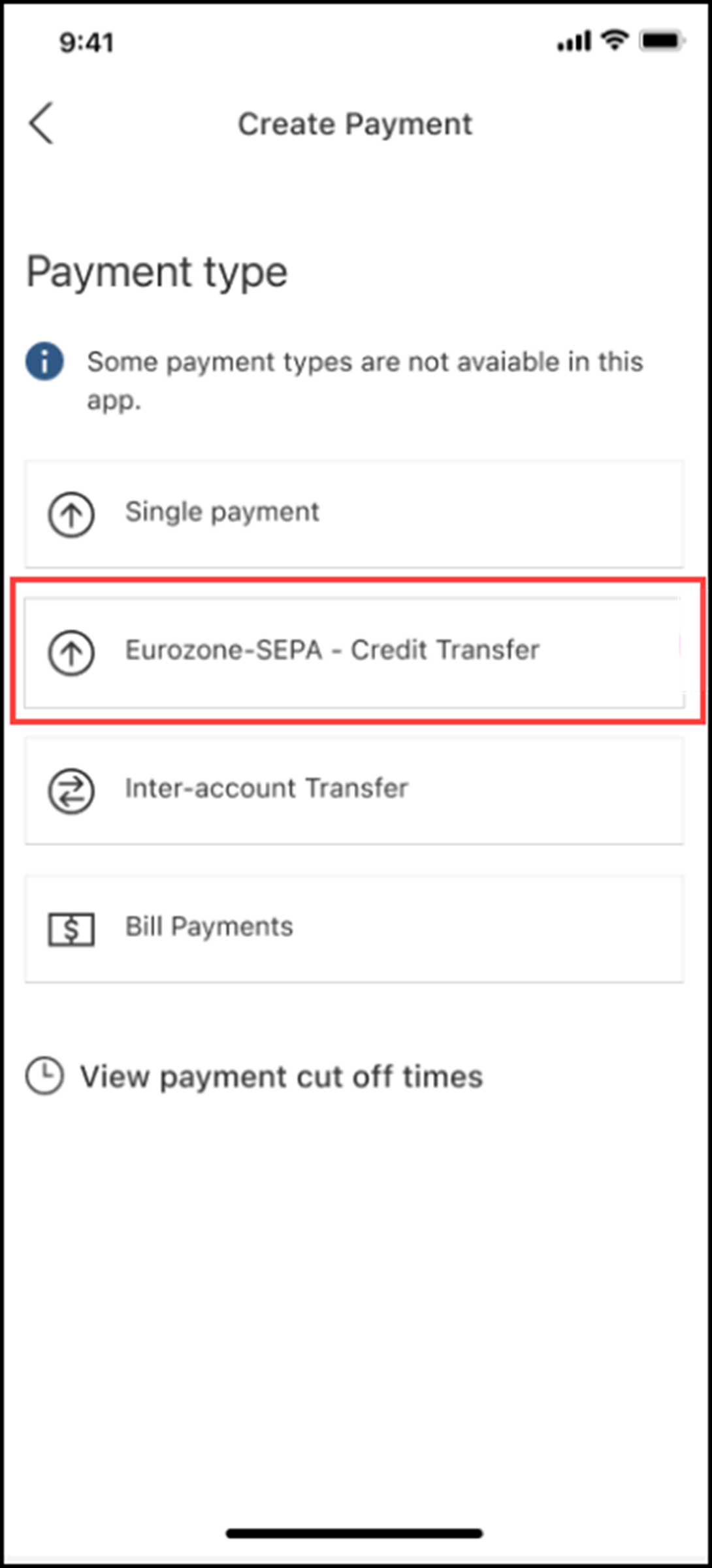

You’ll find the ‘Eurozone-SEPA - Credit Transfer’ option within the ‘Create Payment’ screen:

Enhanced SEPA payment status details will be available in Track Payments

Currently, an overview of submitted SEPA payments are available within the Track Payments service. Further details regarding individual transactions can then be found in reports available through ‘Reports and files’.

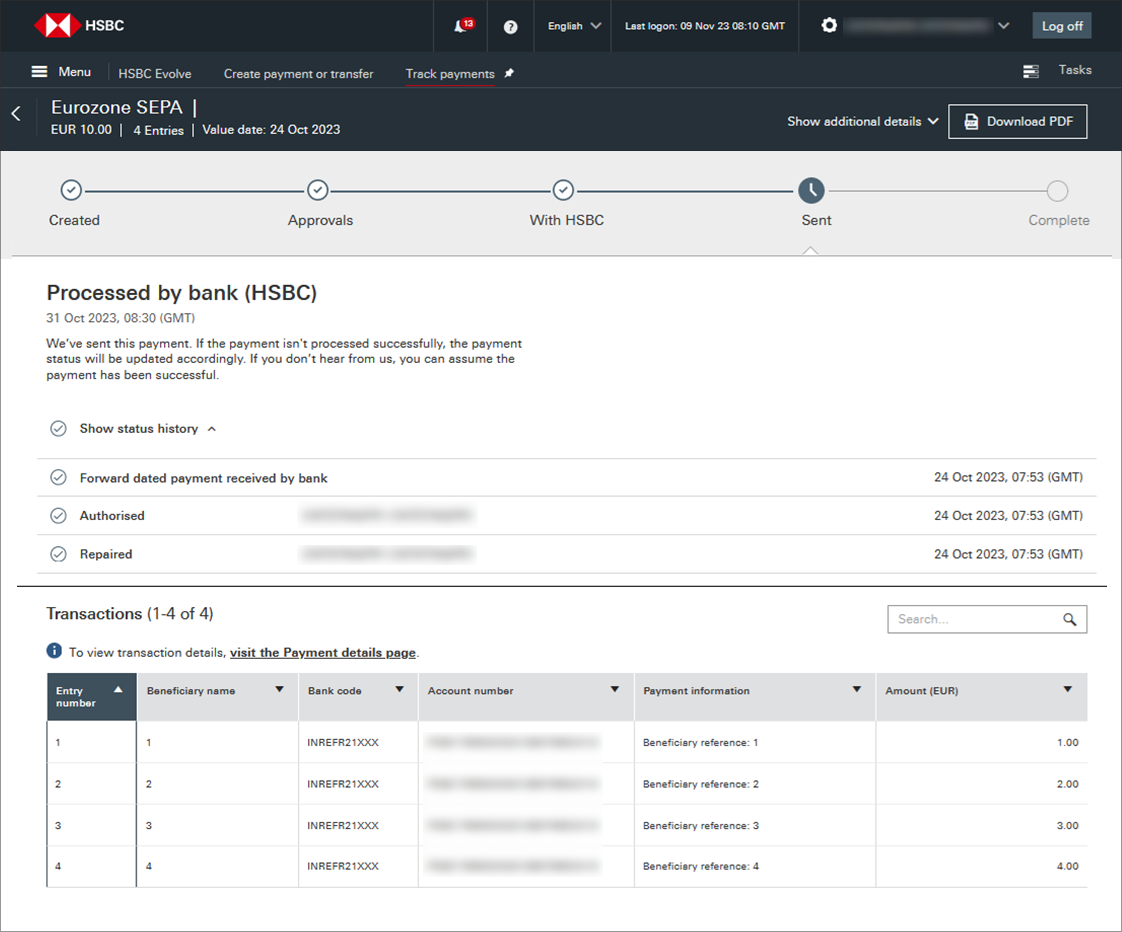

Starting 13 July 2024, certain SEPA payments, including details regarding individual transactions, will be shown in the enhanced Track Payments feature. Track Payments will also provide further payment statuses for SEPA payments to allow you to follow the payment until it has been released from HSBC.

Here’s an example of what Track Payments will show for SEPA payments:

Changes to SEPA transaction details shown in reports

As a part of this enhancement, some additional details will be included for SEPA transactions in the following advices, end of day statements, and intraday statements reports from 13 July 2024:

| Report | Previous field details | New field details |

|---|---|---|

XML Intra-day, |

Sequence number of instruction NOT included in <Instrld> |

Sequence number of instruction included in <Instrld> |

camt52, |

Customer country/region and institution NOT included in <Id> |

Customer country/region and institution included in <Id> |

If you use Enterprise Resource Planning (ERP) systems or automated account reconciliation programs for your electronic statements, you may be impacted. To ensure the on-going operation of your automated reconciliation processes, we recommend that you review these updates with your own IT specialists and, if necessary, make arrangements to update your systems.

Find out more

For more about how to create or track SEPA payments, visit the following pages in the HSBCnet User Guides portal:

- Eurozone-SEPA Credit Transfers

- Using the HSBCnet Mobile app

- Tracking payments and transfers

If you have any questions, please contact your local HSBCnet Support Centre.