Important information about making tax payments in the UAE

Last updated: 10 October 2023

As a reminder, from 4 December 2022, all tax payments submitted to the UAE Federal Tax Authority (FTA) must include the relevant Generated International Bank Account Number (GIBAN) and unique payment reference number, as provided by the FTA. This is required for tax payments from HSBC UAE accounts submitted through HSBCnet (including the HSBCnet Mobile app), HSBC Connect and SwiftNET.

You can use the HSBCnet Bill Payments service to enquire and directly settle outstanding Value-added tax (VAT) payments. The Bill Payments screens make it easier for you to include the GIBAN and unique payment reference, reducing the risk that your payment will be cancelled due to incomplete information.

Using Bill Payments to make VAT payments

HSBCnet’s Bill Payments service allows you to make VAT payments to the Federal Tax Authority in the UAE.

When paying a biller from an HSBC account in the UAE:

- Select ‘Bill Payments’ from the Payments and Transfers menu.

- Select the HSBC UAE debit account you want to pay from the Debit account drop down field.

- Choose the UAE as the beneficiary bank location.

- Select the ‘Bill Payment’ radio button under Payment type.

- Input the relevant Generated International Bank Account Number (GIBAN) and Invoice number to enquire on available bills to pay. You can pay up to 10 invoices at one time.

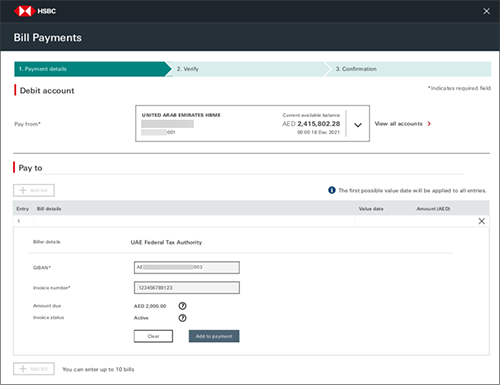

Here’s what the Bill Payments screen looks like:

Note: this image is provided for demonstration purposes only. Your screen may look different.

Get started making Bill Payments

To begin making Bill Payments, your System Administrator will need to grant you permissions to the Bill Payments service and the account(s) you’ll be making payments from. The Bill Payments service is available for all HSBC accounts in the UAE.

Bill payments submitted through HSBCnet are subject to the currently agreed charges as applicable for ‘Outward Electronic Remittances - Local RTGS Domestic Transactions’. To learn more about fees and charges, please see the ‘HSBC UAE Corporate Tariff and Charges’ document on www.business.hsbc.ae.

Find out more

To learn more about using the Bill Payments service in HSBCnet, review the UAE version of our ’Bill Payments’ page available in the HSBCnet User Guides portal.

You can contact the FTA or refer to https://tax.gov.ae/en/emaratax.aspx to obtain the relevant GIBAN and unique payment reference number information for your tax payment.

If you have any questions, please contact your local HSBCnet Support Centre.

No member of the HSBC Group (as defined below and including but not limited to HSBC Bank plc) is responsible for the content or accuracy of any third party websites, nor is the HSBC Group responsible or liable for any software downloaded from those websites. Please read the websites' terms and conditions. The HSBC Group has no control over non-HSBC Group websites and is not liable for your use of them or any information you obtain from them.

If you choose to download software from these sites, you acknowledge that the agreement for the provision of such software is entirely between you and the third party provider and the HSBC Group has no responsibility, nor makes any representations or warranties expressed or implied, for the software in any way.

You may be required to enter into a licence agreement directly with the third party provider for the provision of the software. You do so at your own risk and you are responsible for your own compliance with that agreement.

References to 'HSBC Group' in this disclaimer means HSBC Holdings plc and each of its subsidiaries, related bodies corporate, associated entities and undertakings and any of their branches.