Customers with accounts in the UAE: upcoming pension contribution changes

Last updated: 28 August 2017

Effective 1 October 2017, the General Pension & Social Security Authority (GPSSA) and Central Bank of the UAE will be introducing the following new code words for pension contributions:

New code words effective 1 October 2017 (CODEW) |

Description |

|---|---|

GPNEW |

For New Employee |

GPEOS |

For Last Contribution for Existing Employee |

GPRET |

For Retro Payments for Existing Employee |

GPTSP |

For temporary suspension |

GPRSM |

For resumption post temporary suspension |

Please note, the above new code words are in addition to the existing GPSSA code words for regular payments and pension adjustments. |

|

Customers submitting pension contributions via ACH on-screen

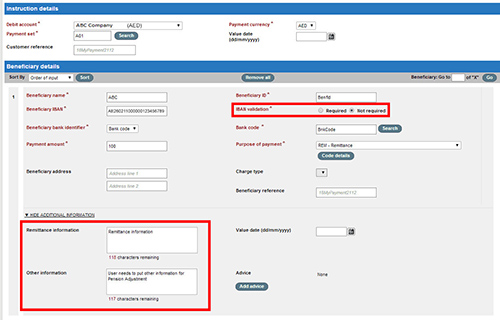

In the ACH Credit screen on HSBCnet, enter the appropriate code word and details in the Remittance Information and Other Information fields from 1 October.

In addition, please select ‘Not required’ in the IBAN validation field.

To make sure the pension contribution information is captured accurately in your payment, please follow the format as outlined in the table below:

Field |

Pension details |

|---|---|

Remittance Information |

This field will accepts up to 140 characters CODEWEMPLOYEEIDXXXXX/EMPLOYERIDXXX/S/MMYYYY/B0000000.00/ H0000000.00/S0000000.00/C0000000.00/L0000000.00/O0000000.00/ T0000000.00 Where CODEW is a static key word to be used for Pension payments (input one of the following: GPNEW,GPEOS,GPRET,GPTSP,GPRSM). EMPLOYEEIDXXXXX is the 15 characters Employee ID of the UAE National EMPLOYERIDXXX is the 13 characters Employer ID as provided by GPSSA S is the type of employer. This must be ‘R’ for Private and ‘U’ for Public MMYYYY is the month and year B0000000.00 is the Basic Amount prefixed with fixed letter ‘B’ H0000000.00 is the Housing Allowance prefixed with fixed letter ‘H’ S0000000.00 is the Social Allowance prefixed with fixed letter ‘S’ C0000000.00 is the Child Allowance prefixed with fixed letter ‘C’ L0000000.00 is the Cost of Living Allowance prefixed with fixed letter ‘L’ O0000000.00 is the Other/ Supplementary Allowance prefixed with fixed letter ‘O’ T0000000.00 is the Total Monthly Salary inclusive of all allowances prefixed with fixed letter ‘T’ All above amounts must be 7 digits and 2 decimals. You must provide amounts left padded with zeroes (e.g. B0000250.00) |

Other Information |

This field will accept up to 175 characters Format for New Employee Pension E0000000.00/C0000000.00/SDDDMMYY Where E0000000.00 is the Employee Contribution prefixed with fixed letter ‘E’ C0000000.00 is the Employer Contribution prefixed with fixed letter ‘C’ SDDDMMYY is the joining date of the employee in format DDMMYY prefixed with fixed letter ‘SD’ Format for Last Pension Contribution for Existing Employee E0000000.00/C0000000.00/EDDDMMYY Where E0000000.00 is the Employee Contribution prefixed with fixed letter ‘E’ C0000000.00 is the Employer Contribution prefixed with fixed letter ‘C’ EDDDMMYY is the last working date of the employee in format DDMMYY prefixed with fixed letter ‘ED’ Format for Retro Pension Payments for Existing Employee E0000000.00/C0000000.00/SDDDMMYY/EDDDMMYY Where E0000000.00 is the Employee Contribution prefixed with fixed letter ‘E’ C0000000.00 is the Employer Contribution prefixed with fixed letter ‘C’ SDDDMMYY is the start date of the retro payment in format DDMMYY prefixed with fixed letter ‘SD’ EDDDMMYY is the end date of the retro payment in format DDMMYY prefixed with fixed letter ‘ED’ Format for temporary suspension of pension payment E0000000.00/C0000000.00/SDDDMMYY/EDDDMMYY Where E0000000.00 is the Employee Contribution prefixed with fixed letter ‘E’ C0000000.00 is the Employer Contribution prefixed with fixed letter ‘C’ SDDDMMYY is the start date of the temporary suspension of the contribution in format DDMMYY prefixed with fixed letter ‘SD’ EDDDMMYY is the end date of the temporary suspension of the contribution in format DDMMYY prefixed with fixed letter ‘ED’ Format for resumption post temporary suspension E0000000.00/C0000000.00/RODDMMYY Where E0000000.00 is the Employee Contribution prefixed with fixed letter ‘E’ C0000000.00 is the Employer Contribution prefixed with fixed letter ‘C’ RODDMMYY is the date of resumption to duty in the format DDMMYY prefixed with fixed letter ‘RO’ |

Purpose of Payment |

Please provide ‘PEN’ as Purpose of Payment for your pension payments and pension adjustments Please note that Purpose of Payment code is mandatory for all ACH Credit payments and can be selected from a drop down list with detailed information on the selected code available via the Code details button |

Bank Code |

Please provide ‘985110101’ as Bank Code for your pension payments and pension adjustments |

To avoid payment rejections, please do not provide pension payments, pension adjustments and other ACH Credit payments in a single batch. |

|

Select here for information on submitting pension contributions via File Upload >

Please note: the following new Central Bank of the UAE validations for pension contributions will be effective 1 October:

- If the value date of a pension payment is before the 18th day of the month, you can only use the previous three months as the contribution period.

- If the value date of a pension payment is on or after the 18th day of a month, you can only use the current and previous two months as the contribution period.

Example: to process a payment with the current month as the contribution month, the value date must be on the 18th calendar day of the month or later.

The Central Bank of the UAE will also be validating debit accounts from 1 October. As part of this validation, the debit account number for your pension payments must be the same as the account registered with GPSSA (only matching records will be accepted).

For questions about UAE Pension payments, please contact your local HSBCnet Support Centre or your HSBC representative.

The postal address for related inquiries is:

HSBC Group Head Office

HSBC - E-Channels

London UK E14 5HQ

This communication is provided by HSBC Bank plc on behalf of the member of the HSBC Group that has contracted with your organisation for the provision of HSBCnet services. You received this email notification because you are a registered User of HSBCnet. Should you have any concerns regarding the validity of this message, please contact your local HSBCnet customer support.

We maintain strict security standards and procedures to prevent unauthorised access to information about you. HSBC will never contact you by email or otherwise ask you to validate personal information, such as your Username, Password or account numbers. If you receive such a request, please call your local HSBCnet customer support. Links within our emails will only take you to information pages.

If you wish to unsubscribe from receiving service information from HSBCnet, please click here.

© Copyright. HSBC Bank plc 2017. All rights reserved.