|

||||||||||||||||||||

|

||||||||||||||||||||

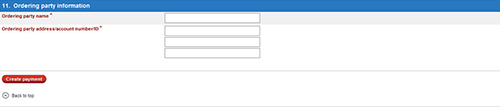

Frequently Asked Questions (FAQ) 1. What changes can I and my Users expect? Once your HSBCnet profile has been converted, Priority Payment screens will no longer be available and will be replaced with the Customer Transfer screen which will enable you to generate a priority payment but will have additional fields available: Ordering Party name and details and, in time, Ordering Institution.

2. What payment Types are available after conversion?

|

||||||||||||||||||||

Brazil (TED) |

Mexico (STD and SPEI Banxico) |

Chile (Online Payment) |

Poland (Tax and ZUS payments) |

China |

South Africa |

Czech Republic |

South Korea |

India (Cashier Order, Demand Draft, RTGS, NEFT) |

Switzerland |

Israel ( MT101, foreign currency cross-border and foreign currency domestic payments, RTGS |

Thailand (need to choose payment type: RTGS or Cashier's Order instead) |

Japan Zengin |

Turkey (standard payment) |

If you are unable to find the new location fo you Standing Instructions, contact the HSBCnet Help Desk for assistance.

16. What happens to Priority Payments that are Pending Authorisation?

Ensure that all Priority Payments are authorised. Any Payments pending authorization before conversion will be sent back to Pending Repair in order for you to correctly capture the Ordering Party name and details.

17. What happens to Forward Dated Priority Payments?

They will continue to exist on HSBCnet but can be found under Customer Transfers and not Priority Payments. However, if you have Forward Dated Country Domestic Priority Payment in the above listed countries you should reject them and re-enter them from Monday 12th October so that the full Ordering party details can be included.

18. I see that I now have new access to Bank to Bank transfers (MT202) when I set up my accounts and users for this payment type. Are they available in all countries?

Please contact your helpdesk or HSBC representative if you wish to use Bank to Bank Transfers.

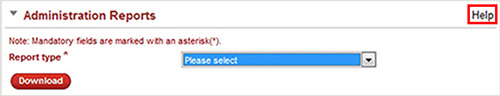

19. How do I get a report to view existing entitlements?

Use the guide for instructions available here

File Upload Requirements Post Migration

File Upload need to include the ordering customer name & address (including state & country) and Beneficiary Name which are mandatory.

It is recommended that you include details such as ordering party account number,beneficiary account number and beneficiary address (including state and country) in any file you upload for cross-border purposes.

Which file formats can we use?

The following files formats are acceptable to make cross-border payments: (ACH file formats can continue to be used)

|

|

After the conversion, you will need to ensure that the Ordering Party details (name and address) are included within the payments instructions in these file formats otherwise it may be rejected

Please note that Instruction Level Authorisation Files will now map across to the Customer Transfer Screen.

The below formats support Domestic High Value (HV), Cross Border HV and Automated Clearing House (ACH) payments but do not allow population of Ordering Party details and therefore cannot be used either to make cross-border payments or with File Upload - Instruction Level Authorisation.

- MEABASIC (Middle East)

- MEDMHVCI (Middle East)

- Israel Flat File (Israel)

- TXT (csv) (Russia)

- TXT (cbft) (Russia)

- PAP (Bermuda)

What if I need help on File Upload and File formats?

Please contact your HSBC representative for assistance.

Please do not reply to this e-mail.

The postal address for related inquiries is:

HSBC - E-Channels

8 Canada Square

London UK E14 5HQ

This communication is provided by HSBC Bank plc on behalf of the member of the HSBC Group that has contracted with your organisation for the provision of HSBCnet services. You received this e-mail notification because you are a registered User of HSBCnet. Should you have any concerns regarding the validity of this message, please contact your local HSBCnet customer support.

We maintain strict security standards and procedures to prevent unauthorised access to information about you. HSBC will never contact you by e-mail or otherwise ask you to validate personal information, such as your Username, Password or account numbers. If you receive such a request, please call your local HSBCnet customer support. Links within our e-mails will only take you to information pages.

If you wish to unsubscribe from receiving service information from HSBCnet, please click here.

© Copyright. HSBC Bank plc 2015. All rights reserved.

Privacy & Data Protection Statement | Terms & Conditions