Customers with accounts in Oman: enhancements for ACH Credit payment screens

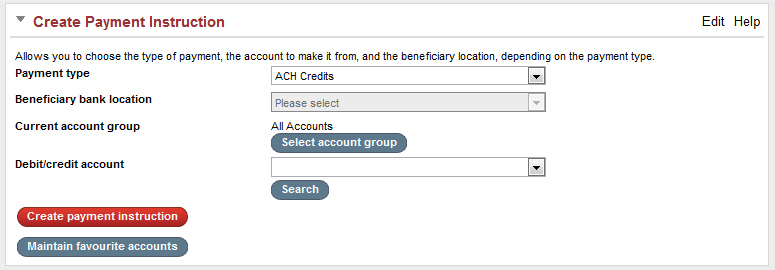

Effective 20 March, 2016 ACH Credit screens for accounts in Oman are being updated to capture additional details. The new screens are much more user friendly and follow the current payment processing workflow for easy transition. To launch the new ACH payment ‘Create’ screen from ‘Create Payment Instruction’, select “ACH Credits” as the ‘Payment type’ and the appropriate ‘Debit/credit account’.

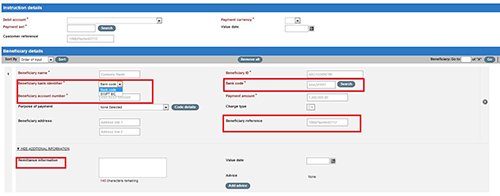

When ‘Create payment instruction’ is selected, the ‘Create new ACH Credit payments’ screen will be launched in a new window.

Several labels on the ‘Create new ACH Payment’ screen have been changed to ensure payment instruction information is easier to complete and more accurate.

Changes to existing labels

|

|

Beneficiary ID

|

Existing Second Party ID label is being changed to Beneficiary ID. |

Beneficiary name

|

Existing Second party Name label is being changed to Beneficiary Name and will accept up to 35 characters. |

Beneficiary bank identifier

|

Existing Bank number label is being changed to Beneficiary bank code. |

Beneficiary reference

|

Existing Reference field label is being changed to Beneficiary Reference and will accept up to 35 characters. |

New fields

|

|

Purpose of Payment

|

Purpose of Payment is an optional field at this stage. For ACH Credit payments, you may select an appropriate purpose code from the drop down list. *Although Purpose of Payment (PoP) is an optional field, you are requested not to populate any other data for Priority Payments. |

Remittance information

|

This field can be used to provide details of the payment and will accept up to 140 characters. |

The look and feel for the ‘Review’, ‘Acknowledgement’, ‘Authorisation Summary’, ‘Authorisation’ and ‘Partial Authorisation’ screens have also been updated but previous functionality remains intact.

Please note that after 20 March, 2016, when attempting to create a payment instruction using general/restricted templates, the instruction will be displayed using the new input screen and the new fields will be editable.

Forward dated payment instructions cannot be modified. If details need to be changed, the instruction will need to be cancelled and recreated.

For additional information on the Oman ACH Credit enhancement, please contact your local HSBCnet Support Centre or your HSBC representative.

Customers with accounts in Oman: SWIFT Bank Identification Codes (BIC) for ACH Credit payments

Customers with accounts in Oman currently provide CBID codes (HSBC specific bank codes) in the “Bank Code” entry field when creating ACH Credit payments. Effective 20 March 2016, HSBCnet ACH Credit payment instruction screens will be enhanced to support the industry standard SWIFT Bank Identification Codes (BIC) for payments from accounts in Oman.

After the effective date, HSBCnet ACH Credit screens will include a new drop down list in the “Beneficiary Bank Identifier” entry field where you can select either the Bank Code or the SWIFT BIC. Please note that the Bank Code (CBID) will be the default option in the field at this time.

To input the SWIFT BIC for your payment, please select SWIFT BIC in the “Beneficiary Bank Identifier” field. You will now be able to provide the SWIFT BIC by manually entering the code in the text box or by searching for a valid SWIFT BIC using the search function.

After 20 March, when creating a payment instruction using general templates, you may change the “Beneficiary Bank Identifier” to SWIFT BIC to include a valid SWIFT BIC for the payment instruction. You will not be able to edit the “Beneficiary Bank Identifier” field in restricted templates. You will need to create a new restricted template to provide a valid SWIFT BIC for the payment instruction.

The table below outlines the SWIFT BIC information for Payment Files uploaded via HSBCnet File Upload:

File Format |

Field where you can provide SWIFT BIC for ACH Credit payments |

XML v3

|

<CdtrAgt> <FinInstnId><BIC> |

XML v2.0

|

<CdtrAgt> <FinInstnId><CmbndId><BIC> |

iFile

|

SECPTY- "@LVP@" -Field 36 (Beneficiary Bank ID/SWIFT Address) Please provide “SWF” in Field 35 - Bene Bank ID/SWIFT Address Code |

MEABASIC

|

Column R (LCC code/CBID code) Please provide “SWF” in Column AL |

Paymul

|

Group 12 - FII+BF; Element - C088-3433 (Institution name identification) |

We encourage you to start providing the SWIFT BIC for ACH Credit payments on Oman accounts. We will eventually end support for CBID codes for ACH Credit payments. In order to ensure you have time to make any necessary changes on your end, you will receive notification prior to the removal of CBID codes from HSBCnet.

For additional information on the Oman ACH Credit enhancement, please contact your local HSBCnet Support Centre or your HSBC representative.

The postal address for related inquiries is:

HSBC Group Head Office

HSBC - E-Channels

London UK E14 5HQ

This communication is provided by HSBC Bank plc on behalf of the member of the HSBC Group that has contracted with your organisation for the provision of HSBCnet services. You received this e-mail notification because you are a registered User of HSBCnet. Should you have any concerns regarding the validity of this message, please contact your local HSBCnet customer support.

We maintain strict security standards and procedures to prevent unauthorised access to information about you. HSBC will never contact you by e-mail or otherwise ask you to validate personal information, such as your Username, Password or account numbers. If you receive such a request, please call your local HSBCnet customer support. Links within our e-mails will only take you to information pages.

If you wish to unsubscribe from receiving service information from HSBCnet, please click here.

© Copyright. HSBC Bank plc 2016. All rights reserved.