France and the Netherlands accounts: send SEPA Instant Credit Transfers starting in October

Last updated: 8 October 2019

Further to our communications earlier this year, starting in October 2019, you’ll be able to send real-time payments from your French and Dutch accounts via the Single Euro Payments Area (SEPA) Instant Credit Transfer payment system.

What is SEPA Instant Credit Transfer?

SEPA Instant Credit Transfer (SCT Inst) is the European Payments Council’s latest payment scheme.* SCT Inst transactions are:

- Processed within 10 seconds;

- Available 24 hours a day, 7 days a week, 365 days a year; and

- Sent from participating banks for payments valued at EUR 15,000 equivalent or less

Since they’re processed immediately, 24/7/365, SCT Inst transactions are final and irrevocable.

What does this mean for me?

On 21 October, you’ll be able to start sending SEPA Instant payments from HSBC accounts domiciled in the Netherlands with HSBC France Amsterdam Branch. From 12 November, SEPA Instant payments will be available for accounts in France.

1. SEPA payments on-screen in HSBCnet

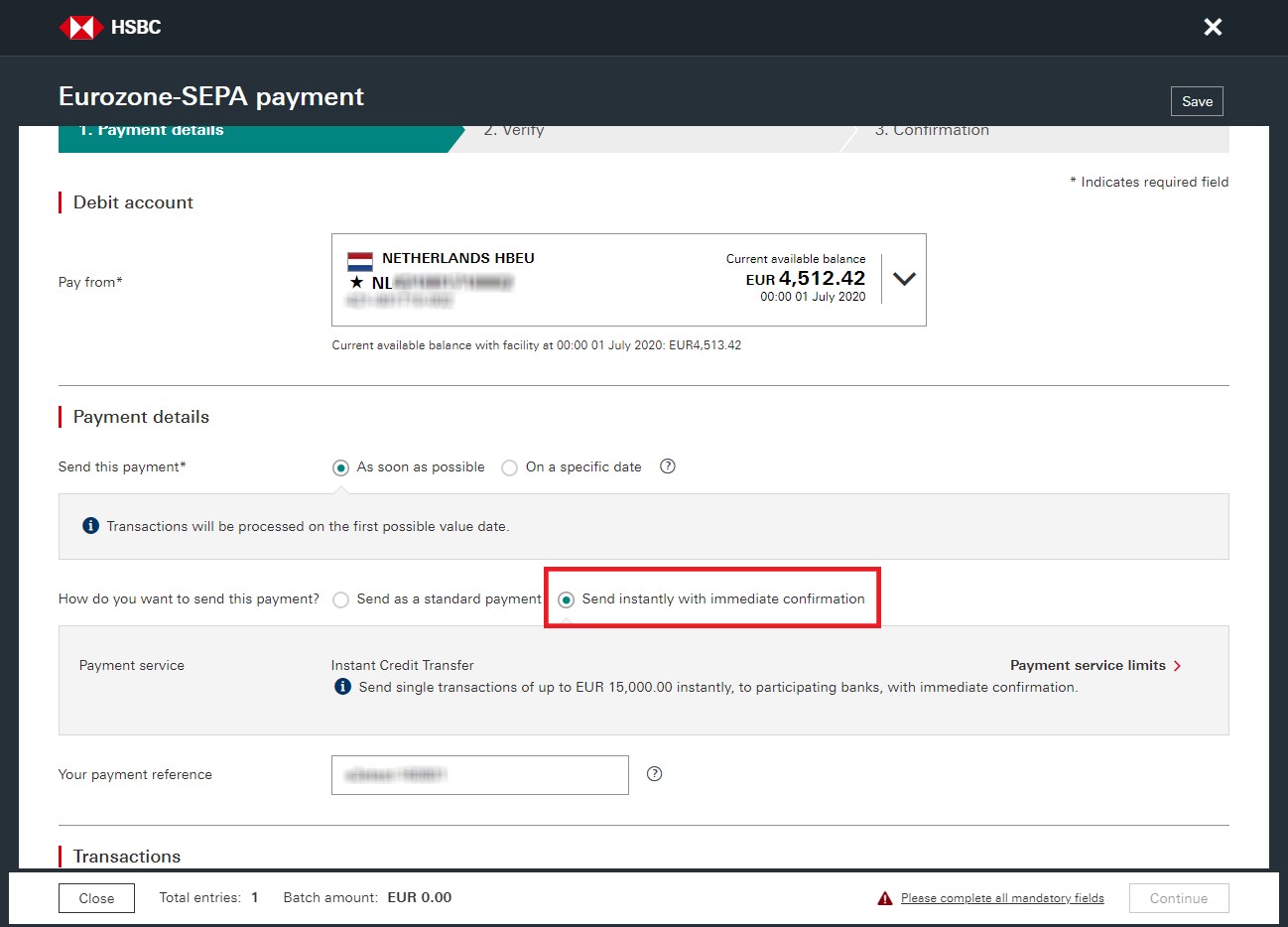

When you create a SEPA Payment instruction from a EUR account domiciled in France or the Netherlands, you will be able to choose to send as an instant payment by selecting the ‘Send instantly with immediate confirmation’ radio button.

Note that you will not be able to make batched transactions (i.e. single debit, multiple credits) using your templates. In the Transactions section, please use the radio button to select the single beneficiary to receive the SEPA Instant Payment.

Reminder: when you create or update a restricted template, you will need to have another user approve the changes in the Authorisation Summary service before the template can be used to make payments.

2. Payments submitted via File Upload:

You’ll also be able to send SCT Inst payments using HSBCnet’s File Upload service. Your payment files must include the necessary SCT Inst Identification tag details. Please note that SCT Inst payments are not eligible for batched transactions. For details on creating SCT Inst payment files, please contact your HSBC Client Integration manager.

What’s next?

We’ll continue rolling out SCT Inst transactions to other HSBC SEPA countries in 2019/2020 and will notify you as they become available.

Find out more

For more information about SEPA payments, review the ‘How do I create a Eurozone-SEPA payment?’ guide available in the HSBCnet Centre.

For further assistance regarding SEPA Instant payments, please contact your local HSBCnet Support Centre.

*Additional fees may apply. Please refer to terms and charges or contact your HSBC Representative.

The postal address for related inquiries is:

HSBC Group Head Office

HSBC - GLCM Digital

London UK E14 5HQ

This communication is provided by HSBC Bank plc on behalf of the member of the HSBC Group that has contracted with your organisation for the provision of HSBCnet services. You received this email notification because you are a registered user of HSBCnet. Should you have any concerns regarding the validity of this message, please contact your local HSBCnet customer support.

We maintain strict security standards and procedures to prevent unauthorised access to information about you. HSBC will never contact you by email or otherwise ask you to validate personal information, such as your username, password or account numbers. If you receive such a request, please call your local HSBCnet customer support. Links within our emails will only take you to information pages.

If you wish to unsubscribe from receiving service information from HSBCnet, please select here.

© Copyright. HSBC Bank plc 2019. All rights reserved.

Privacy & Data Protection Statement | Terms & Conditions

Deutsche | En español | En français (Canadian) | En français (European) | 繁體中文 | 简体中文