For customers with accounts in the UAE: Abu Dhabi Pension Contribution requirements

Last updated: 10 October 2017

Beginning 1 September 2017, in compliance with local regulations, banks in the UAE are required to report details of Abu Dhabi pension contributions issued by employers to the Abu Dhabi Pension Benefits & Retirement Fund (ADPBRF).

What this means for you

If you’re an employer that makes pension contributions to the ADPBRF, you will need to include the below pension payment details in your ACH Credit payment instructions from 1 September 2017. To support this, ACH Credit screens for accounts in UAE are available to capture additional details for pension payments and follow the current payment processing workflow for easy transition.

Customers submitting Abu Dhabi pension contributions via HSBCnet ACH Credit screen

How to submit ADPBRF pension contributions from 1 September 2017:

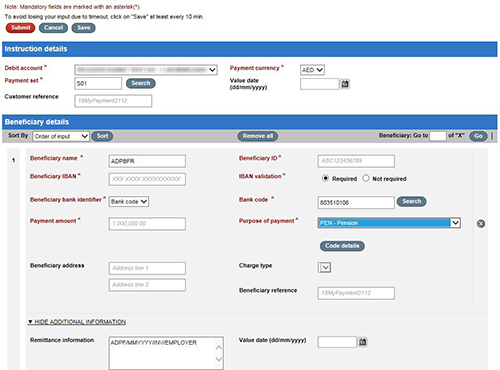

- Create a new payment instruction, selecting ACH credits as the payment type and the appropriate UAE debit account.

- Complete the fields in the Beneficiary details section, following the guidelines outlined in the table below:

| To make sure the Abu Dhabi Pension details are captured accurately, include the following information in your ACH Credit payment instructions: | |

|---|---|

Beneficiary name |

|

Input the Beneficiary Account Name as ABU DHABI PENSION BENEFITS AND RETIR (fixed value). |

|

Beneficiary bank identifier – Bank code |

|

Input the following bank identifier in the Bank code field: - 803510106 |

|

Beneficiary IBAN |

|

Provide the employee account with ADPBRF for your pension payments (as communicated by Abu Dhabi pension contribution funds). |

|

Purpose of Payment |

|

Please provide ‘PEN’ as Purpose of Payment for your AD pension payments as per ADPBRF. |

|

Remittance information |

|

Please provide Remittance Information in the below format for your Abu Dhabi pension payments: OR ADPF/MMYYYY/INV/EMPLOYER/EMPLOYEEEIDANUM (for payments with PSM INV code only) |

|

The following information is MANDATORY for Abu Dhabi pension payments: |

|

ADPF/ |

Fixed text format: ADPF |

MMYYYY/ |

The Month and Year for the payment. Example: 072017/ |

INV/ |

For Abu Dhabi pension contributions, please use one of the following /INV/ codes to indicate the invoice type: CON Contributions |

/EMPLOYER |

Include your EMPLOYER ID as provided to your organization by ADPBRF |

/EMPLOYEEEIDANUM |

*If INV code is PSM: ADPF/MMYYYY/INV/EMPLOYER/EMPLOYEEEIDANUM Where /EMPLOYEEEIDANUM is the Employee ID of the UAE National who is receiving the pension contribution. This information is mandatory only when the invoice type (INV code) is “PSM” and should not be included otherwise.

|

Customers submitting Abu Dhabi pension contributions via File Upload

Please refer to the below table for information on how to incorporate remittance information in your Abu Dhabi pension contribution payment files

| Abu Dhabi Pension contributions (ADPBRF) | |

|---|---|

iFile |

|

SECPTY -"@LVP@" - Field 65 Regulatory Reporting Line 1 |

‘PEN’ as purpose of payment |

SECPTY -"@LVP@" - Field 44 Payment Details Line 1 |

ADPF/MMYYYY/INV/EMPLOYER |

SECPTY -"@LVP@" - Field 45 Payment Details Line 2 |

only IF INV=PSM EMPLOYEEEIDANUM |

SECPTY -"@LVP@" - Field 46 Payment Details Line 3 |

Field should be blank, do not capture details here |

SECPTY -"@LVP@" - Field 47 Payment Details Line 4 |

Field should be blank, do not capture details here |

SECPTY -"@LVP@" - Field 55 Bank to Bank Information Line 1 |

Field should be blank, do not capture details here |

SECPTY -"@LVP@" - Field 56 Bank to Bank Information Line 2 |

Field should be blank, do not capture details here |

MEABASIC |

|

Column No – AK – Purpose of Payment |

‘PEN’ as purpose of payment |

Column No - AF - Remittance Information 1 |

ADPF/MMYYYY/INV/EMPLOYER |

Column No - AG - Remittance Information 2 |

only IF INV=PSM EMPLOYEEEIDANUM |

Column No - AH - Remittance Information 3 |

Field should be blank, do not capture details here |

Column No - AI - Remittance Information 4 |

Field should be blank, do not capture details here |

Column No - AM - Bank to Bank Information 1 |

Field should be blank, do not capture details here |

Column No - AN - Bank to Bank Information 2 |

Field should be blank, do not capture details here |

XML v2.0 |

|

Regulatory Reporting |

‘PEN’ as purpose of payment |

<RgltryRptg> |

|

|

<RgltryDtls> |

|

|

<Inf> |

|

Remittance Information Unstructured |

ADPF/MMYYYY/INV/EMPLOYER OR IF INV=PSM ADPF/MMYYYY/INV/EMPLOYER/ |

<RmtInf> <Ustrd>

|

only IF INV=PSM EMPLOYEEEIDANUM |

<RmtInf> <Ustrd>

|

Field should be blank, do not capture details here otherwise payment will be rejected |

<RmtInf> <Ustrd>

|

Field should be blank, do not capture details here otherwise payment will be rejected |

<RmtInf> <Ustrd>

|

Field should be blank, do not capture details here otherwise payment will be rejected |

<RmtInf> <Ustrd> |

Field should be blank, do not capture details here otherwise payment will be rejected |

Paymul |

|

Group 15 - FTX+ABY |

‘PEN’ as purpose of payment |

Group 16 - FTX+PMD |

ADPF/MMYYYY/INV/EMPLOYER |

Group 16 - FTX+PMD |

only IF INV=PSM EMPLOYEEEIDANUM |

Group 16 - FTX+PMD |

Field should be blank, do not capture details here |

Group 16 - FTX+PMD |

Field should be blank, do not capture details here |

Group 16 - FTX+PMD |

Field should be blank, do not capture details here |

Group 16 - FTX+PMD |

Field should be blank, do not capture details here |

You must provide details exactly in the format specified. For XML v3.0, please contact your HSBC representative. |

|

To avoid payment rejections, please do not provide Abu Dhabi pension payments and other ACH Credit payments in a single batch. |

|

Find out more

For more information, please contact your local HSBCnet Support Centre.

The postal address for related inquiries is:

HSBC Group Head Office

HSBC - E-Channels

London UK E14 5HQ

This communication is provided by HSBC Bank plc on behalf of the member of the HSBC Group that has contracted with your organisation for the provision of HSBCnet services. You received this email notification because you are a registered User of HSBCnet. Should you have any concerns regarding the validity of this message, please contact your local HSBCnet customer support.

We maintain strict security standards and procedures to prevent unauthorised access to information about you. HSBC will never contact you by email or otherwise ask you to validate personal information, such as your Username, Password or account numbers. If you receive such a request, please call your local HSBCnet customer support. Links within our emails will only take you to information pages.

If you wish to unsubscribe from receiving service information from HSBCnet, please click here.

© Copyright. HSBC Bank plc 2017. All rights reserved.