|

||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

Important changes coming in December

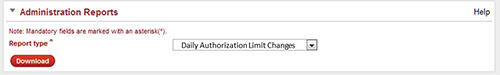

Be sure to read on to see how these changes will enrich your HSBCnet experience. Enhancements effective 6/7 December: Account Information enhancements Effective 8 December as part of our transition to Account Information (AI) as your main account balance and statement enquiry service, Print file names generated via AI will no longer start with “BTR” – instead, they will begin with “AI”. A new option within the Customise My View feature of AI will also give you control over the visibility of opening and closing balance lines in the statement and PDF print options. Improved usage of page space will also allow you to view more statements per page. New HSBCnet Daily Limit Change ReportHSBCnet will introduce a new administration report titled Daily Authorisation Limit Changes that will indicate any daily limit changes for your HSBCnet profile. This report will automatically be available as a report type option as of 8 December as part of your Administration Reports. Message Centre enhancements for customers in Australia and New ZealandTo assist in the submission of instructions/enquiries online via Message Centre, the following additional services will be made available as of 8 December.

Bill Payee introduces Payee Nickname The Bill Payments service will now include a Bill Payee Nickname field within the Quick Filter section and an additional column for the Search Results section of the Bill Pay Summary and Pay Bill screens.

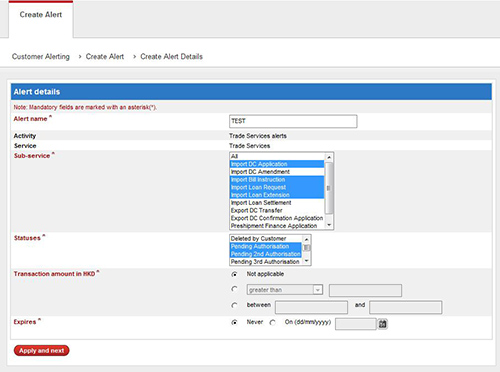

File Upload customers with accounts in Saudi Arabia: important information regarding Wage Protection System (WPS) payments As of 6 December, creation of ACH Wage Protection System (WPS) credit payments for local beneficiaries will be supported via HSBCnet screens as part of the regulatory requirement for WPS implementation in Saudi Arabia. Important note regarding File Upload service For additional information regarding this payment conversion process, please contact your local HSBCnet Support Centre. Customers with US domiciled accounts: foreign currency enhancements Customers with US accounts linked to their HSBCnet profile will have access to updated foreign exchange reconcilement information in the Report Writer reports service offering, as well as in Account Information (AI). For increased convenience during payment input customers will now be able to specify the amount of a foreign currency payment in USD. This enhancement is applicable for both Get Rate and Non Get Rate transactions. This new payment input option will be available for Priority Payments, Inter-account Transfers, and Customer Transfers via HSBCnet, HSBCnet Mobile and Connect. Customers with GBP accounts domiciled in the UK: Charges and Interest information Effective 8 December, charges and interest details for UK domiciled GBP Business Current Accounts will be available in a new tab entitled "Charges and Interest". Located beside the Statement and Balances tab, this tab will display the charges and interest for the current charging period with an option to view a detailed breakdown. Customers can also view the previous 12 charging periods using the drop-down menu or view more charging periods beyond the previous 12 periods. This information can be downloaded (exported) and/or printed. Customers with South Korea Digital Certificate (SKDS): ActiveX update As a reminder, effective 8 December 2014, a new version of ActiveX (Version 7.2.7.7) will be automatically updated on your computer when accessing any HSBCnet service that requires South Korea Digital Signing (SKDS) services (for example, Payment Authorisation* or My KCC). Until the ActiveX installation has been completed, you will not be able to perform any further functions in HSBCnet related to SKDS. Please note: installation of this ActiveX update is only available via Internet Explorer. * SKDS is required for the payments debited from accounts in Korea. HSBCnet Payment Advising for HASE China As of 8 December, payment advising through email will be available for Hang Seng Bank (HASE) China customers. The following are the outbound payment types that will support email advising when debiting China HASE accounts: • Priority Payment (both for manual online input and file upload) Report Writer: date range information included in PDF ReportsTo enhance record keeping and enable select reports generated through Report Writer to be used as official records from the bank (HSBC) for audit, accounting or other purposes, the date range for information being provided will be automatically printed on select reports beginning 8 December. The new date range information will be visible on PDF reports generated via Report Writer for all customers (excluding ICL, SCS, COS and RCMS PDF reports). Please note that existing reports held in the repository will not be automatically updated. However, if a report is re-generated the new date range information will be included. Also, this new information will note be included in the report preview option for the Report Definition Summary. Market Information Product enhancementsAs of 8 December, Jordan will be removed as a market country for Custody and Clearing (CNC), and added to Global Custody Europe (GCE) and Global Custody Asia (GCA) product lines in the Market Information Portal (MIP) within the Client View Portal. Enhancements to Customer Alerts on HSBCnet for Trade, Guarantee and Standby Documentary Credit transactions Effective 8 December, the Customer Alerts feature available within HSBCnet for Trade, Guarantee and Standby Documentary Credit transactions will be enhanced as follows: • Customers will be able to select one or more sub-services when creating e-mail alerts: • Customer Alerts for Trade will be extended to the following countries:

For more information, please contact your local trade representative. Shariah-compliant term deposit available We are pleased to inform that HSBCnet will support Amanah Term Deposit-i (TD-i) as of 8 December. TD-i is a Shariah-compliant term deposit product based on the underlying concept of Commodity Murabahah, with features such as fixed profit rate, flexible tenures, as well as the option for immediate payment upfront (upfront profit scheme). The following services will be available for TD-i on HSBCnet:

For more information about TD-i, please contact your HSBCnet representative. |

||||||||||||||||||||||||||||||