|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

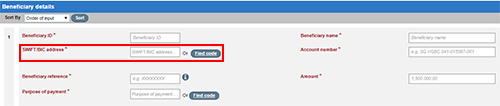

Customers with accounts in Singapore: SWIFT Bank Identifier Codes for domestic SGD ACH payments Due to an industry-wide initiative supported by The Monetary Authority of Singapore (MAS) and The Association of Banks in Singapore (ABS), the interbank payment infrastructure for GIRO payments will be upgraded in the first quarter of 2015. HSBC will be enhancing its GIRO (ACH) services along with this industry wide initiative. As a result of the GIRO service upgrade, when making domestic SGD ACH payments from accounts in Singapore on screen in HSBCnet you will be required to input a SWIFT Bank Identification Code (BIC). Customers using File Upload service will not be required to include a SWIFT/BIC as a result of this upgrade. SWIFT Bank Identifier Code (BIC) When creating a payment instruction in HSBCnet, input the SWIFT/BIC in the “Beneficiary details” section. To ensure accuracy when entering the code in HSBCnet, select the 'Find code' button next to the “SWIFT/BIC address” field to locate a SWIFT/BIC from a master list. The introduction of SWIFT/BIC replaces the need to input bank and branch codes. For a list of financial institutions and their associated SWIFT/BIC, please review the information provided in the link below. In addition to the introduction of SWIFT/BIC, the input of beneficiary account numbers on HSBCnet is also changing. After the GIRO upgrade, you will no longer be required to input bank and branch codes. After the upgrade, you will need to enter only beneficiary’s account number as outlined in the table below:

Important note: following the upgrade, payments made via HSBCnet that do not include the revised beneficiary account number format may be rejected by the beneficiary bank. Please note the following key exceptions:

If you have further queries, please email us at hsbcnetcentresg@hsbc.com.sg or contact your local HSBCnet Support Centre. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Please do not reply to this e-mail. The postal address for related inquiries is: If you wish to unsubscribe from receiving service information from HSBCnet, please click here. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||