Thailand accounts: upcoming ISO 20022 payment updates

Last updated: 25 July 2024

Following our successful launch of ISO 20022 capabilities for outward domestic payments in Thailand, we’re extending these ISO 20022 features to cross-border payments in October 2024. We will confirm the exact date in October through a follow-up communication in the coming weeks.

What this means for you

From October 2024, structured address fields for cross-border payments from accounts in Thailand will be available for the following channels :

- HSBCnet (including the HSBCnet Mobile app)

- File Upload service

- HSBC Connect

We recommend that you review and update your payments to include the additional address fields in the enhanced Priority Payment screen once it’s available. Please note that some fields will be mandatory.

Learn more about ISO address requirements and formats ❯

What’s changing in HSBCnet?

Below are some of the changes you will notice in HSBCnet starting from October 2024.

New address fields for Priority Payment screens and templates:

In line with domestic payments, we will introduce the same payment fields for cross-border payments, which will be captured as below:

| Section in Priority Payment screens | Current address fields | New address fields (from October 2024) |

|---|---|---|

|

Name* Address*

|

Name* (extended to support up to 140 characters) |

Town / city* |

||

State / county |

||

Country / territory* |

||

Additional address details |

||

* Indicates a mandatory field Note: the Beneficiary Details section will include the new address fields as detailed in above table; however, providing details in “Town / city” and “Country / territory” fields is currently not mandatory. |

||

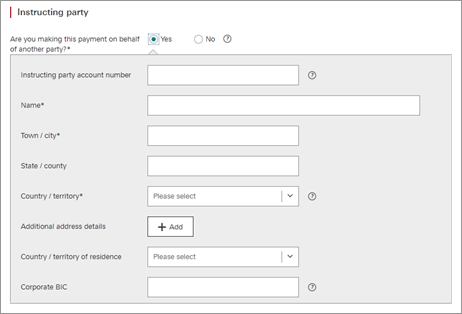

Here’s an example of what the new ‘Instructing party’ address fields will look like:

New Unique End-to-end Transaction Reference (UETR) field:

The UETR field will be available for cross-border transactions from October 2024.

A UETR is a string of 36 unique characters featured in all payment instruction messages carried over Swift and RTGS systems that support ISO 20022 standards. You can quote the UETR to our Client Service team when requesting payment investigation.

What you need to do

To prepare for this change, we recommend that you review your HSBCnet payment instructions for cross-border transactions as follows:

- Payment templates:

If you have any restricted or general templates created before October 2024, you may not be able to use this template for payment creation after the effective date. We strongly recommend that you create a new template or modify the existing template as soon as the enhanced screen becomes available. This helps make sure you can continue to use your payment templates.

You will need to modify existing restricted templates by replacing any unstructured address with the structured address, specifically providing inputs in the ’Town / city’ and ‘Country / territory’ fields.

Here’s the structured address requirements from October 2024:

Payment parties Town / city field Country / territory field Beneficiary

Optional

Optional

Instructing Party

(if used)Mandatory

Mandatory

Originating Financial Institution

(if used)Mandatory

Mandatory

Final Beneficiary

(if used)Mandatory

Mandatory

Please note that in existing templates, beneficiary address will appear pre-filled in the ‘Non-standard beneficiary address’ section. However, we recommend that you begin updating the existing template and providing structured address details in ‘Town / city’ and ‘Country / territory’ fields.

- Priority Payments in ‘pending’ status:

If you have any Priority Payments with Instructing Party details in ‘pending’ status, we recommend that you submit them before October 2024 to avoid payment rejections. If you complete these pending payments after the effective date, the payment creator will need to update the instruction using the new address fields before the payment can be authorised.

- Forward-dated payments and standing instructions:

If you have any forward-dated payments or standing instructions, they will be submitted with the payment information that has already been entered. We recommend that you cancel and re-create these payment instructions once the enhanced screen is available.

For any standing instructions with Beneficiary and/or Instructing Party address details, you will need to re-create those instructions using the new fields once the enhanced screen is available. This will help you benefit from the enhanced name and structured address information.

What’s changing for HSBCnet’s File Upload service and HSBC Connect?

To prepare for the upcoming changes, make sure that payment files comply with the requirements for cross-border payments by November 2025. Please review the updated File Format Specifications (formerly known as Message Implementation Guides) for iFile, XML V2 and XML V3.

Here’s some of the changes we’ve made to the File Format Specifications for cross-border payments:

For payments with: |

Required details: |

|

Forwarding agent |

Forwarding agent name |

Include accompanying address in the structured address format, with a minimum of Town and Country code. |

Ultimate debtor |

Ultimate debtor name |

|

Ultimate creditor |

Ultimate creditor name |

|

| Creditor | Creditor name | |

Initiating Party |

Choose one of the following options:

|

|

Debtor Agent |

Choose one of the following options:

|

|

Creditor Agent |

||

Intermediary Agent1 |

||

For all cross-border payments: For all Instruction Level Authorization (ILA) payment files: |

||

Please review the updated specifications to see all the updated payment file requirements. The upgrade will be introduced to HSBCnet File Upload and HSBC Connect customers in phases.

Making payments to beneficiaries in Canada?

In addition to the above ISO requirements, as per local regulatory requirement, the following beneficiary address fields continues to be mandatory for all cross-border payments to beneficiary accounts in Canada:

- Street name

- State / county

- Post code / zip code

Find out more

To learn more about this change and to obtain the updated File Format Specifications, contact your local HSBC representative.