|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

Important changes coming in September

Several new enhancements will be introduced to HSBCnet over the weekend of 14/15 September delivering more convenience to your banking experience. Changes include the first phase in revamping our HSBCnet Help Text services making it even easier to connect to the support material you need, where and when you need it. Be sure to read on to determine how your use of HSBCnet may be improved. Enhancements effective 14/15 September: Starting September 15, HSBCnet Users will experience the first of a phased approach to revamping your Help Text experience. The new look, feel, format and content of Help Text will allow you to connect with relevant support material directly from the HSBCnet service you are using. In addition to the support currently provided, you will have access to the associated Quick Guides, Videos, and User Manuals from within the Help Text links that are part of this first phase. The enhancements being made to Help Text are part of a long term project which will improve your interactions by:· providing more intuitive navigation; Changes will be implemented over the next several months with an expectation to have the entire Help Text service upgraded by the end of 2013. During the conversion process, you can expect to see updates to the format and content of Help Text files rollout gradually. Benefits:

Message Centre enhancement for accounts in Australia, UAE, New Zealand and Malta Effective 16 September 2013, Users working on accounts in Australia, UAE, New Zealand and Malta will need to select "Investigate Transaction" instead of "Payment Investigation" from the Message Centre or from an on-line statement in order to initiate a request for a payment investigation or cancellation. Please note this service now allows requests for investigations on any transaction that displays in the on-line statement. As a reminder, Message Centre was launched in June 2013 offering an improved interface and replacing services previously accessed through Self Service. If you need assistance with this updated service please review the new Message Centre User Guide which is available in the HSBCnet Help Centre or contact your local HSBCnet Support Centre for help. Customers with accounts in Canada: later cut-off times for Priority Payments and Inter-account transfers Effective 16 September 2013, cut-off times for Priority Payments and Inter-account transfers made from accounts in Canada will be extended for greater convenience. Payments received after the established deadlines will be processed on the next business day. If you have any questions regarding the new payments deadlines outlined below, please contact your local HSBCnet Support Centre.

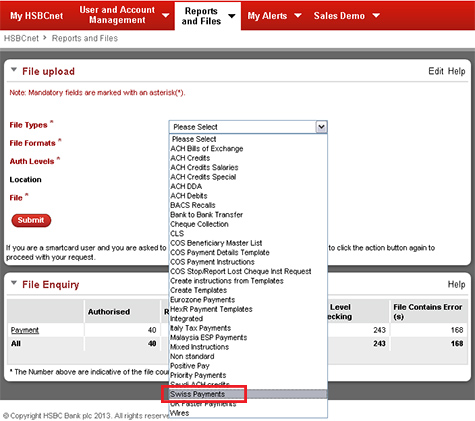

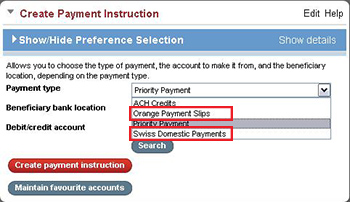

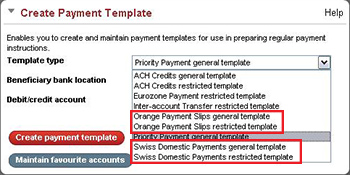

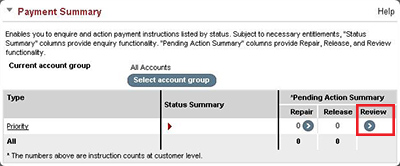

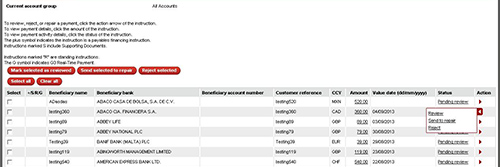

Please note: The cut-off times quoted for Priority Payments to another HSBC Bank Canada account (with or without FX conversion required) and Inter-account transfers between two HSBC Bank Canada accounts (with or without FX conversion required) apply only to transactions that can be processed without manual intervention. If the transaction is received before cut-off and requires any repair or manual processing the transaction may be held until the next business day. Customers in Switzerland: consolidation of Swiss payment format/typesTo provide a more streamlined experience, the selection of three Swiss File Upload file types are being consolidated into a single option titled “Swiss Payments”. Additionally, two Swiss payment types and payment template types are being renamed from Swiss A 10 Mass Payments and Giro Payments to Swiss Domestic Payments and Orange Payments respectively. Activity logs and template creation screens will also reflect these new names.Enhanced transaction Review service "Reviewer" service is an HSBCnet service which enables customers to require a User to review instructions in the file/screen before authorising the payment. Effective 14/15 September customers subscribed to the transaction Review service will be able to have Users review Priority Payments and Inter-account transfers in bulk. Users with Reviewer status enabled will be able to select multiple transactions for repair and rejection in one step. Payments are accessed from the Payments and Transfers tab under Payment Summary. Select the “review” option to review the payment details. From there you can select multiple transactions to review by checking the boxes on the left-hand side, send them for repair, reject or review individually if desired.Indonesian language available on HSBCnet screensCustomers who would prefer to view HSBCnet screens in Indonesian will have this option available effective 16 September. Please ensure that 'Indonesian' is selected as your preferred language within your User profile in order to view applicable screens in Indonesian. Indonesian language is available on the following screens:

SMS notification for customers with Sole Transaction Control on accounts in Hong Kong Effective 14/15 September, customers with Sole Transaction Control on accounts in Hong Kong will be notified via SMS when changes are made to the following User profile fields:

Customers with Brazilian accounts: enhancements to boleto payment process for amounts equal to or greater than BRL250 thousand (BRL250.000,00) Starting 16 September, the ability to make boleto payments equal to or greater than BRL250 thousand (BRL250.000,00) through HSBCnet screens (which has been temporarily unavailable from 28 June) is being restored. Please note that while it will be possible to make these payments directly through HSBCnet screens as of 16 September, the following changes which also took effect on 28 June still apply:

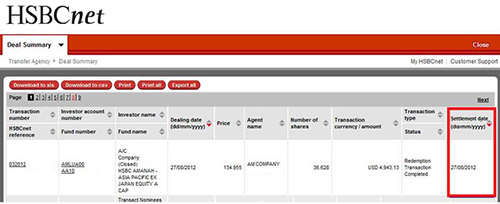

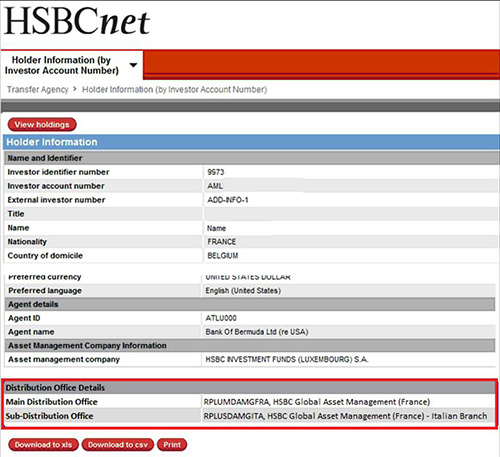

Customers with Brazilian accounts: new Payment Order functionality available through ACH Credits A Payment Order makes a credit available to a non-account holder beneficiary through an HSBC branch. Starting 16 September, customers with accounts in Brazil will be able to send Payment Orders though ACH Credits either on screen or via file upload using the following supported formats: XMLv2, Paymul and CNAB240. For further assistance, please contact Brazilian HSBCnet Support at 0800 701 3911 (Local) or + 55 41 3307 6911 (International) or via e-mail: hsbcnet.supportbrazil@hsbc.com.br. Global Disbursements: Beneficiary Templates enhancements Global Disbursements (GD) allows HSBC corporate customers to send to the Bank, a single file of payments (multiple payments in multiple currencies for multiple destinations) including Priority Payments, Low Priority Payments (ACH, SEPA, etc.), Cheques, and other methods of payment. HSBC converts the file (applying varied Foreign Exchange options) and on the required processing date, processes it through its payment network to beneficiaries globally. The Global Disbursements Track and Trace service via HSBCnet provides functionality that enables GD clients to search and view their GD batches and payments along with the ability to cancel and release batches as well as cancel payment instructions. From 16 September, further enhancements will enable Global Disbursements clients to upload, search and view their Beneficiary Templates. This range of options, along with a comprehensive suite of GD reports, will provide full visibility of and transparency on, all GD transaction activities. Transfer Agency customers: new fields visible As of 16 September, you will notice additional fields visible on the Deal Summary Screen and the Holder Information Screen under HSBCnet Transfer Agency services. Please note these fields will remain blank where the information for these fields is not available and will not affect your current Transfer Agency use. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

Please do not reply to this e-mail. Our postal address: You received this e-mail notification because you are a registered User of HSBCnet. Should you have any concerns regarding the validity of this message, please contact your local HSBCnet customer support. If you wish to unsubscribe from receiving service information from HSBCnet, please click here. |

||||||||||||||||||||||||||||||||||||||||||||||||||||