Submitting pension contributions to the General Pension and Social Security Authority (GPSSA)

If you make pension contributions to the General Pension and Social Security Authority (GPSSA), we recommend that you review and, if necessary, update your payment templates and payment files to include the required pension details.

Core ACH Credits in HSBCnet

- The debit account used to submit a UAE pension contribution must be the same account that is registered with GPSSA. Pension contributions made from accounts that are not registered with the GPSSA will be rejected.

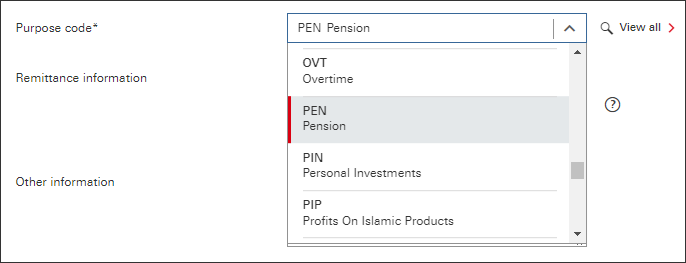

- In the ‘Purpose code’ field, select ‘PEN’ for pension:

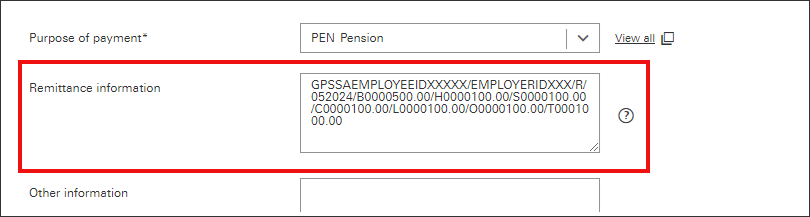

- Input the pension details in the ‘Remittance information’ field. It’s important that you make sure to include the correct details as the GPSSA will reject pension payments with missing details or incorrect amounts.

Review the table below for more information on how to include pension details in the ‘Remittance information’ field:

| Pension details in ‘Remittance information’ field |

|---|

|

This field will accept up to 140 characters and must be included in the below format: CODEWEMPLOYEEIDXXXXX/EMPLOYERIDXXX/S/MMYYYY/B0000000.00/ Where: All below amounts must be 7 digits and 2 decimals. You must provide amounts left padded with zeroes (e.g. B0000250.00):

- B0000000.00 is the Basic Amount prefixed with fixed letter ‘B’. |

Important notes:

|

Here’s an example of how pension details should be formatted in the ‘Remittance information’ field:

Payments submitted using File Upload or HSBC Connect

iFile |

|

|---|---|

Input field |

Pension details |

SECPTY -"@LVP@" - Field 44 |

CODEWEMPLOYEEID12345/EMPLOYERID123/ |

SECPTY -"@LVP@" - Field 45 |

S/MMYYYY/B0000000.00/H0000000.00/ |

SECPTY -"@LVP@" - Field 46 |

S0000000.00/C0000000.00/ |

SECPTY -"@LVP@" - Field 47 |

L0000000.00/O0000000.00/T0000000.00 |

Important notes:

|

|

MEABASIC |

|

|---|---|

Input field |

Pension details |

Column No - AF - Remittance Information 1 |

CODEWEMPLOYEEID12345/EMPLOYERID123/ |

Column No - AG - Remittance Information 2 |

S/MMYYYY/B0000000.00/H0000000.00/ |

Column No - AH - Remittance Information 3 |

S0000000.00/C0000000.00/ |

Column No - AI - Remittance Information 4 |

L0000000.00/O0000000.00/T0000000.00 |

Important notes:

|

|

Paymul |

|

|---|---|

Input field |

Pension details |

Group 16 - FTX+PMD |

CODEWEMPLOYEEID12345/EMPLOYERID123/ |

Group 16 - FTX+PMD |

S/MMYYYY/B0000000.00/H0000000.00/ |

Group 16 - FTX+PMD |

S0000000.00/C0000000.00/ |

Group 16 - FTX+PMD |

L0000000.00/O0000000.00/T0000000.00 |

Important notes:

|

|