Canada, China, India and Malaysia accounts: upcoming foreign exchange enhancements

Last updated: 23 November 2020

From November 2020 for Malaysia and January 2021 for Canada, China and India, we’re continuing our system upgrades to provide you with more information on your FX transactions from accounts in Canada, China, India and Malaysia. These enhancements will be made across a number of other markets into 2021. We’ll continue to keep you informed of progress.

You may be impacted if you are using an Enterprise Resource Planning (ERP) system or automated account reconciliation program for your electronic statements.

The following new fields will be introduced into your account statements:

- HSBC mid-market rate: The mid-market rate indicates the midpoint between the prevailing rates at which HSBC could buy or sell one currency against another in the interbank market. It’s based on the exchange rate market for each currency we offer, so it fluctuates in accordance with market conditions.

- FX booking timestamp: In addition to the mid-market rate information, we’ll provide the booking timestamp to help you understand the time of your foreign currency booking.

We provide this rate for information purposes only, as it does not include our risk appetite, the costs and charges we incur when conducting the transaction, or our commercial return.

Here’s what the new narrative will look like in Account Information transactions pages*:

(select image to enlarge)

Please note: in some instances, we will change the way we display the direction of the exchange rate to align with the mid-market rate. You may notice this change from November, before you see the mid-market rate and FX booking timestamp.

This enhancement will be applied on statements in the following file formats (space permitting): HSBCnet Account Information Excel exports, MT940/942, BAI2, CSV, camt.052/053 and FINSTA.

Will I see the new foreign exchange information for all my transactions?

The enhanced foreign exchange information will be provided for both incoming and outgoing foreign exchange transactions.

Note that in certain circumstances, you may not see these changes on your transactions, and the enhanced information will not appear in your account statements and advices.

These could include, but are not limited to:

- payments made using pre-arranged HSBC exchange rates,

- paper (cash/cheque/draft) transactions,

- transactions in restricted currencies,

- payment fee transactions (Time of Transaction),

- payments made where the FX is booked using an HSBC dealing platform (except Canada), and

- Inter-account transfers made between HSBC Malaysia entities (Malaysia only)

Please note: Further to the inclusion of the above new fields, in some instances, we will change the way we display the direction of the exchange rate to align with the mid-market rate. You may notice this change ahead of the introduction of the mid-market rate and FX booking timestamp coming in November 2020 for Malaysia and January 2021 for India and China.

What else is changing?

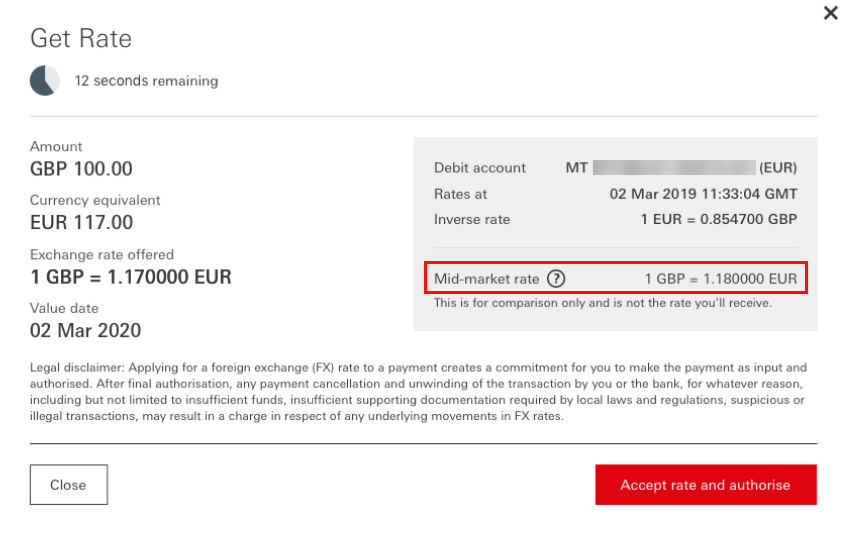

We’ll also be introducing the mid-market rate in HSBCnet’s Get Rate and Preview exchange rate screens. The mid-market rate helps you assess the currency conversion rate offered for your payments and transfers.

Here’s what the new screen will look like:

(select image to enlarge)

Find out more

You can learn more about HSBC’s foreign exchange rates by selecting the ‘?’ icon in Get Rate and Preview Rate screens on HSBCnet.

If you have any questions, please don’t hesitate to contact your local HSBCnet Support Centre.