Hong Kong SAR Faster Payment System: summary of key changes for ACH Credit

Comparison between the current ACH Credit and upcoming ACH Credit via FPS processing |

||

|---|---|---|

Current ACH Credit |

ACH Credit via FPS (effective on 15 July 2019) |

|

Payment value day |

Supports value date on Monday to Friday (excluding public holiday). |

Supports value date on Monday to Saturday (excluding public holiday). |

Payment cut-off time Local Hong Kong SAR time (GMT+8) |

- At 17:55 on the prior day or - At 12:30 on the prior day |

- For payments value dated on Monday to Friday: - For payments value dated on Saturday: Public holidays excluded. |

Processing cycle |

Payments are processed and debited on the value date. |

- For payments value dated on the same working day (Monday to Friday): - For payments value dated on the next working day (Monday to Saturday): |

Beneficiary name |

Maximum 20 characters. |

Maximum 140 characters (subject to file format) and special characters are supported. You'll still be able to submit payment instruction up to 20 characters. Note: If you choose to send funds to your beneficiary using their account number, the 'Beneficiary name' field will also become mandatory in your ACH Credit instructions. You're responsible for ensuring that the name of the beneficiary that you input in your payment instructions is identical to their name registered with the beneficiary bank. This is to minimise risks of your ACH payment being rejected by the beneficiary bank due to a mismatch of the beneficiary name. |

Beneficiary information option |

Bank account number only. |

- Bank account number. or - Alias (maximum 34 characters). |

Supported payment currencies |

HKD and RMB. |

HKD and RMB. |

Maximum payment amount (subject to transaction limit set by your organisation) |

No transaction threshold. |

No transaction threshold. |

Time when funds are debited from your account |

On the value date. |

On the value date. Note: Funds will be debited from your account when HSBC or Hang Seng Bank receives your authorised payment instructions on the same day. Please ensure that your bank account has sufficient funds for your payment. |

Time when ACH transaction fees are debited from your account |

On the value date of ACH instructions. |

Next working day (Monday to Friday) after the value date. |

Electronic Payment Report delivery cycle |

Between the end of payment instruction day and next working day. |

Between the payment instruction day and next working day. This is subject to payment instruction time, report turnaround time can be as low as 3 hours and deliver before 20:30. |

Credit Return Report delivery cycle |

End of day (Monday to Friday). |

End of day (Monday to Sunday). |

Payment Statistics Report delivery cycle |

End of day.

Report generation frequency is subject to your selection on the Autopay Services Application Form. |

End of day. Report generation frequency is subject to your selection on the Autopay Services Application Form. |

The following key changes will be effective on 15 July 2019:

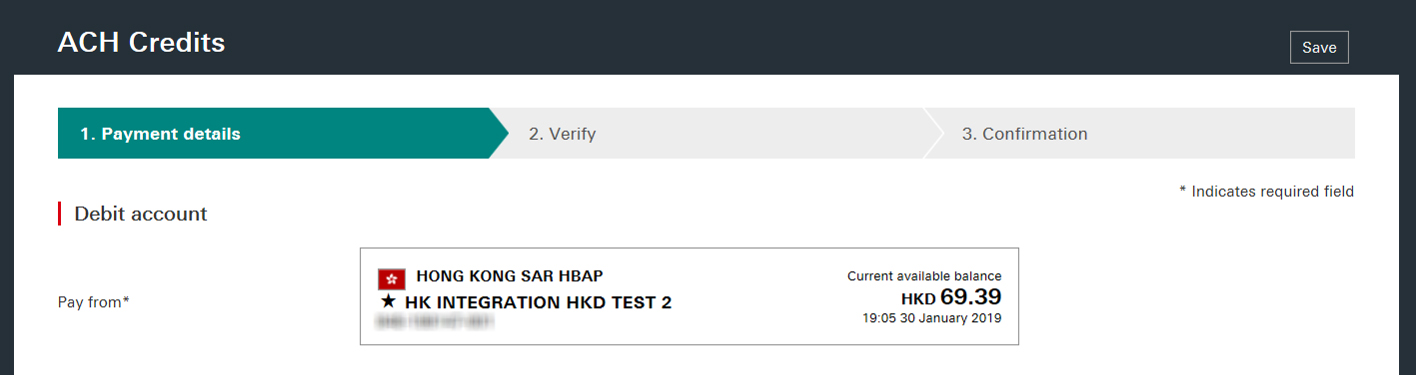

1. HSBCnet ACH Credit payment screens:

When you initiate an ACH Credit payment from a Hong Kong SAR-domiciled account, you'll see the following key changes:

- New look-and-feel:

We've created a new and modern interface that is more user-friendly and will make your day-to-day payment activities a lot easier. - Creating payment using the ‘alias’ option:

You'll have the option to choose how to input your beneficiary information, using either the the new ‘alias’ feature or name and account number.

Note: Alias refers to email address, mobile phone number, or a Faster Payment System ID registered by the beneficiary (i.e. FPS Identifier).

2. File Upload service:

With HSBCnet File Upload Service or HSBC Connect, you'll be able to send ACH Credit payments to beneficiaries using their alias, instead of their bank account number and name. If your organisation plans to send ACH Credit payment files using beneficiaries' alias, please contact your Client Services representative to obtain the new file specification requirements in our Message Implementation Guides (MIG) as soon as practicable.

3. Same-day processing:

ACH Credit payments from Hong Kong SAR-domiciled accounts can be value dated and processed on the same day (Monday to Friday).

Note: payment authorisation

must also be on the same value date.

Same-day processing is not available for Saturdays. Payments value dated on a Saturday must be submitted before the cut-off time on the prior working day.

Please note that for same-day payment processing, funds will also be debited from your account at payment authorisation. Please ensure that sufficient funds for your transactions are available in your account at the time of payment authorisation. If there are insufficient funds, your payment instructions may be rejected.

4. Beneficiary name:

As per the FPS clearing requirements, if you send funds to your beneficiary using their account number, it becomes mandatory for you to also include their name in the correct field. HSBC or Hang Seng Bank will reject such payment instruction that don’t include a beneficiary name.

In order to minimise risks of your ACH payment being rejected by the beneficiary bank due to a mismatch of the beneficiary name, you're responsible for ensuring that the name of the beneficiary that you've provided in the payment instructions is identical to their name registered with the beneficiary bank.

Please note that in the past, beneficiary name was not a mandatory field and the system supported a field length of up to 20 characters only.

From 15 July, the FPS supports up to 140 characters for the beneficiary name field in your ACH Credit instructions. To include beneficiary names of up to 140 characters in your payment files, please contact your Client Services representative to obtain the new MIG.

5. Payment advising:

If you use an alias in a FPS fund transfer, the ‘Beneficiary account’ field will be replaced with a ‘Beneficiary alias’ field in your advices. There will also be a new field called ‘Beneficiary alias type’ that will contain the following codes:

- MOBILE NUMBER for mobile number

- EMAIL ID for email address

- FPS IDENTIFIER for Faster Payment System Identifier

6. New ACH Credit related reports on HSBCnet:

To support transactions made using the beneficiary’s alias and additional details, we're introducing a new set of reports for ACH Credit via the FPS. These new reports will be in a new format and contain new fields as well as enhanced existing ones.

Please refer to the below table for the listing of new reports and data files:

Report name |

Report Level |

Report ID (HSBC) |

Report ID (Hang Seng) |

|---|---|---|---|

Autopay Electronic Payment Report |

Account Level |

HKR101NEW |

HKR103NEW |

Payment Code Level |

HKR101PNEW |

HKR103PNEW |

|

Autopay Credit Return Report |

Account Level |

HKR105NEW |

HKR107NEW |

Payment Code Level |

HKR105PNEW |

HKR107PNEW |

|

Autopay Payment Statistics Report |

Account Level |

Not Applicable (N/A) |

HKR110NEW |

Payment Code Level |

HKR109PNEW |

HKR110PNEW |

|

Autopay Electronic Payment Data File |

Payment Code Level |

HKR205PNEW |

HKR205PNEW |

Autopay Credit Return Data File |

Account Level |

HKR201NEW |

HKR201NEW |

Payment Code Level |

HKR201PNEW |

HKR201PNEW |

|

Autopay Payment Statistics Data File |

Payment Code Level |

HKR203PNEW |

HKR203PNEW |

If you have an automated reconciliation process in place for your HKD and/or RMB accounts in Hong Kong SAR for Autopay reports/data files, please review the full details on the changes to reports available here, and data file specifications available here.

If you're using HSBC Connect, full details on the changes to reports and data files is available here.

To allow you time to transition to our new reports, we'll continue to make the currently generating reports and data files available to you until further notice. At this time, we're estimating the current reports to be available until 31 January 2020. We'll communicate the exact date to you in due course.

7. HSBCnet Account Information service:

We've introduced new statement narratives and transaction codes for transactions that will be processed through the FPS.

8. Statement reporting:

If you have an automated reconciliation process in place for your HKD and/or RMB accounts, detailed information on new statement narratives is available here.

The postal address for related inquiries is:

HSBC Group Head Office

HSBC - GLCM Digital

London UK E14 5HQ

This communication is provided by HSBC Bank plc on behalf of the member of the HSBC Group that has contracted with your organisation for the provision of HSBCnet services. You received this email notification because you are a registered User of HSBCnet. Should you have any concerns regarding the validity of this message, please contact your local HSBCnet customer support.

We maintain strict security standards and procedures to prevent unauthorised access to information about you. HSBC will never contact you by email or otherwise ask you to validate personal information, such as your Username, Password or account numbers. If you receive such a request, please call your local HSBCnet customer support. Links within our emails will only take you to information pages.

If you wish to unsubscribe from receiving service information from HSBCnet, please click here.

© Copyright. HSBC Bank plc 2018. All rights reserved.